Good morning. Happy Thursday.

The Asian/Pacific markets closed with a lean to the upside. Hong Kong and South Korean gained more than 1%; Taiwan and Australia also did well. Japan fell 0.7%. Europe is currently mostly up. Norway is up 2%; the UK, France, Australia, the Netherlands, Sweden, Poland, Denmark, Hungary and Poland are up more than 1%. The Czech Republic is down more than 1%. Futures here in the States point towards a down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is flat. Oil is up; copper is down. Gold and silver are down. Bonds are mixed.

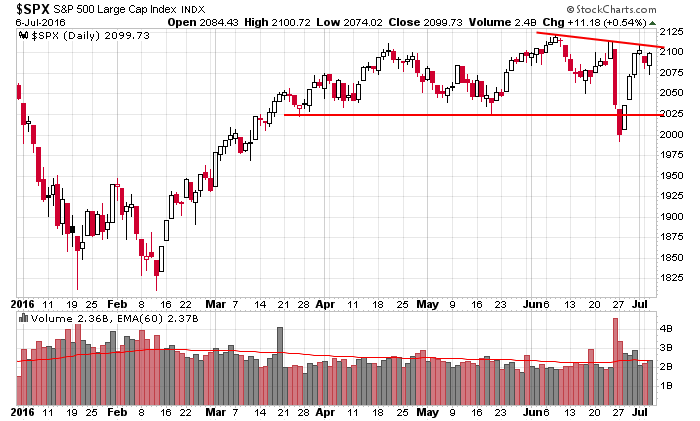

I’d hate to say it, but the overall market has been pretty boring. Other than the quick drop after the Brexit vote and an equally quick recovery, there has been very little excitement. The S&P has moved in a 100-point range for 3+ months.

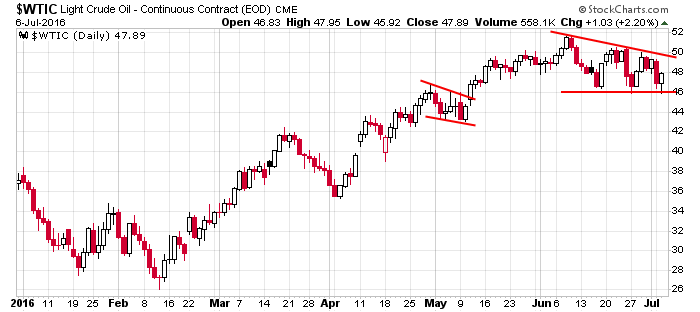

Even oil, which has provided us with many big winners this year, has been flat over the last two months.

But beneath the surface, there have been big out-performers. This tends to be the case most of the time. The indexes, which are an average of many stocks, spend more time moving in a range than trending, but beneath the surface there are groups providing opportunities. Gold and silver have done great. Utilities are up big. Some REITs have done very well. The indexes tell you nothing is happening, yet a lot is happening if you dig deeper. It’s the reason I focus so much on group strength.

Stock headlines from barchart.com…

First Solar (FSLR +2.85%) slipped 3% in pre-market trading after it was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

WhiteWave Foods (WWAV +0.94%) jumped 18% in pre-market trading after Danone agreed to buy the company for about $10 billion.

Endologix (ELGX +2.49%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital Markets.

Depomed (DEPO +3.79%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Red Hat (RHT +1.25%) was downgraded to ‘Equalweight’ from ‘Overweight’ at Morgan Stanley.

Pepsico (PEP -0.47%) reported Q2 EPS of $1.35, better than consensus of $1.29.

Plains GP Holdings LP (PSGP unch) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI.

Seagate Technology (STX +1.55%) gained almost 2% in after-hours trading after the company announced that Mark Long will become CFO in addition to his current role as chief strategy officer.

Time Warner (TWX +0.93%) was rated a new ‘Buy’ at Brean Capital with a 12-month price target of $90.

Western Digital (WDC +1.65%) climbed nearly 3% in after-hours trading after it reported preliminary Q4 adjusted EPS of 72 cents, above a previous forecast of 65 cents-70 cents.

CBS Corp. (CBS +0.77%) was rated a new ‘Buy’ at Brean Capital with a 12-month price target of $65.

Wednesday’s Key Earnings

Walgreens (NASDAQ:WBA) -2.4% on Brexit, Rite Aid deal uncertainty.

Today’s Economic Calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:15 ADP Jobs Report

8:30 Initial Jobless Claims

8:30 Gallup Good Jobs Rate

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Jul 7)”

Leave a Reply

You must be logged in to post a comment.

Check The WSJ today: THE

shortage of gov’t bonds, worldwide which means world banks are smaller in asset structure today, and the banks are themselves are now about 30% of average World GDP vice the 69% they were last year. Care is due for all. There is a shortage of safe gov’t funds,for banks, insurance cos and retirement funds

; all pinched and could restrict withdrawals.

5