Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Australia fell 0.7%, but China, Singapore, Indonesia and Taiwan posted decent gains. Europe is currently up across-the-board. Greece, Finland and Italy are up more than 2%; London, Germany, Franc, Belgium, Norway, Sweden, Switzerland, Turkey, Denmark, Norway, Hungary, Spain and Portugal are up more than 2%. Futures here in the States point towards a relatively big gap up open for the cash market.

—————

My podcast – with Trading Story

—————

The dollar is down. Oil and copper are up. Gold and silver are down. Bonds are down.

The bulls are going to get a nice relief bounce at today’s open.

Since the Brexit vote, the S&P has posted its biggest 2-day loss since last August when it fell from about 2100 to 1867 in four days.

With the selling pressure taking most by surprise (not many expected the Brexit vote), a bounce will offer an opportunity to exit positions at better levels and salvage some losses.

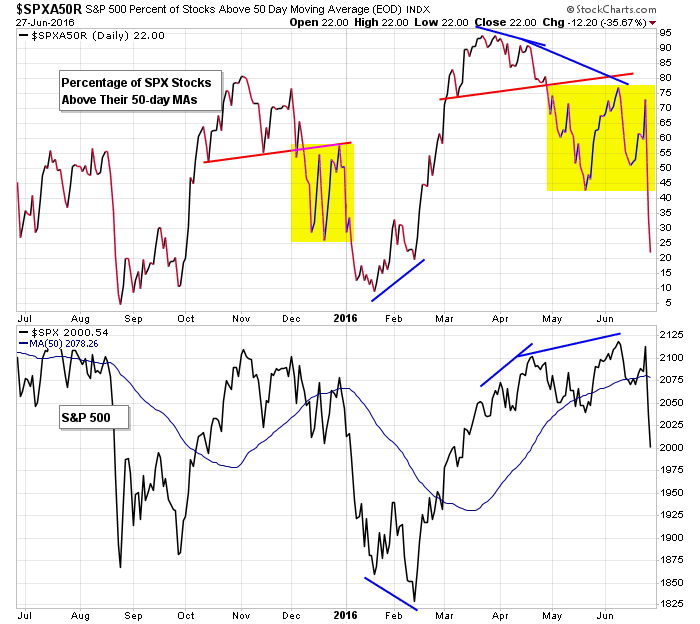

In my eyes, even without the Brexit vote, the market was more likely to correct than to make a run at its highs. Internally, the market was deteriorating, so the stage was not set for a run to the highs. The bullish percent charts had put in lower highs, and the percentage of stocks above various moving averages were also diverging from the underlying price action.

Here’s the percentage of SPX stocks above their 50-day moving averages. It had already put in an obvious lower high earlier this month and was trading below support. The market wasn’t likely to rally while this was taking place.

Expect volatility to remain high. Expect big gaps in both directions. To lesson the risk, buy dips within patterns or sell rallies. Playing breakouts and breakdowns will be more risky. More after the open.

Stock headlines from barchart.com…

Travelers Cos. (TRV -0.60%) was upgraded to ‘Buy’ from ‘Neutral’ at Bank of America/Merrill Lynch with a price target of $127.

Olin Corp. (OLN -6.18%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Cowen with a 12-month price target of $31.

Dow Chemical (DOW -3.10%) said it plans to eliminate about 2,500 jobs and shut plants in North Carolina and Japan and sees $410 million to $460 million in charges in Q2 as it restructures Dow Corning ownership.

Tesla Motors (TSLA +2.80%) was downgraded to ‘Hold’ from ‘Buy’ at Argus Research

Snap-on (SNA -1.40%) was rated a new ‘Buy’ at CL King with a 12-month price target of $174.

Charles River Laboratories International (CRL -5.48%) rose 5% in after-hours trading after it said it acquired Blue Stream Laboratories.

Karyopharm Therapeutics (KPTI -10.11%) was rated a new ‘Outperform’ at Robert Baird.

North Tide Capital reported a 7.5% passive stake in BioScrip (BIOS -3.61%) .

Blue Buffalo Pet Products (BUFF -2.70%) dropped nearly 6% in after-hours trading after holders downsized the secondary offering to 15 million shares from 25 million shares.

Sanchez Energy (SN -10.48%) was rated a new ‘Buy’ at National Securities.

MeetMe (MEET -3.91%) climbed nearly 3% in after-hours trading after it acquired Skout for $54.6 million in cash and stock.

Regulus Therapeutics (RGLS -5.29%) plunged 60% in after-hours trading after the FDA said that the company’s hepatitis C treatment RG-101 has been placed on clinical hold after a second serious event of jaundice occurred in a patient taking the RG-101.

Ziopharm Oncology (ZIOP -5.85%) rose nearly 2% in after-hours trading after the company said immunologic activity after its gene therapy candidate IL-12 suggests that no further dose escalation will be necessary and optimal dosing may be reached sooner than initially expected.

Today’s Economic Calendar

8:30 GDP Q1

8:30 Corporate Profits

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Jun 28)”

Leave a Reply

You must be logged in to post a comment.

End of June month investments start today. Bradley cycles hyperactive now thru 5th of July. No idea what this means, But the market rises to allow some IRA investing. I am patient since there is a slowing in the US economy that may slow attempts to recover equities to the silly levels that prevailed recently . No rush about investing, Cash is still the choice of the cautious. Best to all for the 4th.

the bears need a small dead cat after taking profits