Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the downside, but movement was minimal. India dropped 1.1%, and Taiwan moved up 0.5%. Otherwise the markets were all within 0.3% of their unchanged levels. Europe is currently mostly down, but movement is minimal there too. Austria, Norway and Denmark are down; Greece is up. Everything else is close to unchanged. Futures in the States point towards a positive open for the cash market.

————————-

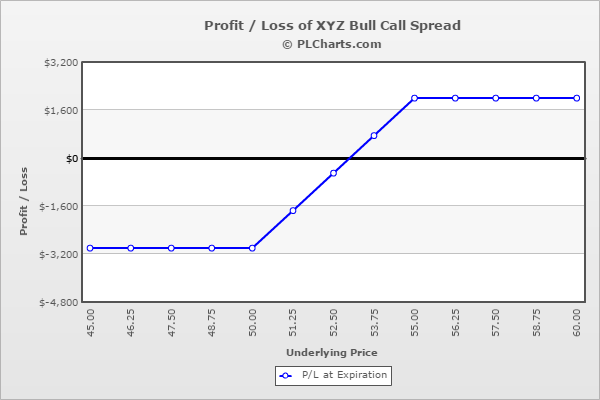

Sponsor: PLcharts.com – draw and share profit/loss charts on the web. Here’s an example of a 50/55 call spread.

————————-

The dollar is down. Oil is down; copper is up. Gold and silver are up. Bonds are up.

There is very little going on with the market right now. In fact I can’t remember a time when the market was so quiet. The intraday range, volume, movement, volatility – all very low. I’m not a quant, so I can’t crunch numbers and give you an historical perspective, but purely from observation I can tell you this is as slow as it gets. This is a true summer doldrums.

I, of course, remain bullish and believe the S&P is headed for 2300-2400, which at this point isn’t that far away. The index rallied 150 points off its post-Brexit low in two weeks. It could do the same at any time. It’s doubtful it happens now, but once the ball gets rolling, it could certainly happen quickly.

Gold and silver remain a place to be. Despite not much going on among the indexes (it seems all the cross-currents are canceling each other out) there are a few groups doing very well. We’ve been long gold and silver since February and have no reason to abandon positions. Today I’ll update the gold and silver report I posted two weeks ago. More after the open.

Stock headlines from barchart.com…

Yelp (YELP +3.03%) jumped 12% in pre-market trading after it reported a surprise Q2 EPS profit of 1 cent, much better than consensus of a -7 cent loss, and then raised its full-year revenue estimate to $700 million-$708 million from a prior view of $690 million-$702 million.

Michael Kors Holdings Ltd. (KORS -0.32%) slipped nearly 3% in pre-market trading after it reported Q1 adjusted EPS of 88 cents, better than consensus of 74 cents, but said it sees Q2 adjusted EPS of 84 cents-88 cents, below consensus of $1.03.

Disney (DIS +0.96%) fell over 1% in pre-market trading after it reported Q3 adjusted EPS of $1.62, above consensus of $1.61, but said its Q3 free cash flow was $33 million, well below consensus of $2.0 billion, after it bought a minority stake in BAMtech for $1 billion.

WhiteWave Foods (WWAV +0.29%) was downgraded to ‘Neutral’ from ‘Buy’ at DA Davidson.

Cinemark Holdings (CNK -0.82%) was downgraded to ‘Hold’ from ‘Buy’ at Drexel Hamilton LLC.

Buffalo Wild Wings (BWLD +0.53%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Raymond James.

Fossil Group (FOSL -1.24%) gained over 2% in after-hours trading after it reported Q2 EPS of 12 cents, higher than consensus of 9 cents.

Cliffs Natural Resources (CLF -4.58%) dropped 3% in after-hours trading after it announced a $300 million secondary offering.

Mylan NV (MYL +2.86%) lost nearly 2% in after-hours trading after it reported Q2 adjusted EPS of $1.16, higher than consensus of $1.14, but Q2 revenue of $2.56 billion was weaker than consensus of $2.57 billion.

SunPower (SPWR -3.40%) plunged over 22% in pre-market trading after it abandoned plans to at least break even this year, citing challenging conditions in its power-plant business. SPWR now sees a 2016 net loss of $125 million-$175 million, well below a May forecast of break-even or a profit of as much as $50 million.

Myriad Genetics (MYGN -1.77%) sank over 20% in after-hours trading after it reported Q4 adjusted EPS of 36 cents, weaker than consensus of 38 cents, and said it sees 2017 adjusted EPS of $1.00-$1.10, well below consensus of $1.79.

Halozyme Therapeutics (HALO +3.07%) rose over 6% in after-hours trading after it reported a Q2 loss of -21 cents a share. a smaller loss than consensus of -29 cents.

DHT Holdings (DHT -1.44%) rallied almost 5% in after-hours trading after it reported Q2 EPS of 34 cents, better than consensus of 30 cents.

Clean Energy Fuels (CLNE +1.75%) surged 15% in after-hours trading after it reported an unexpected Q2 adjusted EPS profit of 3 cents, much better than consensus of a -14 cent loss.

Tuesday’s Key Earnings

Cheniere Energy (NYSEMKT:LNG) -1.8% as a natural gas glut depressed prices.

Disney (DIS) -1.2% AH despite topping estimates.

SolarCity (NASDAQ:SCTY) -1.4% AH issuing weak guidance.

SunPower (NASDAQ:SPWR) -22.3% AH cutting its revenue forecast, workforce.

Valeant (NYSE:VRX) +25.4% receiving offers for its core assets.

Yelp (NYSE:YELP) +11.4% AH after beating expectations.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

10:00 Job Openings and Labor Turnover Survey

10:30 EIA Petroleum Inventories

1:00 PM Results of $23B, 10-Year Note Auction

2:00 PM Treasury Budget

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Aug 10)”

Leave a Reply

You must be logged in to post a comment.

The small caps are showing a slowing in productivity mirroring larger business units which are very slow. 1% growth in the US GDP is not going to be easy. Care is good these days. Dividends such as EDI have my attention, with 5% stops of course.