Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Singapore, Hong Kong, Indonesia and Taiwan dropped more than 1%. Japan and New Zealand did well. Europe is currently mixed. Belgium, Spain, Italy and Portugal are up more than 1%; Greece is also doing well. The Czech Republic, Russia and Poland are down. Futures in the States point towards a mixed open for the cash market.

—————

Sponsor: PLcharts.com – draw and share profit/loss charts in the cloud

—————

The dollar is down. Oil and copper are down. Gold is flat; silver is down. Bonds are down.

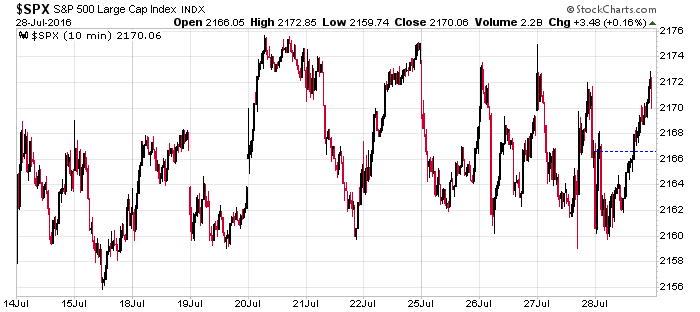

The market has done this over the last 11 days: up, down, up, down, up, down, up, down, up, down, up, down. Here’s an intraday chart.

Considering this is earnings season and stocks are jumping in both directions – not to mention there has been some M&A activity – it’s remarkable the S&P has been able to just sit in a 20-point range.

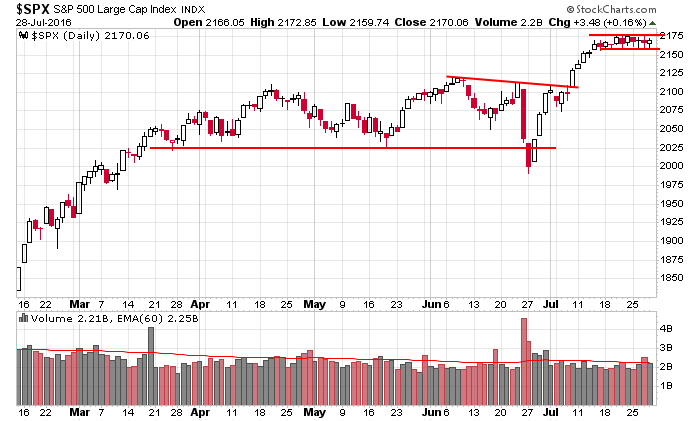

Here’s the daily. After a brief move below support, the index shot up. And now, instead of correcting with a price increase, it’s correcting with time. Prices are just drifting sideways to allow some key moving averages to catch up and to give the breadth indicators time to work off their negative divergences. I remain in the camp that believes the S&P is heading to 2300-2400.

Stock headlines from barchart.com…

Alphabet (GOOG +0.56%) is up +3% in overnight trading after reporting Q2 adjusted EPS of $8.42 late Thursday, above the consensus of $8.03, on mobile adds and cost controls.

Amazon.com (AMZN +2.16%) rallied as much as +4% in after-hours trading yesterday and is up +1.4% this morning after Q3 revenue guidance was stronger than expected.

NextEra Energy (NEE) agreed to buy the Oncor Electric Delivery Co. LLC utility unit from Energy Future Holdings in a deal worth $18.4 billion as part of the process of allowing Energy Future Holdings to emerge from bankruptcy.

Wynn Resorts (WYNN +2.37%) fell -5% in after-hours trading on disappointment about a 24% drop in Macau betting.

Stamps.com (STMP +1.63%) rallied by +5% in after-hours trading after management raised its full-year revenue and EPS guidance.

Expedia (EXPE +1.77%) fell -6% in after-hours trading after saying that there was some lost booking time involved in moving Orbitz to its back-end technology platform, causing a Q2 revenue miss.

Earnings reports this morning have been mostly positive with reports including UPS (UPS -0.06%) (1.43 vs 1.427), Merck (MRK -0.29%) (0.93 vs 0.91), Tyco (TYC -0.72%) (0.54 vs 0.53), Xerox (XRX -0.90%) (0.30 vs 0.25), Ventas (VTR +1.33%) (1.04 vs 1.034), Phillips 66 (PSX +1.13%) (0.94 vs 0.933). Disappointing reports include Cigna (CI -1.55%) (1.98 vs 2.37) and Public Service Enterprise Group (PEG -0.16%) (0.17 vs 0.58).

Thursday’s Key Earnings

DigitalGlobe (NYSE:DGI) unchanged after topping Q2 estimates.

Columbia Sportswear (NASDAQ:COLM) -2.5% on disappointing sales levels.

Starz (NASDAQ:STRZA) -0.5% after in-line EPS.

Western Digital (NASDAQ:WDC) -6.9% after posting a loss.

SkyWest (NASDAQ:SKYW) +1% after strong earnings.

Expedia (NASDAQ:EXPE) -6.5% due to sales miss.

Today’s Economic Calendar

8:30 GDP Q2

8:30 Employment Cost Index

9:30 PM Fed’s Williams Speech

9:45 Chicago PMI

10:00 Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

3:00 Farm Prices

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Jul 29)”

Leave a Reply

You must be logged in to post a comment.

Corporate spending on equipment, structures and intellectual property, decreased an annualized 2.2 percent after a 3.4 percent fall in the first quarter 2016. Outlays for equipment dropped for the fourth quarter in the last five. Spending on structures — everything from factories to shops to oil rigs — have increased in just one quarter since the end of 2014. Bloomberg.

Watch Japan the JCB needs to get money into economy. Just giving money to the public is being considered, it may suggest where the USA is headed.

It is easy to throw a target of 2300-2400 without any mention of the timeframe! How about correction? how much if there is one? All this questions are very difficult for you to answer..!

Your point is legit. Of course the S&P will eventually rally to 2300-2400, even if it’s in 10 years.

My time frame is right now, this year. Maybe there’s a minor correction. Who knows? But I’m betting the target will be hit within the market’s current trend.