Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan dropped 1.1%, and Singapore fell 0.8%. India and Indonesia did well. Europe is currently mostly down. Spain and Italy are down more than 1%; Austria, Belgium, the Netherlands, Norway, the Czech Republic, Greece and Poland are also weak. Russia, Denmark and Turkey are doing well. Futures in the States point towards a slight down open for the cash market.

—————

Sponsor: PLcharts.com – draw and share profit/loss charts on the web.

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are down.

The Fed has come and gone without much for us market participants to talk about. Even though the market is near its highs, rates will continue to be held down.

Gold and silver popped the last two days. These have been my favorite groups going back a couple months. They just went through a soft spot where, in many cases, stocks dropped to their up-trending 50-day moving averages. Now they’re heading north again. We’ll see if they hit higher highs or form larger consolidation patterns.

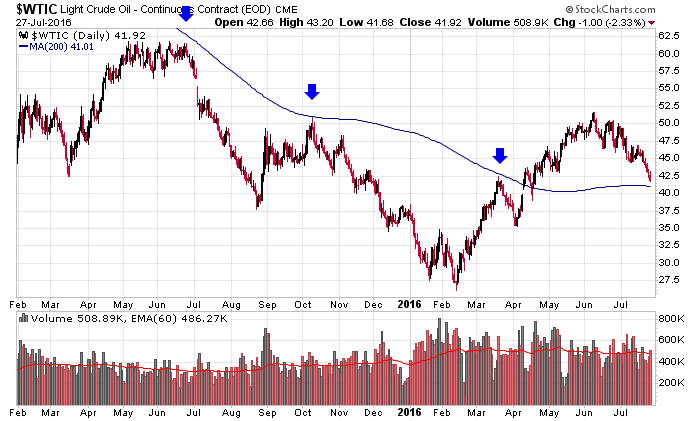

Oil continues to deteriorate. It’s legit to ask if the recent action is just a pullback within an uptrend or the beginning of a downtrend. This is one of the oil charts I’m keying on. If crude can hold its 200-day down near $41, I’ll consider the uptrend to be intact.

Earnings season isn’t having a huge affect on stocks. There are movers but very few big movers. Still recognize the risk if you hold into a report.

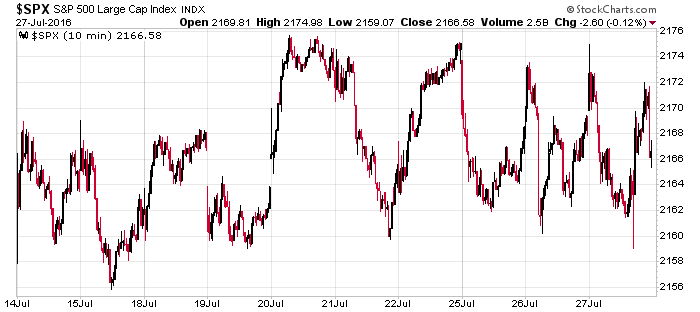

Here’s the S&P over the last 10 days. Ugh.

Stock headlines from barchart.com…

Facebook (FB +1.75%) rallied 5% overnight after revenue and user figures topped estimates on a surge in mobile ads.

Groupon (GRPN -3.32%) rallied 24% in after-hours trading on higher sales guidance for the remainder of the year.

Cirrus Logic (CRUS +2.50%) rallied 14% in after-hours trading after strong revenue guidance and EPS and sales figures that beat the consensus (Q1 EPS of 44 cents vs 27 cent consensus).

Whole Foods (WFM -1.38%) fell 4% in after-hours trading after missing sales estimates on tougher competition.

Vertex Pharmaceuticals (VRTX +1.08%) fell -2.5% in after-hours trading after reporting disappointing sales for its Orkambi therapy.

Barrick Gold (ABX +4.40%) fell -2.6% in after-hours trading after releasing its quarterly earnings report.

Earnings reports this morning have been nearly all positive with results including: Fifth Third (FITB -0.05%)(0.41 vs 0.38 consensus), Marathon Petroleum (MPC -2.02%)(1.62 vs 0.97), Dow Chemical (DOW +0.17%)(0.95 vs 0.85), Colgate-Palmolive (CL -0.95%)(0.70 vs 0.60), Raytheon (RTN -0.04%)(2.38 vs 2.02), Bristol-Myers (BMY +1.88%)(0.69 vs 0.66), CME Group (CME +1.20%) (1.14 vs 1.11),

Wednesday’s Key Earnings

Altria (NYSE:MO) -1.7% as smokable products volume declined.

Amgen (NASDAQ:AMGN) flat AH despite raising guidance.

Barrick Gold (NYSE:ABX) -0.4% after missing expectations.

Boeing (NYSE:BA) +0.8% after beating estimates.

Coca-Cola (NYSE:KO) -3.3% cutting its sales forecasts.

Comcast (NASDAQ:CMCSA) +1.1% on a strong Internet business.

Corning (NYSE:GLW) -1% following a decline in Q2 profit.

Facebook (FB) +4.7% on ad sales growth.

GoPro (NASDAQ:GPRO) +1.6% AH after topping expectations.

Groupon (NASDAQ:GRPN) +23.8% increasing the level of active users.

T-Mobile (NASDAQ:TMUS) +1.5% on new subscriber additions.

Whole Foods (NASDAQ:WFM) -5.2% AH as comparable sales declined.

Today’s Economic Calendar

8:30 International trade in goods

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $28B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

6 thoughts on “Before the Open (Jul 28)”

Leave a Reply

You must be logged in to post a comment.

TED spread is saying indices are not paying attention (too high relative to bonds). THE bond spread is not reflected in index stocks for some time. But when its noticed by investors, pull up your pants cause you will be swimming in the sewer.

Jason, any comment on WTIC relatively status quo YOY?

No one seems to notice. Sam Danziger

No, the fact that oil is flat yoy is not meaningful to me. I look at the trends. Right now we have a pullback within an uptrend and a key level coming up. That’s all I’m looking at.

oil plunged when usa and russia were adversaries in syria, recovered a bit when usa and russia cooperated on solutions, and began falling again when the syria end game scenarios of the two nuclear superpowers diverged again. there might be more pain to come in the oil pit based on what i am seeing in the syrian conflict. new swing lows possible. but this can turn on a dime if usa and russia agree again. if and when it turns, it will be a fast and furious and spectacular rally that blows past the recent highs and tests the fundamentally fair value of oil, currently round $70/bbl.

Thx LL

30-point consolidation in SPY is over, broke out decisively. target 240. 240 is also the first target for long-term breakout from the 800-1,600 consolidation pattern. major rally will be confirmed when IWM breaks out to new all-time highs. Qs already caught up after lagging for quite a while.