Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed with a lean to the upside. Japan bounced back 2.4%, and China rallied 1.5%. The other markets were quiet. Europe is currently down across-the-board. Sweden and Finland are down more than 6%; Austria, Belgium and the Czech Republic are down more than 3%; London, Germany, the Netherlands, Norway, Greece, Denmark and Italy are down more than 2%. Futures here in the States point towards a relatively big gap down open for the cash market.

—————

LB Weekly – the indexes, the breadth indicators, a look at the big picture

—————

The dollar is up 1%; Oil and copper are down. Gold and silver are up. Bonds are up.

Today is day #2 after the Brexit vote, and I don’t have anything to add to the weekly report posted and sent out over the weekend.

In that report I essentially said even though the Brexit vote was a shock and pushed prices down hard on Friday, many breadth indicators were already warning a pullback was likely. Said another way, even if the Brexit vote failed, the market was likely to sell-off on the news.

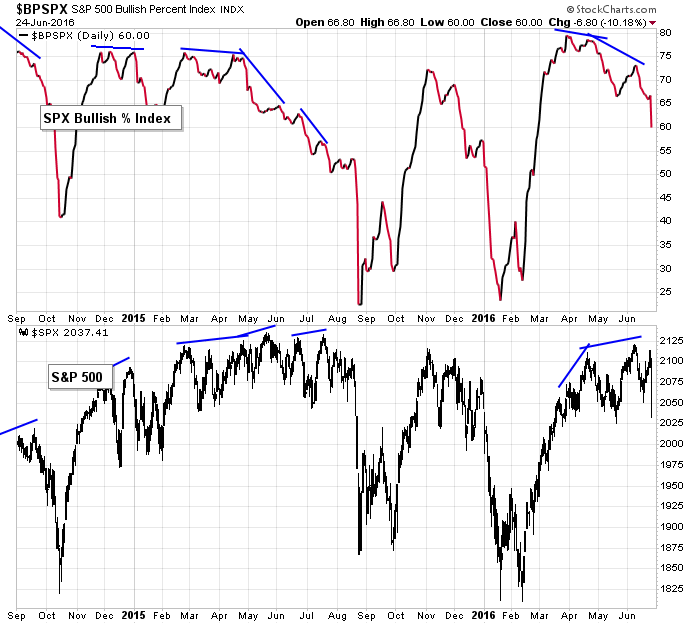

The S&P bullish percent chart had already diverged from the SPX.

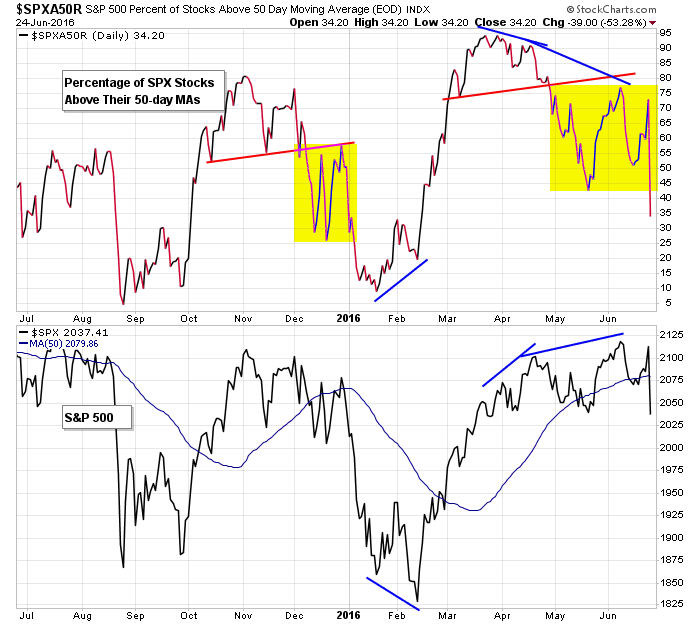

The percentage of S&P stocks above their 50-day moving averages had already put in a lower high.

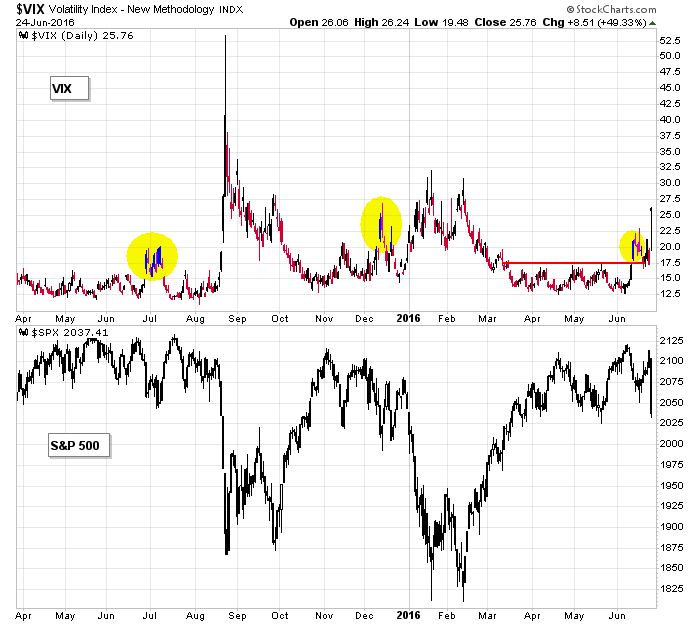

The VIX had already jumped, even though the market was trading calmly in a range.

There were others. Some indicators were in decent shape, but several told us the participation rate on the most recent move up was waning.

The question now is whether we continue to get bad news and dire predictions or if things calm down. For now risk is elevated. You certainly don’t want to be placing big long side bets until thing settle down. More after the open.

Stock headlines from barchart.com…

Analog Devices (ADI -5.28%) , Maxim Integrated Products (MXIM -7.36%) and NXP Semiconductors NV (NXPI -8.34%) were all downgraded to ‘Neutral’ from ‘Buy’ at Bank of America/Merrill Lynch.

ManpowerGroup (MAN -13.41%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse with a price target of $73.

ResMed (RMD -5.56%) was downgraded to ‘Underperform’ from ‘Hold’ at Needham.

Pandora Media (P -3.77%) was upgraded to ‘Overweight’ from ‘Equalweight’ at Morgan Stanley.

Halliburton (HAL -4.19%) was rated a new ‘Buy’ at Daishin Securities with a 12-month price target of $54.

Skyworks (SWKS -8.33%) was rated a new ‘Underweight’ at Morgan Stanley with a price target of $61.

Lennar (LEN -3.97%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Raymond James with a 12-month price target of $53.

Moody’s Investors Service cut its outlook on the UK’s long-term issuer and debt ratings to ‘Negative’ from ‘Stable.’

Energy Transfer Equity LP (ETE -3.62%) jumped nearly 8% in after-hours trading after a Delaware judge ruled that Energy Transfer can back out of its deal to acquire Williams Cos.

Williams Cos. (WMB -2.16%) fell nearly 7% in after-hours trading after a Delaware judge ruled that Energy Transfer is entitled to terminate the merger with Williams Cos.

Today’s Economic Calendar

8:30 International trade in goods

9:45 PMI Services Index Flash

10:30 Dallas Fed Manufacturing Survey

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Jun 27)”

Leave a Reply

You must be logged in to post a comment.

Hold on its the calm before the financial storm. The US has some notable slippage in business investment, slow sales v. inventories,and low wages. A slow summer. Happy 4th.

STops are not just for a bus.

a break below spx 2000 is needed or we may get a failed up poop

central banks world wide are intervaining in currencies to hold the world together

but everyone knows thats a failed practice and the nude cenral bankers are poethetic

social mood has changed to people power and its the gilotine for bankers and corrupt polies and

public servants ,military judges and police

down with those scared bulls ,,bears are much nicer