Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. China dropped 2.3%; Hong Kong and Taiwan were also weak. India, Australia and New Zealand did well. Europe currently leans to the upside, but movement is minimal. Russia and Spain are up more than 1%; Belgium, the Netherlands and Portugal are also doing well. Denmark is down. Futures here in the States point towards a slight up open for the cash market (after having been down in overnight action).

—————

List of Indexes and ETFs – here

—————

The dollar is flat. Oil and copper are down. Gold is down, silver is up. Bonds are down.

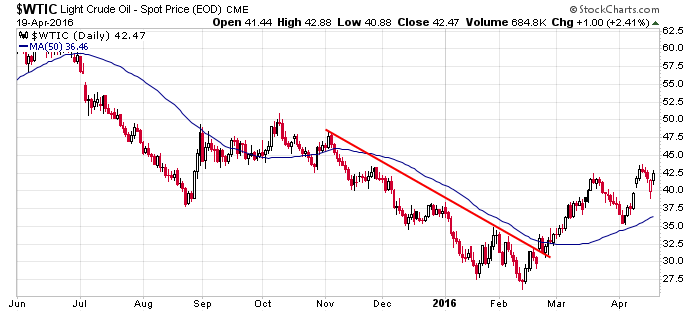

Oil is getting a 1-2 punch this week. First it was the news out of Doha that oil producers had not agreed to freeze production. Now Kuwait oil workers have ended their strike that had cut production in half. Oh, and data showed US inventory build last week of 3.1M (double the expectations). Like I said yesterday, it’s extremely bullish when a market can move up on bad news. We’ll see what happens. Many oil stocks moved up early yesterday but then closed well off their highs. Up or down today, I’ll consider the trend up as long as crude trades above its up-trending 50-day MA.

Yesterday IBM and NFLX got hit after earnings. Today it’s INTC’s turn. The stock is down a couple percent on a weak outlook and news they’re cutting 12,000 jobs globally.

Big cap tech was weak across-the-board yesterday (the Nas and Nas 100 were the only indexes to post a loss).

Meanwhile the indexes keep chugging along. This has been a hated rally. It’s hard to go long here because the market has come so far in such a short period of time without offering a second chance to get in. And of course anyone who has attempted to short this move has gotten run over a few times.

We’re in nosebleed territory with some declining internals. Be careful on the long side…but I have little interest in going short. More after the open.

Stock headlines from barchart.com…

Intel (INTC -0.16%) lost nearly 2% in pre-market trading after it said Q2 net revenue will be about $13.5 billion, below consensus of $14.2 billion, and said it will cut 12,000 jobs, or 11% of its workforce.

Halliburton (HAL +2.69%) declined 1% in pre-market trading as the price of crude oil is down -1.77% in early trade.

Lexmark International (LXK +0.99%) jumped over 10% in pre-market-trading after it was acquired by a consortium led by Apex Technology and PAG Asia Capital for $3.6 billion.

Boeing (BA +0.54%) slipped 2% in pre-market trading after Bank of America downgraded it to ‘Underperform’ from ‘Neutral.’

Yahoo! (YHOO -0.52%) climbed over 1% in after-hours trading after it reported Q1 adjusted Ebitda of $147 million, above consensus of $115.9 million.

Intuitive Surgical (ISRG -0.52%) gained nearly 2% in after-hours trading after it reported Q1 adjusted EPS of $4.42, better than consensus of $4.33.

Global Payments (GPN -0.42%) rose over 1% in after-hours trading when it was announced that it will replace GameStop GME in the S&P 500 at the end of trading on Friday, April 22.

Discover Financial Services (DFS +1.15%) climbed 4% in after-hours trading after it reported Q1 EPS of $1.35, better than consensus of $1.29.

VMware (VMW -0.44%) jumped over 10% in after-hours trading after it reported Q1 adjusted EPS of 86 cents, higher than consensus of 84 cents, and said it authorized a $1.2 billion stock buyback program.

Woodward (WWD +0.04%) slid over 2% in after-hours trading after it reported Q2 adjusted EPS of 65 cents, below consensus of 66 cents.

Interactive Brokers Group (IBKR -0.55%) rose nearly 4% in after-hours trading after it reported Q1 comprehensive EPS of 60 cents, well above consensus of 47 cents.

Manhattan Associates (MANH +0.51%) gained over 7% in after-hours trading after it raised guidance on fiscal 2016 adjusted EPS to $1.73-$1.76 from a February 2 estimate of $1.69-$1.72, above consensus of $1.71.

CalAmp (CAMP +1.69%) fell over 7% in after-hours trading after it said it sees fiscal 2017 adjusted EPS from continuing operations of $1.15-$1.35, below consensus of $1.43.

Tuesday’s Key Earnings

Goldman Sachs (NYSE:GS) +2.3% despite a rough quarter.

Harley-Davidson (NYSE:HOG) -2.6% on falling profits.

Intel (INTC) -1.9% AH on a weak outlook, big job cuts.

Johnson & Johnson (NYSE:JNJ) +1.6% following a guidance boost.

Philip Morris (NYSE:PM) -1.3% after earnings took another hit.

UnitedHealth (UNH) +2.1% exiting most Obamacare exchanges.

VMware (NYSE:VMW) +8.8% AH after authorizing a $1.2B buyback.

Yahoo (YHOO) +0.7% AH as it works through its bidding process.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

10:00 Existing Home Sales

10:30 EIA Petroleum Inventories

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 20)”

Leave a Reply

You must be logged in to post a comment.

Moving towards a correction, but it will take some more questions about potentials. I see no building boom, Intel let 11,000 staff go, or laid them off. I worry over banks ;earnings sliding. Looks weak to me.

All food looks ready. Beans, corn, wheat etc.. Longer run play

SILJ looked so good, I went for some. Really chasing the pooch. Watch out, this is near my first sell point – use stops.

“Be careful on the long side…but I have little interest in going short.”

Agree. I won’t even sell out of the money puts or calls which is my standard way of doing things when the market has no direction.

chop fest today

I like commodities, the sector is likely to keep its proper course. Equities are likely to follow on-up at least on the short term probably to new highs. Next week up coming FOMC meeting the Fed is likely to keep a dovish tone seeing the dollar stabilized or at least seem favorable to continue to decrease against other major currencies. The one scenario that can bring major volatility to global markets would be in June’s up-coming referendum regarding Brexit folowed by the general elections Trump VS Clinton.

markets run by supply and demand and opts ex

this means they are controled by the unholly instos that only get a fine for maniplulation

london is the largest market in the galaxcy and has monthy opts ex friday as most of europe aussie some asia

instos control supply/demand by withholding one to push prices up or down on low volume

instos wont drop the market till they are fully set and only they can profit

their is no such thing as bulls or bears –only the corrupt

viva the corrupt–they are close to set

aussie how does the opt ex look on the markets..any ideas were we are headed?

a lot of calls have been added,with the instos taking the bets from the other side

yea, hellova melt up at the these nose bleed levels…

this looks like a rigga mortis move for the bulls

corrective wave 2’s can go almost to wave 1 highs

but if we hit new highs in dow and spx ,then look out below for a massive wave 1 down