Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Japan rallied better than 3%; Hong Kong, Singapore and Australia did better than 1%. Europe is currently mostly up. Germany is up more than 2%; France, Austria, the Netherlands, Norway, Sweden, Switzerland, the Czech Republic, Russia, Greece, Denmark, Finland and Spain are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

—————

My podcast – with Chat With Traders

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are down.

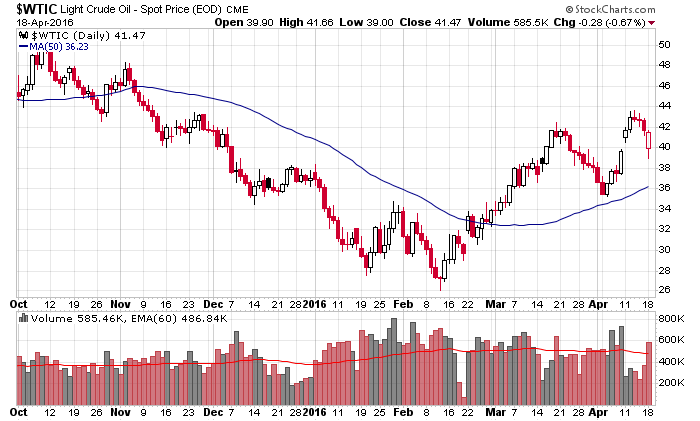

Yesterday was a big day for oil. Bad news from Doha pushed crude down almost 3 bucks in overnight trading, but some of those losses were recovered by the open. Then, after a noticeable gap down, the commodity chopped around and then move up into the close. For the day it only fell 28 cents.

To resist falling much on such bad news is a very positive sign – in fact it’s one of the strongest signals the market can offer. Follow through today would bode well for oil. The trend is up. Being able to absorb and otherwise brush off the news will keep me in the bulls’ camp.

Here’s the daily chart…

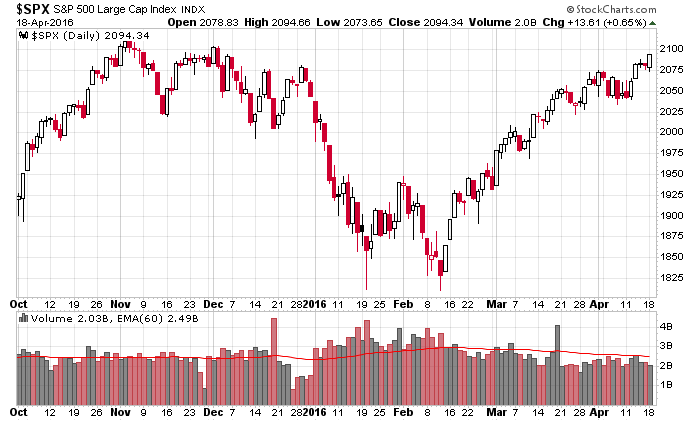

Despite some internals trending down, the indexes pushed to higher highs yesterday. The move off the February low has been steady and consistent, and corrections have come with time, not price declines. The risk/rewards aren’t great up here, but you can’t deny the 2-month trend.

It would be nice to get some follow through today…to prove yesterday’s low-volume day wasn’t just a knee-jerk reaction to the Doha news. More after the open.

Stock headlines from barchart.com…

Newmont Mining (NEM +0.31%) climbed nearly 2% in pre-market tradng after the price of silver surged to a 10-1/2 month high.

Dish Network (DISH +4.19%) climbed nearly 4% in after-hours trading after it said it has joined with China Central Television in suing HTV International over its h.TV streaming device.

International Business Machines (IBM +0.53%) dropped over 4% in pre-market trading after it projected Q2 growth of about $2.78 to $2.92 a share, below consensus of $3.45.

Ebay (EBAY +0.36%) slid over 2% in pre-market trading after it was dowmgraded by Morgan Stanley to ‘Underweight’ from ‘Equal-weight.’

Netflix (NFLX -2.79%) sank over 7% in pre-market trading after it said it sees Q2 domestic streaming net adds of 500,000, below consensus of 505,000, and said it expects Q2 international streaming adds of 2.0 million, less than consensus of 3.451 million.

Illumina (ILMN +2.59%) tumbled 19% in after-hours trading after it said it sees Q1 preliminary revenue of $572 million, below consensus of $596.8 million and the lowest estimate of $590 million.

Spirit Airlines (SAVE -0.12%) rose almost 1% in after-hours trading after it said it sees Q1 operating margin of 21,5%, higher than a prior estimate of 19%-20.5%.

Rambus (RMBS +0.73%) dropped over 7% in after-hours trading after it reported Q1 adjusted EPS of 13 cents, better than consensus of 12 cents, but then said it expected Q2 revenue of $72 million-$77 million, below consensus of $78.7 million.

Badger Meter (BMI +0.43%) rose over 4% in after-hours trading after it reported Q1 adjusted EPS of 55 cents, better than consensus of 41 cents.

Celanese (CE +0.79%) gained over 7% in after-hours trading after it reported Q1 adjusted EPS of $1.83, well above consensus of $1.49, and then raised its view of fiscal 2016 adjusted EPS to up 8%-10% from a January view of up 5% to 10%.

Dynavax Technologies (DVAX +4.91%) rose over 4% in after-hours trading after it said that results of a trial demonstrated both co-primary endpoints were met with its Heplisav-B vaccine.

GigPeak (GIG +2.73%) climbed almost 1% in after-hours trading after it reported Q1 adjusted EPS of 5 cents, above consensus of 4 cents.

Heron Therapeutics (HRTX +2.77%) jumped 18% in after-hours trading after the U.S. Food & Drug Administration (FDA) indicated no substantive deficiencies in the company’s Sustol NDA and the FDA has begun labeling discussions with Heron for Sustol Injection.

Applied Optoelectronics (AAOI +1.83%) plunged over 20% in after-hours trading after it lowered guidance on Q1 adjusted EPS to a loss of -4 cents to -6 cents from a February estimate of a 21 cent to 28 cent gain.

Monday’s Key Earnings

Hasbro (NASDAQ:HAS) +5.8% on a big boost from Disney toys.

IBM (NYSE:IBM) -4.5% AH after the worst quarterly revenue in 14 years.

Morgan Stanley (NYSE:MS) -0.2% following a tough quarter.

Netflix (NASDAQ:NFLX) -7.4% AH as subscriber growth underwhelmed.

PepsiCo (NYSE:PEP) flat after a set of mixed results.

Today’s Economic Calendar

8:30 Housing Starts

8:55 Redbook Chain Store Sales

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 19)”

Leave a Reply

You must be logged in to post a comment.

To the moon! own it all. But, no one knows where it lands. Caution is my idea of bravery. If you live in NY you might vote. Hang on to your cash….