Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan fell more than 2%; Australia and Taiwan were also weak. Hong Kong, China and India did well. Europe currently leans to the upside. Austria and Spain are up more than 1%; Prague, Greece, Poland, Hungary, the Netherlands, Italy and Portugal are also doing well. Denmark is down. Futures here in the States point towards a down open for the cash market.

The dollar is down. Oil and copper are flat. Gold and silver are up. Bonds are up.

The market has been somewhat uninteresting lately. Volume has fallen off, the ranges have been small and volatility has declined. The quality and quantity of decent trading set ups has improved, but is not on par with what’s normal. Even commodities, the market’s best place to make money this year, are in consolidation mode.

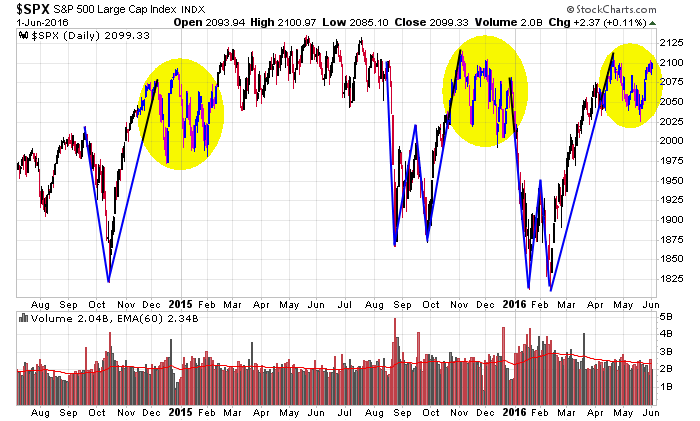

Here’s the daily S&P going back almost two years. Three times the index has rallied vertically, and all three times it has settled into a wide-swinging range. In early-2015 it broke out to the upside but didn’t go far. In late-2015 it broke down and gave back the entire move. We’re currently sitting in #3.

Until this thing resolves one way or the other, we can’t assume moves will last long. We don’t have a gentle breeze at our backs which enable us to enter a core position and then ride it for a few months while trading around it. Instead there have been many more “all in, all out” trades for smaller profits.

But know this. You can’t wait for the pattern to resolve, because when it does, the S&P can move 100 points in a week, and you’ll be sitting there in cash, waiting for a second chance, which won’t happen. More after the open.

Stock headlines from barchart.com…

Oracle (ORCL +0.15%) is down over 2% in pre-market trading after a former senior finance manager said in a whistleblower lawsuit that she was instructed to add millions of dollars in accruals to cloud-service reports.

Exxon Mobile (XOM +0.25%) was downgraded to ‘Neutral’ from ‘Buy’ at Bank of America/Merrill Lynch.

Sally Beauty Holdings (SBH +2.40%) was upgraded to ‘Market Perform’ from ‘Underperform’ at Wells Fargo Securities.

Lending Tree (TREE +0.85%) was rated a new ‘Buy’ at Compass Point Research & Trading LLC with a 12-month price target of $100

Semtech (SMTC +3.53%) reported Q1 adjusted EPS of 30 cents, better than consensus of 28 cents.

Analogic (ALOG -0.61%) reported Q3 non-GAAP EPS of 80 cents, below consensus of 88 cents, although Q3 revenue of $128 million was better than consensus of $127.7 million.

Guidewire Software (GWRE +3.03%) gained over 3% in after-hours trading after it reported Q3 adjusted EPS of 14 cents, higher than consensus of 6 cents.

Box (BOX +1.99%) sank over 10% in pre-market trading after it reported Q1 billings up +9% y/y to $75.9 million, weaker than consensus of +20% y/y growth.

Ollie’s Bargain Outlet Holdings (OLLI +4.55%) reported Q1 adjusted EPS of 29 cents, higher than consensus of 16 cents, and then raised its full-year EPS estimate to 85 cents-87 cents from an April 6 view of 83 cents-85 cents.

Weatherford International PLC (WFT -1.43%) slumped over 9% in after-hours trading after it said it plans a $1 billion bond offering to refinance its debt.

Fidelity & Guaranty Life (FGL -3.83%) slid over 3% in after-hours trading after China’s Anbang Insurance Group pulled its offer to buy Fidelity.

Keryx Biopharmaceuticals (KERX -0.50%) rose over 4% in after-hours trading after Baupost Group reported a 42.5% stake in the company.

Dermira (DERM +0.82%) climbed nearly 5% in after-hours trading after it said it met 3 of 4 primary endpoints in two studies that showed its DRM04 drug for excessive underarm sweating showed statistically significant improvements.

Wednesday’s Key Earnings

Box (NYSE:BOX) -9.9% AH on slowing billings growth.

Michael Kors (NYSE:KORS) +6.6% after beating expectations.

Today’s Economic Calendar

Chain Store Sales

Fed’s Evans: U.S. Economic and Monetary Policy

7:30 Challenger Job-Cut Report

8:15 ADP Jobs Report

8:30 Initial Jobless Claims

8:30 Gallup Good Jobs Rate

8:35 Fed’s Powell speech

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

1:00 PM Fed’s Kaplan speech

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Jun 2)”

Leave a Reply

You must be logged in to post a comment.

good call on alxn