Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mostly down. Japan dropped more than 1%; Hong Kong, China, Singapore and South Korea were also weak. Europe is currently mostly up. Italy is up more than 2%; Germany, France, Finland and Spain are up more than 1%; Austria, Belgium, the Netherlands, Sweden and Portugal are also doing well. Norway is down more than 1%. Prior to the release of the latest employment data, futures in the States pointed towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil and copper are up. Gold and silver are down. Bonds are mixed.

Here are the employment numbers…

unemployment rate: 4.9% (was 4.7% last month)

nonfarm payrolls: +287K

private payrolls:

average workweek: flat at 34.4 hours

hourly wages: up 0.1% to $25.61

labor participation rate: 62.7% (up from 62.6%)

April job gain raised from 123K to 144K.

May job gain cut from 38K to 11K.

On the news, S&P futures jumped from being up 5 to being up 15. The dollar also jumped while gold and silver dropped. Oil dropped but has since recovered its loss and is up about 65 cents about 40 minutes before the open.

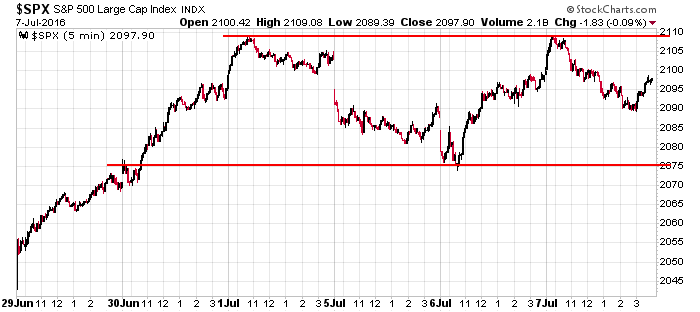

Going back to the last day of June, this is what the S&P has done. Not shown is the vertical post-Brexit drop and subsequent vertical rally. Since then, the market has quietly traded in range. As of this writing, S&P futures are up about 15, so the index will open somewhere near the high of the range.

I looked at many charts last night and didn’t find much worth buying. The groups that have provided many great opportunities (gold, silver, utilities, REITs) are either too far extended or have neutralized. Otherwise I saw many charts there were just bouncing around and very noncommittal.

Call it the summer doldrums if you wish. There just aren’t many patterns that jump of the screen yelling “trade me.” Don’t force things right now. More after the open.

Stock headlines from barchart.com…

Molson Coors Brewing (TAP -1.40%) was upgraded to ‘Buy’ from ‘Neutral’ at Bryan Garnier & Cie with a 6-month price target of $110.

GrubHub (GRUB +0.78%) was rated a new ‘Outperform’ at Wedbush with a 12-month price target of $40.

Transocean Ltd (RIG +0.50%) was downgraded to ‘Sell’ from ‘Hold’ at Cananccord Genuity.

McDonald’s (MCD +0.24%) said it sees a Q2 pretax charge of $235 million, or 20 cents a share, on refranchising and G&A programs along with the move of its corporate headquarters.

United Technologies’ (UTX +0.58%) Pratt Unit was awarded a contract by the U.S. Navy valued at $1.5 billion for 99 total engines for the Martin F-35 Lightning II aircraft.

The Gap (GPS -0.73%) climbed 4% in after-hours trading after Retail Metrics reported that Jun comparable same-store-sales were up +2% y/y, better than expectations of down -3.6% y/y.

PriceSmart (PSMT -2.90%) fell over 4% in after-hours trading after it reported Q3 EPS od 55 cents, well below consensus of 70 cents.

Capital One Financial (COF +1.00%) was upgraded to ‘Buy’ from ‘Neutral’ at D.A. Davidson with a price target of $76.

WD-40 (WDFC +0.28%) slid over 3% in after-hours trading after it cut its view on 2016 revenue to $378 million-$383 million from an April 7 estimate of $385 million-$394 million.

The $360 million punitive award in the trial alleging defects in Johnson & Johnson’s (JNJ -0.11%) hip implants was cut to $10 million after a Texas judge applied a cap on punitive damages.

Barracuda Networks (CUDA +3.40%) jumped 15% in after-hours trading after it raised guidance on fiscal 2017 adjusted EPS to 54 cents-59 cents from an April 26 estimate of 45 cents-50 cents.

Roche Holding AG (RHHBY -0.15%) said it received FDA approval for its test for human papillomavirus that can be used with cervical cells obtained for a Pap test for use with SurePath Preservative Fluid.

Eleven Biotherapeutics (EBIO -3.45%) surged over 20% in after-hours trading after it said its IND application for EDI-031 for the treatment of ocular diseases has become effective.

Wednesday’s Key Earnings

Walgreens (NASDAQ:WBA) -2.4% on Brexit, Rite Aid deal uncertainty.

Today’s Economic Calendar

8:30 Non-farm payrolls

1:00 PM Baker-Hughes Rig Count

3:00 PM Consumer Credit

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

18 thoughts on “Before the Open (Jul 8)”

Leave a Reply

You must be logged in to post a comment.

Ignore the payroll numbers: pure politics, or imcompetitence, 0r both. The markets are set up for correction to start.

Quite the turn. Now the dollar is down, and gold and silver are up.

Things that are going up: defensive stocks (PG, JNJ etc.) and safe havens like consumer staples, utilities, gold.

Things that are going down: financials, materials, some technology.

Does this tell us anything about what the smart money is preparing for? Just asking.

It is definitely worth noting the rotation.

But doesn’t a VIX at 13.50 indicate a fair amount of complacency?

The VIX isn’t very sensitive. I can stay low for a long time.

Great note. This is likely a correction of some duration, or the 2016 summer in any case. But use the time to plan your portfolio. If the election is popular we could see a strong drive into May 2017.After that who knows…pure seasonality, if not worse.

dividend stocks (e.g. utilities) are rallying because yields are going down. and defensive stocks are usually high-dividend stocks. i’d be careful to not confuse that effect with rotation into defensive groups.

sell

brexit schmexit fedexit. the magicians fool us to look at their lips and in their eyes, and convince us that rates are going up and markets are going down. before we can turn around to see what is really going on, markets are almost at new highs and rates are carving new multi-decade lows day after day. 10yr under 1.4%, 30y under 2.12%.

whilst i may close my index longs early ,i certainly wont be taking any new long direction futures moves

other world futures do not confirm usa moves, whilst money may be coming into usa

however today could be a exhurstion high

if usa does break to new highs i will consider if its a false break or not

but i feel more comfortable to wait for shorts here

any new high would be a extremly bearish broadening pattern and spx is very close

waiting is harder than trading

Jason you mentioned gold is extended, do you believe the rally in gold is over?

No I don’t think it’s over. The stock could rest at any time, but I’d expect higher prices, and if we happen to get a pullback soon, it’ll be a great buying opportunity.

Thanks for the insight Jason. Seems like gold has stalled a tad but hopefully it can punch through the resistance in the mid 1370s…

i cant imagine holding any longs here with so much geopolitical crap going on…yesterday was a gap up and fade back…now gap up and go…

now imagine holding shorts over the weekend. you’d be shaking in your boots (or rather in your beachwear given the season and your location) with the visions of a 50-point (ES) gap up monday morning. lol

Why not hold long? The S&P is in a consolidation pattern within an uptrend. It’s business as usual as far as I’m concerned.