Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan, Singapore and India moved up; Hong Kong moved down. Europe is currently up across-the-board. France, Belgium, Norway, the Czech Republic, Greece, Spain and Portugal are up more than 1%. Futures here in the States point towards a relatively big gap up open for the cash market.

—————

I wrote an article for Top Shelf Traders emagazie. You can check it out here. I consider it very important. It’s at the heart of what I do.

—————

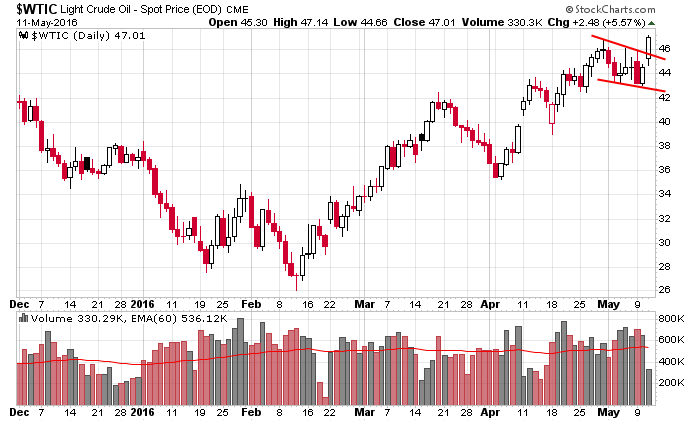

The dollar is up. Oil and copper are up. Gold and silver are down. Bonds are down.

The market can’t make up its mind. Up one day, down the next. And now today will start with a sizable gap up.

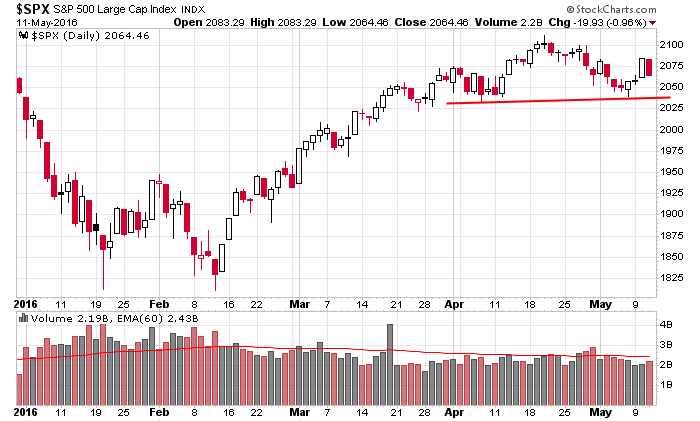

The S&P is unchanged going back to the beginning of April. The breadth indicators have mostly kept us on the right side of the movement, but the moves are much smaller than they’ve been. Instead of 100-point swings, we’re getting 50-point swings. Oh well. It is what it is. If you don’t have a strategy to profit during choppy periods you’ll be sitting on the sidelines most of the time because the market trades range bound more than it trades directionally.

Here’s the S&P. Very neutral going back six weeks.

Oil continues to do well. It broke out yesterday and will follow through some at today’s open. Along with gold and silver, it remains my favorite group to play. Trading is hard, but it is much less hard if you understand that “there’s a bull market somewhere,” and you focus your attention there. Oil has been in an uptrend for three months.

Stock headlines from barchart.com…

Jack in the Box (JACK -5.24%) jumped 11% in pre-market trading after it reported Q2 adjusted operating EPS of 85 cents, higher than consensus of 70 cents.

Berry Plastics Group (BERY +2.32%) was rated a new ‘Buy’ at Goldman Sachs.

Weight Watchers International (WTW -0.88%) climbed over 1% in after-hours trading after Oprah Winfrey was elected to a 2-year term on the company’s board.

Janus Capital Group (JNS -2.05%) was downgraded to ‘Market Perform’ from ‘Outpeform’ at Wells Fargo Securities.

St. Jude Medical (STJ +0.23%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Kohl’s (KSS -6.02%) slid over 4% in pre-market trading after it reported Q1 EPS of 31 cents, below consensus of 37 cents.

Owens-Illinois (OI +0.57%) was rated a new ‘Sell’ by Goldman Sachs.

SINA Corp/China (SINA +0.67%) dropped over 4% in after-hours trading after it reported a Q1 adjusted EPS loss of -4 cents, a wider loss than consensus of -3 cents.

Weibo (WB -0.43%) rose nearly 3% in after-hours trading after it reported Q1 adjusted EPS of 7 cents, better than consensus of 4 cents.

Spin Master (SNMSF +2.40%) reported Q1 adjusted EPS of 12 cents, double consensus of 6 cents.

CA Inc. (CA -0.63%) gained 3% in after-hours trading after it reported Q4 adjusted continuing operations EPS of 60 cents, higher than consensus of 57 cents, and said it sees fiscal 2017 adjusted EPS continuing operation of $2.51-$2.56, above consensus of $2.49.

Loxo Oncology (LOXO -5.36%) dropped over 4% in after-hours trading after it announced a public equity offering. Price, volume and terms have yet to be announced.

Wednesday’s Key Earnings

Sina (NASDAQ:SINA) -3.9% as E-House pushes it to an adjusted loss.

Weibo (NASDAQ:WB) +1.8% on beat and strong guidance.

CA, Inc. (NASDAQ:CA) +4.1% after beat, though currencies hit revenue.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Import/Export Prices

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:00 Fed’s Mester: Monetary policy

1:00 PM Results of $15B, 30-Year Note Auction

2:15 PM Fed’s George speech

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 12)”

Leave a Reply

You must be logged in to post a comment.

Volatility is the rule of confusion. First time Claims up this AM and the planned rally for Thursday is hurting. Apple is falling. Beans up (sell them soon) Gold is weak. Dividends look stable today. REM IRM are new to me as dividends With stops.

But…SELL soon and set tight in reits,dividends and bonds???? Just a feeling. Japanese JCB is holding 10% of total the ETFs on the Nikki. Sick? Yow… it is sick I think.

HDENT IS PROFESSING THE END OF THE WORLD AGAIN.,..