Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China, Taiwan and Australia posted losses while Hong Kong, India and Malaysia posted gains. Europe currently leans to the upside. France, Belgium, Switzerland, Greece and Turkey are leading. Futures in the States point towards a positive open for the cash market.

————————-

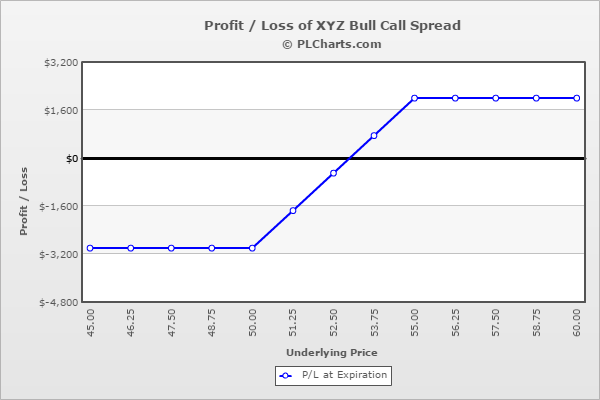

Sponsor: PLcharts.com – draw and share profit/loss charts on the web. Here’s an example of a 50/55 call spread.

————————-

The dollar is up. Oil is down; copper is up. Gold and silver are down. Bonds are down.

There isn’t much for me to talk about here other than just report the news. The market is slow. It’s trading in a small range every day. There’s no energy. There’s little movement and volatility. Volume has fallen off. Despite all that’s going on in the world, this is a true summer doldrums. Kids are getting ready to go back to school, and Wall St. doesn’t seem very interested in aggressively buying or selling.

Don’t force things right now. Be patient.

Stock headlines from barchart.com…

Kohl’s (KSS +0.90%) rallied 6% in pre-market trading after it reported Q2 adjusted EPS of $1.22, higher than consensus of $1.03.

Alibaba Group Holdings Ltd (BABA +2.45%) jumped over 5% in pre-market trading after it reported Q1 revenue of $4.84 billion, well above consensus of $4.54 billion.

Scripps Networks Interactive (SNI +1.04%) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI.

Flowers Foods (FLO -9.01%) reported Q2 adjusted EPS of 24 cents, below consensus of 26 cents, and then cut its 2016 adjusted EPS view to 90 cents-95 cents, weaker than consensus of $1.00.

Masonite International (DOOR +0.13%) reported Q2 adjusted EPS of $1.02, well above consensus of 88 cents.

Shake Shack (SHAK -1.71%) tumbled nearly 10% in pre-market trading after it reported Q2 comparable sales of up +4.5%, below consensus of +5.4%.

Chesapeake Energy (CHK -0.21%) climbed over 5% in after-hours trading after it cut $1.9 billion in commitments by selling its interests in the Barnett Shale operating area to Saddle Barnett Resources.

Spark Energy (SPKE +0.52%) rose over 6% in after-hours trading after it raised its 2016 adjusted Ebitda view to $75 million-$82 million from a May 4 view of $44 million-$48 million.

Blue Buffalo Pet Products (BUFF +1.17%) gained over 2% in after-hours trading after it reported Q2 adjusted EPS of 19 cents, better than consensus of 17 cents, and then raised its full-year adjusted EPS view to 74 cents-76 cents from a prior view of 73 cents-74 cents.

Avinger (AVGR -1.70%) slumped over 15% in after-hours trading after it began a secondary offering of common stock, no amount was mentioned.

Omeros (OMER -3.81%) dropped nearly 9% in after-hours trading after it announced a secondary offering of $40 million of common stock.

Gulf Resources (GURE -3.39%) surged 14% in after-hours trading after it reported Q2 EPS of 28 cents, versus 23 cents y/y.

Wednesday’s Key Earnings

JD.Com (NASDAQ:JD) +4.7% after strong Q2 earnings.

Michael Kors (NYSE:KORS) -2.8% on slumping same store sales.

Shake Shack (NYSE:SHAK) -9.9% AH on slower comparable sales growth.

Silver Wheaton (NYSE:SLW) hardly moved AH following in-line results.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Import/Export Prices

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $15B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Aug 11)”

Leave a Reply

You must be logged in to post a comment.

Waiting, Yesterday’s volume suggested no one is interested. Retail issues seem to suggest recession in retailing has begun. No bold moves warranted this month.

dont be fooled –the market is in for a very big crash

starting very soon

become a bear tomorrow and have some fun

demand is approaching zero and supply is about to arrive

sure hope so…i count 7 gap ups on spx…