Good morning. Happy Friday.

The Asian/Pacific markets closed down across-the-board. Japan, Hong Kong, India and Malaysia fell more than 1%. Europe is currently mostly down, but there aren’t many big movers. Greece and Hungary are down more than 1%; Belgium, the Netherlands, Denmark and Portugal are down noticeably. Futures here in the States point towards a moderate gap down open for the cash market.

—————

I wrote an article for Top Shelf Traders emagazine. You can check it out here. I consider it very important. It’s at the heart of what I do.

—————

The dollar is up. Oil is down, copper is up. Gold is up, silver is flat. Bonds are up.

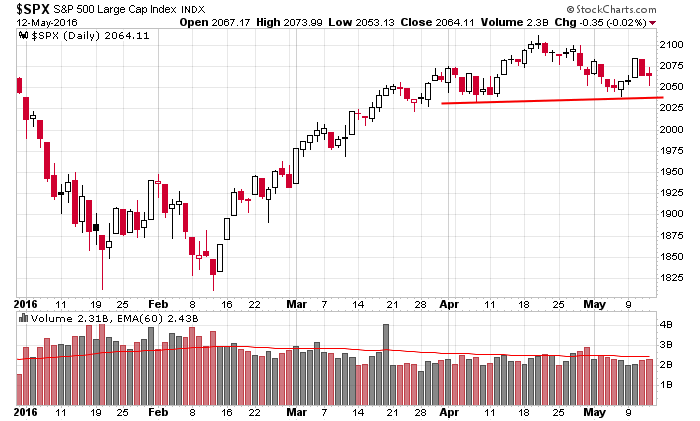

The market hasn’t been able to make up its mind this week. There have been some ups and some downs, and through four days the S&P is up 7 points. With the indexes set to gap down at today’s open, the S&P will be flat. A down week would create the first 3-week losing streak since the beginning of they year and only the third going back 12 months. The last 4-week losing streak was October 2014.

But despite what seems like a lot of selling pressure, here’s the daily S&P 500. The index is flat going back six weeks, and although some technicians will point out a head-n-shoulder top forming, I’m calling this a consolidation pattern within an uptrend.

Beneath the surface there are obvious leading and lagging groups. That’s where you want to focus your energy. Other than an occasional directional move, the index spend a lot more time doing nothing than doing something. But there are always trending groups that can be played. More after the open.

Stock headlines from barchart.com…

Nordstrom (JWN -0.44%) sank over 16% in pre-market trading after it cut its full-year earnings forecast to $2.50 -$2.70, well below a February 18 estimate of $3.35 and well below consensus of $3.20. Other retailers fell on the news as well with Macy’s (M -0.54%) and Michael Kors Holdings Ltd (KORS -0.50%) both down 1% in pre-market trading.

Symantec (SYMC +1.14%) fell nearly 2% in after-hours trading after the company said it was reorganizing its business and will cut 10% of its workforce.

Johnson & Johnson (JNJ -0.12%) was downgraded to ‘Neutral’ from ‘Buy’ at BTIG.

Nvidia (NVDA -1.36%) gained nearly 6% in pre-market trading after it reported Q1 adjusted EPS of 46 cents, better than consensus of 41 cents.

Lockheed Martin (LMT +1.29%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

PTC (PTC -0.88%) lowered guidance on full-year adjusted EPS to $1.45-$1.55 from an April 20 estimate of $1.52-$1.62, below consensus of $1.58.

Darling Ingredients (DAR +0.55%) tumbled over 5% in after-hours trading after it reported Q1 adjusted EPS of 1 cent, well below consensus of 11 cents.

Shake Shack (SHAK -0.12%) rose over 5% in after-hours trading after it reported Q1 adjusted EPS of 8 cents, above consensus of 5 cents and raised guidance on full-year revenue to $245 million-$249 million from a March 7 estimate of $237 million-$242 million.

Dillard’s (DDS -2.96%) dropped nearly 6% in after-hours trading after it reported Q1 EPS of $2.17, below consensus of $2.57 and said Q1 comparable sales were down -5%, weaker than consensus of -2.1%

Red Rock Resorts (RRR +1.40%) reported Q1 revenue of $133.2 million, higher than consensus of $119.8 million.

KemPharm (KMPH -7.42%) climbed almost 6% in after-hours trading after it reported a Q1 loss of -20 cents, narrower than consensus of -46 cents.

Sunrun (RUN -3.45%) jumped over 13% in after-hours trading after it reported Q1 revenue of $98.7 million, stronger than consensus of $87.7 million.

ConforMIS (CFMS -7.67%) plunged over 30% in after-hours trading after it cut its full-year revenue estimate to $76 million-$81 million from a prior view of $84 million-$87 million, below consensus of $85.8 million.

Thursday’s Key Earnings

Nordstrom (NYSE:JWN) -16.2% AH after missing estimates.

Nvidia (NASDAQ:NVDA) +6.6% AH on a Q1 beat, strong guidance.

Petrobras (NYSE:PBR) unmoved despite its third straight quarterly loss.

Shake Shack (NYSE:SHAK) +6.3% AH following a big boost to its outlook.

Today’s Economic Calendar

8:30 Producer Price Index

8:30 Retail Sales

10:00 Business Inventories

10:00 Reuters/UofM Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

6:45 PM Fed’s Williams speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 13)”

Leave a Reply

You must be logged in to post a comment.

Friday the 13th. Jason’s new article is very interesting free too. Negative day?? Sell in May? Thinking over a strategy besides cash.