Good morning. Happy Friday. Happy options expiration day.

The Asian/Pacific markets closed mostly up. Japan rallied more that 1%; Hong Kong and Taiwan also did well. New Zealand was weak. Europe is currently posting solid across-the-board gains. Greece is up almost 5%; the Czech Republic and Italy are up more than 2%; Austria, Norway, Sweden, Switzerland, Russia, Turkey, Denmark, Hungary, Spain and Portugal are up more than 1%. Futures in the States point towards a slight down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil and copper are up. Gold and silver are down. Bonds are down.

The market put in a big reversal candle yesterday. It opened down and sold off during the opening hour. Then it staged an impressive rally that put most of the indexes in positive territory. My personal feeling is the reversal had little to do with the Fed and instead is just part of the normal up and down movement we’ve gotten the last three months.

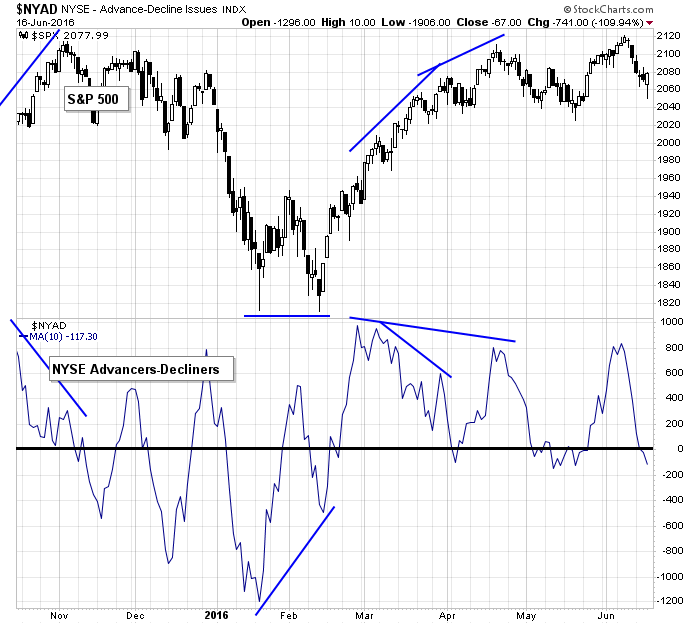

The S&P had fallen 5 straight days for the first time since February, and some breadth indicators had cycled down to levels that would support a bounce. So the market turned around and headed north.

Here’s the S&P 500 vs. the 10-day MA of the AD line as an example.

Oil got hit hard yesterday is now bouncing.

Gold gapped up and ran a little yesterday and then fell hard and posted a pretty ugly daily candle.

I see no reason to force trades right now. The vote in the UK to stay or leave the EU is gigantic. It’s a potential market mover. It’s exactly the kind of news that can trump the charts. Taking on a lot of risk in front of that would not be wise. More after the open.

Stock headlines from barchart.com…

Phillips 66 (PSX +0.37%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Morgan Stanley.

Oracle (ORCL +0.52%) climbed over 2% in after-hours trading after it reported Q4 adjusted EPS of 81 cents, below consensus of 82 cents, but Q4 adjusted revenue of $10.6 billion was higher than consensus of $10.47 billion.

Smith & Wesson (SWHC +1.26%) jumped nearly 7% in after-hours trading after it reported Q4 adjusted EPS of 66 cents, well above consensus of 54 cents, and then raised guidance on fiscal 2017 adjusted EPS to $1.83-$1.93, above consensus of $1.66.

Parsley Energy (PE -2.77%) was rated a new ‘Buy’ at Wunderlich Securities with an 18-month price target of $32.

Envision Healthcare Holdings (EVHC -6.18%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Oppenheimer.

Finisar (FNSR +0.80%) rallied over 8% in after-hours trading after it reported Q4 adjusted EPS of 29 cents, above consensus of 25 cents.

MGM Resorts International (MGM -1.47%) rose over 4% in after-hours trading after guiding annual adjusted Ebitda benefit to $400 million by the end of 2017 from $300 million previously forecast.

Revlon will buy Elizabeth Arden (RDEN -0.21%) for $14/ share cash if deal valued at $870 million.

Lumber Liquidators (LL +0.68%) jumped over 10% in after-hours trading after agreed to not resume sales of laminate flooring previously imported from China and the U.S, Consumer Product Safety Commission said it will not order a product recall.

ServiceNow (NOW -1.06%) was rated a new ‘Market Perform’ at Oppenheimer.

Paypal Holdings (PYPL +0.35%) was rated a new ‘Outperform’ at Oppenheimer with a price target of $43.

Synergy Resources Corp. (SYRG -4.24%) was rated a ‘Strong Buy’ at Raymond James with a 12-month price target of $9.50.

Stanley Furniture (STLY -1.56%) said it hired Stephens as financial adviser on a strategic review.

Thursday’s Key Earnings

Oracle (NYSE:ORCL) +2% AH following cloud business growth.

Smith & Wesson (NASDAQ:SWHC) +7.6% AH on strong guidance.

Today’s Economic Calendar

8:30 Housing Starts

10:00 Atlanta Fed’s Business Inflation Expectations

1:00 PM Baker-Hughes Rig Count

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Jun 17)”

Leave a Reply

You must be logged in to post a comment.

Quad witching today, Brexit is on hold??? due to violence on Brti politician, but outcome still feared by all,or most. Japan via BOJ is seeing it currency crashing around as the economy threatens to weaken further. All in all, caution is due today. My dividend is flat, but not behind yet overall market Not a place to be too involved short or long. Watch gold/silver,crude and bonds at the longer end