Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan, Australia, Indonesia and South Korea led the way. Europe is currently mostly up, but gains are minimal. Switzerland is up more than 2%; Greece more than 1%; and France, Finland and Spain are also doing well. Hungary is weak. Futures here in the States point towards a positive open for the cash market.

—————

List of Indexes and ETFs – here

—————

The dollar is flat. Oil is down; copper is up. Gold and silver are up. Bonds are up.

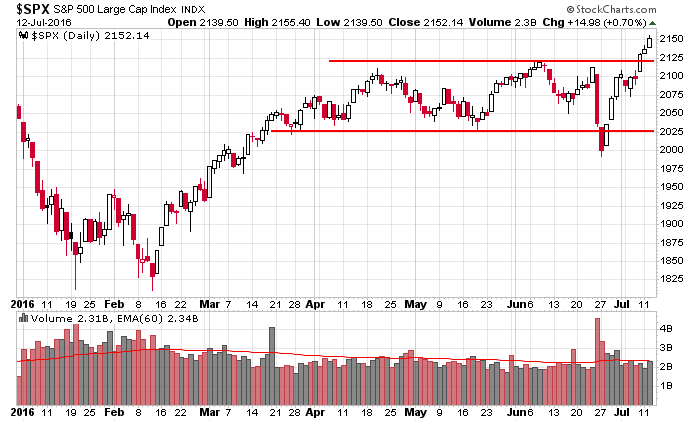

The S&P jumped to another new high yesterday. Since the post-Brexit bottom the index has moved up 8 of 10 days while the Russell 2000 has moved up 9 of 10 days. Here’s the daily S&P. First we got a move below the channel; now we got a move above.

Beneath the surface, there may be a change in leadership taking place. Gold and silver, which have done great this year and have provided us with many very good trades, suffered one of their biggest down days of the year. Utilities, which have also been steadily trending up, also dropped – not a great performance considering the market did well. On the flip side, oil, which has been weakish lately, did very well, and airlines, which have suffered big losses, posted a big gain.

No group goes up forever, and no group drops forever (well, some do), so we need to respect the possible change in leadership.

Trading has been much more hands off this year because several groups that have many components gave us opportunities to buy and hold for several months, but if there’s a change in leadership, we’ll have to be more active re-positioning ourselves.

Stock headlines from barchart.com…

Bank of America (BAC +2.50%) was rated a new ‘Buy’ at Berenberg with a price target of $15.

Whiting Petroleum (WLL +12.53%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

Darden Restaurants (DRI +0.29%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Wells Fargo Securities.

Alexion Pharmaceuticals (ALXN +0.04%) was rated a new ‘Outperform’ at RBC Capital Markets with a 12-month price target of $188.

Michaels Cos (MIK +0.14%) dropped over 3% in after-hours trading after it started a secondary offering of 11 million shares of common stock.

Chesapeake Lodging Trust (CHSP +1.09%) slipped nearly 1% in after-hours trading after it said Q2 pro forma revpar rose +2.2%, below an April 28 forecast of up +4%-6%, citing continued headwinds at the start of the second half of the year.

AAR Corp. (AIR +4.33%) sank 10% in after-hours trading after it said it sees 2017 EPS continuing operations of $1.30-$1.40, well below consensus of $2.07.

Teva Pharmaceutical Industries Ltd. (TEVA +3.00%) gained nearly 2% in after-hours trading after it raised guidance on Q2 revenue to $4.9 billion-$5.0 billion from a prior view of $4.8 billion-$4.9 billion.

Fastenal (FAST -3.46%) was downgraded to ‘Hold’ from ‘Buy’ at Edward Jones.

Minneapolis Fed President Kashkari (non-voter) said the Fed can continue to be patient on raising interest rates as “there’s not a huge urgency to raise rates because inflation is coming up low.”

Juno Therapeutics (JUNO +1.68%) surged 33% in after-hours trading after the FDA removed the clinical hold on Juno’s Phase 2 study of JCAR015 to treat lymphoblastic leukemia.

Avinger (AVGR -0.44%) lowered guidance on 2016 revenue to $19 million-$23 million from a prior view of $25 million-$30 million.

Orexigen Therapeutics (OREX +0.50%) rallied over 4% in after-hours trading after its top shareholder, Baupost, said it may convert/exercise notes/warrants of up to 4.7 million common shares.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Import/Export Prices

9:00 Fed’s Kaplan: Monetary Policy

10:00 Atlanta Fed’s Business Inflation Expectations

10:30 EIA Petroleum Inventories

1:00 PM Results of $12B, 30-Year Note Auction

2:00 PM Treasury Budget

2:00 PM Fed’s Beige Book

6:30 PM Fed’s Harker: Economic Outlook

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Jul 13)”

Leave a Reply

You must be logged in to post a comment.

Nothing new, but P/E ratios on SP suggest buy with care. The ratios say to me that SP is overpriced @ 1/18, but in a move up any PE is fair (Sam Stovld SP honcho). long.