Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the upside. Australia and Taiwan did well; Japan and Malaysia posted losses. Europe is currently mostly up. Austria, Spain, Italy and Sweden are up more than 1%; the UK, Germany, France, Belgium, the Netherlands, the Czech Republic and Greece are also doing well. Futures in the States point towards a positive open for the cash market.

—————

List of Indexes and ETFs – here

—————

The dollar is down. Oil and copper are down. Gold and silver are up. Bonds are down.

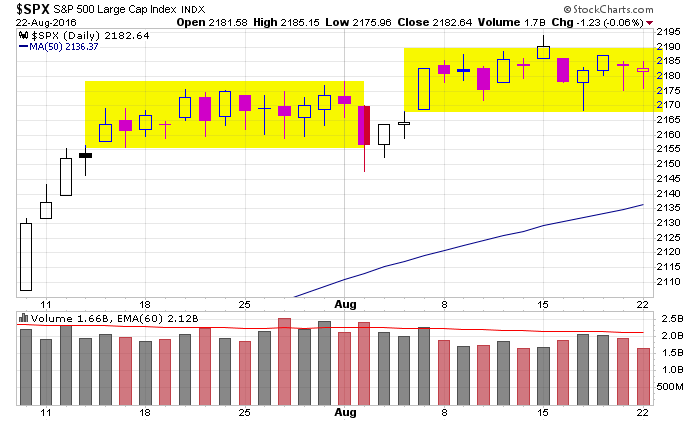

The market didn’t do much yesterday. In fact it hasn’t done much for most of the last five weeks. Once it recovered from its post-Brexit selling, it settled into a range and has just chopped around. Here’s the S&P daily going back six weeks.

The market will move when it wants to move. Not when you and I want it to move. When IT’S ready to move. Maybe it’ll be later this week once the Jackson Hole conference starts. Maybe it’ll be next week. Maybe it’ll be after Labor Day. I don’t know. When it’s ready, it’ll move.

Stock headlines from barchart.com…

Best Buy (BBY +0.64%) jumped over 12% in pre-market trading after it reported Q2 adjusted EPS continuing operations of 57 cents, well above consensus of 43 cents as Q2 enterprise comparable sale unexpectedly rose +0.8%, better than expectations of a -0.6% decline.

Monsanto (MON +0.34%) climbed nearly 4% in pre-market trading after people familiar with the matter said negotiations between Monsanto and Bayer AG are advancing toward a deal.

Darden Restaurants (DRI -0.24%) was rated a new ‘Buy’ at Canaccord Genuity with a 12-month target price of $74.

Nordson (NDSN +0.05%) rose over 2% in after-hours trading after it reported Q3 adjusted EPS of $1.47, higher than consensus of $1.33, and said it sees Q4 sales up 6%-10%.

Sonic (SONC -1.07%) was rated a new ‘Buy’ at Canaccord Genuity with a 12-month price target of $35.

Tableau Software (DATA -0.69%) jumped over 5% in after-hours trading after it announced Adam Selipsky, currently VP of marketing, sales and support for Amazon Web Services, will be Tableau’s new CEO.

Square (SQ +0.17%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel with a 12-month target price of $15.

Multi Packaging Solutions International (MPSX -0.41%) lost nearly 2% in after-hours trading after it reported Q4 adjusted EPS of 3 cents, well below consensus of 9 cents.

Premier (PINC +2.74%) dropped 8% in after-hours trading after it reported Q4 adjusted EPS of 36 cents, below consensus of 38 cents.

Shoe Carnival (SCVL +0.51%) climbed over 3% in after-hours trading when it was announced that it will replace Sagent Pharmaceuticals in the S&P SmallCap 600 at the close of trading on Friday, August 26.

Zoe’s Kitchen (ZOES +1.09%) sank 15% in after-hours trading after it reported Q1 comparable sales up 4%, below consensus of 5.1%, and then lowered its view on annual comparable sales to up 4%-5%, weaker than a previous view of 4.5%-6%.

Eagle Pharmaceuticals (EGRX -1.12%) gained almost 2% in after-hours trading when it was announced that it will replace Cash America in the SmallCap 600 after the close of trading Thursday. September 1.

Tokai Pharmaceuticals (TKAI +22.52%) slumped over 17% in after-hours trading after the company said it will stop enrollment in its Armor2 expansion trial of its treatment of prostate cancer.

Sophiris Bio (SPHS +0.52%) plunged over 25% in after-hours trading after the company said it will sell stock and warrants to raise cash. Price, volume and terms have yet to be announced.

Alimera Sciences (ALIM +4.67%) jumped over 4% in after-hours trading after Great Point Partners LLC reported a 5.12% passive stake in the company.

Today’s Economic Calendar

8:55 Redbook Chain Store Sales

10:00 New Home Sales

10:00 Richmond Fed Mfg.

1:00 PM Results of $26B, 2-Year Note Auction

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Oct 23)”

Leave a Reply

You must be logged in to post a comment.

Bonds are confused. Euro investors want UST bonds, but maybe not a good hedge against NIRate bonds in EU. Keep eye on melt up in stocks.