Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Japan gained more than 3%; Australia and South Korea rallied more than 1%; Hong Kong and Singapore also did well. Indonesia fell 0.8%. Europe is mixed and little changed. Austria, Switzerland, Denmark and Hungary are up, the Czech Republic and Greece are down. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil is up, copper is down. Gold and silver are down. Bonds are down.

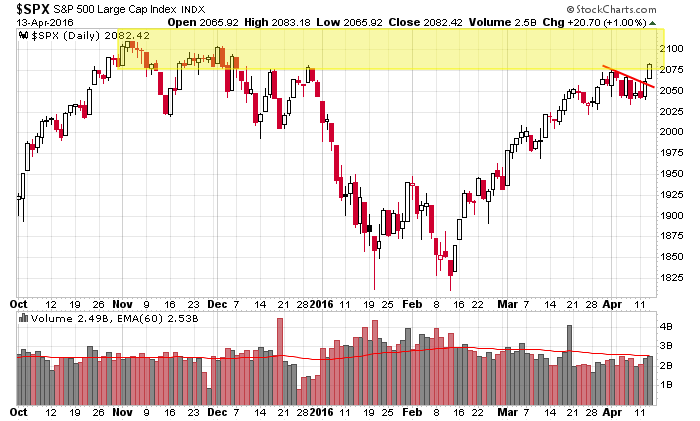

The market has been in consolidation mode for 4+ weeks. Yesterday it broke out and closed at a higher high. As I’ve said a few times the last couple weeks, if the S&P chart was that of an individual stock, we’d be looking to buy a dip within the pattern and a breakout. Out of the water yet? No. There’s a lot of resistance overhead, and the market needs to follow through to confirm the breakout. Simply closing a few points into higher high territory is not sufficient. It has to follow through and separate itself from the pattern. Here’s the daily S&P chart.

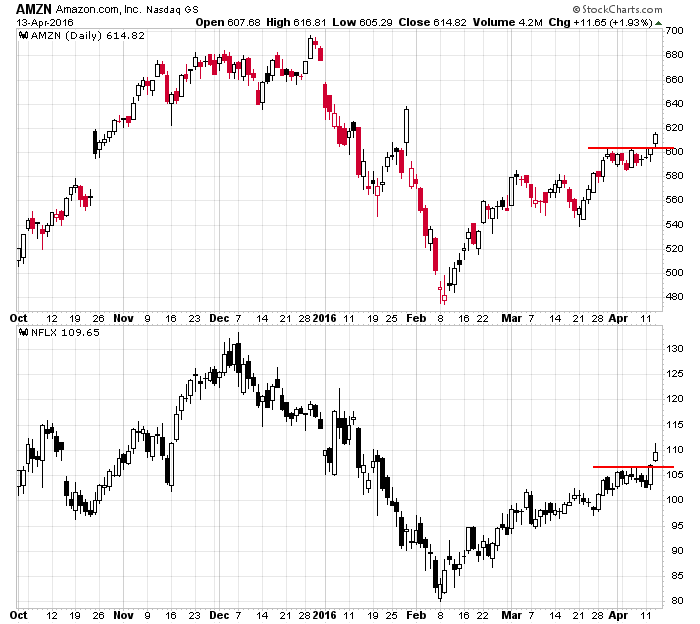

Many large cap tech stocks have lagged, so it was nice to AMZN and NFLX break out yesterday.

Commodities have been obvious leaders the last two months, but for a rally attempt to stick and develop legs, we’ll need broad-based participation. AMZN and NFLX breaking out is a good sign.

We seem to be a key moment – not necessarily today, but over the next week. Follow through or fizzle. We’ll find out soon. More after the open.

Stock headlines from barchart.com…

BlackRock (BLK +2.65%) reported Q1 EPS of $4.25, less than consensus of $4.30.

Bank of America (BAC +3.92%) reported Q1 EPS of 20 cents, below consensus of 21 cents.

3D Systems (DDD -0.18%) jumped 7% in pre-market trading after it was upgraded to ‘Buy’ from ‘Underperform’ by Bank of America/Merril Lynch.

Chipotle Mexican Grill (CMG +0.01%) climbed over 2% in pre-market trading after it ws upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase.

Applied Materials (AMAT +1.82%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS with a price target of $26.

A U.S. District judge ruled that Microsoft’s allegations that InterDigital (IDCC +1.25%) engaged in anticompetitive conduct are “sufficient” for the antitrust suit against InterDigital to proceed.

Insys Therapeutics (INSY +2.35%) was rated a new ‘Buy’ at Janney Montgomery with a 12-month price target of $22.

ECB Vice President Constancio said the ECB will do “whatever necessary” to bring Eurozone inflation close to objective.

Wynn Resorts Ltd. (WYNN +0.50%) rose over 2% in after-hours trading after founder Steve Wynn spent $7.2 million to buy an additional 72,851 shares on April 11, according to a Form 4 filing.

Pier 1 Imports (PIR +5.61%) climbed 4% in after-hours trading after it reported Q3 EPS of 23 cents, above a March 7 estimate of 18 cents-22 cents.

Seagate Technology (STX -3.17%) fell 7% in pre-market trading after it reported preliminary Q3 revenue of $2.6 billion, below consensus of $2.7 billion and said it sees gross margins of 23%, below estimates of 25.7%.

Raytheon (RTN -0.40%) received a $1.01 billion contract from the U.S. Navy for design, manufacture, integration, demonstration and test of 15 Next Generation Jammer (NGJ) systems that will replace the ALQ-99 jammer system on EA-18G aircraft.

Dominion Diamond (DDC -3.06%) gained almost 2% in after-hours trading after it reported Q4 revenue of $178.1 million, better than consensus of $178 million.

Wednesday’s Key Earnings

JPMorgan (NYSE:JPM) +4.2% after beating expectations.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Consumer Price Index

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $12B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 14)”

Leave a Reply

You must be logged in to post a comment.

Where is the market headed.? Up for while it seems. Doha seems to suggest an oil price fix is possible. Enough? No. Watch out for hope to over ride facts. Today? Long SDY, some tax frees and a few Reits. The debts of gov. and consumer are climbing. But some banks are making money…. on mortgages, and/or cars..84 month notes. I am not fooled. Live it up to May, then ..you know.

oil at new swing high today, should get to my 50 target easily in short order. it really belongs in a higher range, but i will not name that right now. i will be out of my positions round the 50 target and worry about the rest later. TF also breaking out after a big impulsive run up and short, shallow consolidation. target 1250 there.