Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed with a lean to the upside, but movement was minimal. Japan, Hong Kong and China closed down; Singapore, Australia and Taiwan closed up. Europe is currently mostly down. Greece is up better than 3%, but London, Germany, France, Austria, Norway, Switzerland, Russia, Poland, Turkey and Italy are all down. Futures here in the States point towards a down open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are up. Bonds are up.

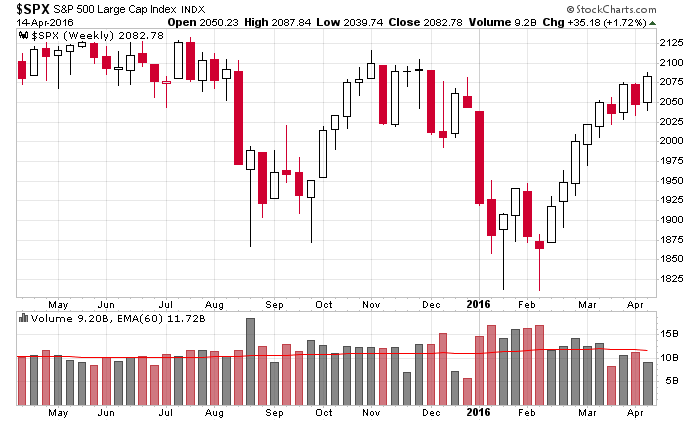

Here’s the S&P weekly. Last week was the biggest down week since the February bottom. This week the entire loss been has recaptured and a higher high made.

Options expire today. There have been times when OE day acted as a turning point for the market. It hasn’t happened recently, but it’s happened enough to keep in mind. Prices could get pushed in one direction, and then when buying wanes after expiration, prices could drift in the other direction. We’ll see.

Several breadth indicators have cycled and could support an attempt to leg up. I say could because all they’ve done is move to levels and reverse, but I wouldn’t say a move is confirmed yet.

The quality and quantity of good set-ups is still so-so. We certainly don’t have a huge basket of great set-ups that look ripe to bust out and run.

Overall I like the market. In the near term I’m long but not all in. I’m not predicting a false breakout, but I’m not entirely convinced the market will shoot up right now. More after the open.

Stock headlines from barchart.com…

Briggs & Stratton (BGG +0.55%) was downgraded to ‘Neutral’ from ‘Outperform’ at Robert Baird.

Foot Locker (FL -0.89%) was downgraded to ‘Market Perform’ from ‘Outperform’ by Cowen.

Relypsa (RLYP -1.08%) plunged 14% in pre-market trading after Benzinga reported that Centerview Partners is no longer advising the company on a possible sale.

General Motors (GM -0.19%) rose nearly 7% in pre-market trading after the European Automobile Manufacturers’ Association said Volkswagen AG’s market share in Europe fell to the lowest in 5 years after the emission scandal that has plagued Volkswagen prompted car buyers to switch to other automakers.

Polycom (PLCM +3.54%) climbed nearly 3% in pre-market trading after Mitel Networks said it agreed to but he company for $1.96 billion.

Reuters reported that Valeant Pharmaceuticals International (VRX -2.24%) is working with investment banks to review options amid interest from buyout firms and other companies “in a number of its businesses.”

Performance Sports Group Ltd. (PSG -0.78%) gained over 1% in after-hours trading after it raised guidance on Q4 adjusted EPS to 18 cents-20 cents from a previous view of 15 cents-17 cents.

Hewlett Packard Enterprise (HPE -1.37%) rose almost 1% in after-hours trading after it was rated a new ‘Outperform by Oppenheimer.

Customers Bancorp (CUBI +3.55%) reported Q1 EPS of 57 cents, above consensus of 56 cents, and said it sees full-year operating EPS of $2.40-$2.50 from bank operations, higher than estimates of $2.37.

Ensco Plc (ESV -4.94%) slid over 6% in pre-market trading after it started a 50 million share offering of Class A stock.

Vivint Solar (VSLR +0.67%) jumped 9% in after-hours trading after it said it sees installations up +12% in 2016 and that it will install 260 MW of rooftop power systems this year.

Casey’s General Stores (CASY -0.48%) reported March same-store-sales for grocery and other rose +6% y/y and March same-store-sales for prepared food and fountain increased +7.5% y/y.

Shopify (SHOP +3.89%) gained almost 1% in after-hours trading after it was rated a new ‘Buy’ at Paradigm Capital with a 12-month price target of $35.

Cherokee (CHKE -0.89%) rallied over 7% in after-hours trading after it reported Q4 adjusted EPS of 19 cents, higher than consensus of 13 cents.

Ixia (XXIA -0.49%) slumped 14% in after-hours trading after it lowered guidance on Q1 revenue to $108 million-$111 million from a February 24 estimate of $121 million-$126 million, below consensus of $123.3 million.

Thursday’s Key Earnings

BofA (NYSE:BAC) +2.5% following assurances from CEO Brian Moynihan.

BlackRock (NYSE:BLK) +1.9% on upcoming restructuring efforts.

Delta (DAL) +1% as fuel savings padded its bottom line.

Wells Fargo (NYSE:WFC) -0.5% on slipping income, rising provisions.

Today’s Economic Calendar

8:30 Empire State Mfg Survey

9:15 Industrial Production

10:00 Reuters/UofM Consumer Sentiment

12:50 PM Fed’s Evans speech

1:00 PM Baker-Hughes Rig Count

4:00 PM Treasury International Capital

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 15)”

Leave a Reply

You must be logged in to post a comment.

Doha and energy is in a fade; Iran no go on controls, energy prices May fall , stocks might follow. Dollar weaker recently so NY Mfg. index jumps to 9.6 v, 3 forecast, US Exporting must have climbed. Opening lower today, but holding positions. Ignoring gold and silver. Just coasting today.

from zero hedge–all markets are manipulated by bid banks–oil,gols silverequties etc

goldmans got a good fine for gold manipulation –jail them –no jail the judges polies that let them get away with it

the fed is just a big bank

but then who would i follow–im short