Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the downside. Japan and Australia fell 1% or more; Indonesia and Taiwan did well. Europe is currently mostly down. Austria, Sweden, Poland, Spain, Italy and Portugal are down more than 1%; France, London, Germany and others are also weak. Hungary is up more than 1%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are up. Bonds are up.

Yesterday was an odd day. The large caps and small caps moved opposite each other…and then got synced up the last two hours. Gold and silver rallied, despite the US dollar moving up. And oil, which started on an up note, fell hard during afternoon trading and closed down. The market was not very correlated.

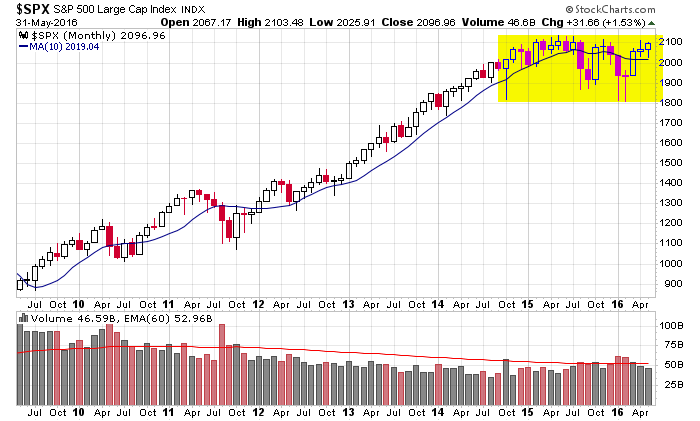

May is in the books. Despite the historical tendencies for the month to be the beginning of the “sell in May and go away” time period where the market tends to be weaker than the other half of the year, this May posted a gain for the fourth straight year. The range was on the smaller side, and volume declined for the fourth consecutive month. The index is in consolidation mode on a long and short term basis. There are many reasons to expect lower prices going forward, but there is nothing wrong with this pattern. If this was an individual stock, playing a breakout with a 300-point target would be in order.

My bias remains to the upside. The market feels like it wants to bust out. It’s had to absorb a lot of bad news lately, and yet here we are near the highs. I don’t know what it will take to get us through the high, but I do know bearishness is high enough that once a little momentum builds, rallying 100 points is something that could take place in just a week or two. More after the open.

Stock headlines from barchart.com…

Nike (NKE -1.73%) fell 2% in pre-market trading after it was downgraded to ‘Neutral’ from ‘Buy’ at Bank of America/Merrill Lynch.

Whole Foods Markets (WFM +1.00%) jumped over 2% in pre-market trading after it was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

Zoetis (ZTS +0.51%) was rated a new ‘Buy’ at Stifel with a 12-month price target of $58.

InterXion Holding NV (INXN +0.86%) rose nearly 1% in after-hours trading after it was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo Securities.

Alibaba Group Holding Ltd. (BABA +1.27%) fell over 2% in pre-market trading after Softbank Group, the largest investor in Alibaba, said it will sell at least $7.9 billion of its Alibaba stake.

Under Armour (UA -0.50%) lost more than 3% in after-hours trading after it cut its full-year net revenue estimate to $4.925 billion from a prior view of $5 billion.

Quanex Building Products (NX +2.47%) reported Q2 adjusted EPS of 10 cents, better than consensus of 9 cents, and boosted its full-year Ebitda estimate to $117 million-$121 million from a December 14 estimate of $112 million-$120 million.

Ascena Retail (ASNA +1.12%) dropped nearly 6% in after-hours trading after it lowered guidance on full-year EPS to 67 cents-70 cents from a prior view of 75 cents-80 cents.

Zoe’s Kitchen (ZOES +2.47%) climbed over 3% in after-hours trading after it reported Q1 adjusted EPS of 6 cents, better than consensus of 4 cents, and then raised its full-year revenue estimate to $277 million-$281 million from a prior estimate of $275 million-$289 million.

NCI Building Systems (NCS +2.48%) reported Q2 sales of $372.2 million, higher than consensus of $363.5 million.

Boyd Gaming (BYD +0.48%) rose more than 4% in after-hours trading after MGM Resorts International acquired Boyd’s 50% stake in Atlantic City’s Borgata hotel and casino for $900 million.

TiVo (TIVO -0.70%) slipped 3% in after-hours trading after it reported Q1 EPS of 4 cents, weaker than consensus of 8 cents.

Tuesday’s Key Earnings

Bank of Nova Scotia (NYSE:BNS) -1.9% lifting bad loan provisions.

Medtronic (NYSE:MDT) -1.5% giving a cautious outlook.

TiVo (NASDAQ:TIVO) swung AH following mixed results.

Workday (NYSE:WDAY) -2.2% AH on climbing expenses.

Today’s Economic Calendar

Auto Sales

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

8:55 Redbook Chain Store Sales

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

2:00 PM Fed’s Beige Book

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Jun 1)”

Leave a Reply

You must be logged in to post a comment.

Another day of confusion. Expecting another news driven day on the economy. But this day may Drive the Fed into doing things like raising rates in June. I suspect it will become the kiss of death for the markets. Playing 35% cash,35% bonds, 30%divibends. Best.