Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the downside. Japan and Singapore did well; Hong Kong and New Zealand did poorly. Europe is currently mostly up, but gains are small. France, Austria, Sweden, the Czech Republic, Spain and Italy are leading. Turkey is down almost 2%; Greece and Russia are also weak. Futures in the States point towards a slight positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil and copper are down. Gold and silver are down. Bonds are up.

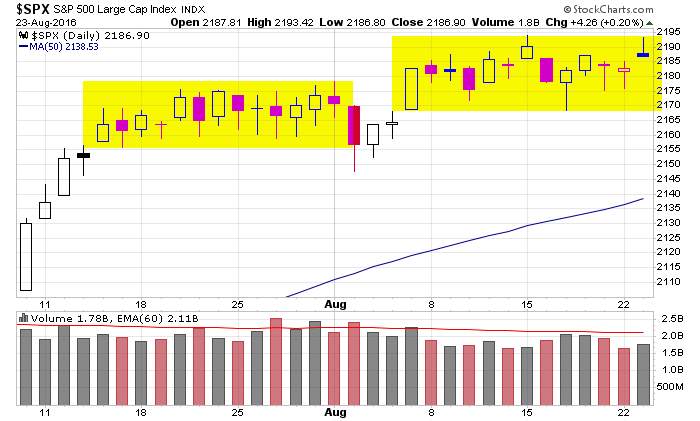

The S&P continues to trade very quietly. Most of the last six weeks have been spent in one of two very tight ranges which have brought the ATR (14) and Bollinger Band Width (20,2) down to 2-year lows. Here’s the daily. Getting a 10-15 intraday range used to be normal for the index. Now, even though it’s at an all-time high and a 10-point range is very small (relatively speaking), we’re still not getting it on most days.

Don’t over-analyze. The market will move when it’s ready to move.

Stock headlines from barchart.com…

Garmin Ltd. (GRMN +0.96%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

CST Brands (CST +0.30%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Wells Fargo.

SEACOR Holdings (CKH +0.88%) was rated a new ‘Buy’ at Stifel with a 12-month price target of $70.

Dycom Industries (DY +0.70%) dropped 4% in after-hours trading after it said the recently acquired operations of Goodman Networks is now expected to produce lower revenue in fiscal 2017 than initially anticipated.

Lannett (LCI +2.83%) surged nearly 15% in after-hours trading after it reported Q4 adjusted EPS of 73 cents, well above consensus of 59 cents, and then raised its fiscal 2017 revenue estimate to $690 million-$700 million from a prior view of $665.4 million.

Intuit (INTU +1.16%) fell over 4% in pre-market trading after it said that it sees Q1 revenue of $740 million-$760 million, below consensus of $771.9 million.

Wabash National (WNC +0.89%) climbed over 2% in after-hours trading after it was announced that it will replace Enersys in the S&P SmallCap 600 after the close of trading on Thursday, August 25.

OraSure Technologies (OSUR +0.14%) jumped over 9% in after-hours trading after it said it received a 6-year contract worth up to $16.6 million from the U.S. Department of Health and Human Services to advance the company’s rapid Zika tests.

La-Z-Boy (LZB +3.59%) tumbled 15% in after-hours trading after it reported Q1 EPS of 28 cents, weaker than consensus of 29 cents.

Nimble Storage (NMBL +1.73%) gained over 2% in after-hours trading after it reported a Q2 adjusted loss of 018 cents, a smaller loss than consensus of -20 cents.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

9:00 FHFA House Price Index

10:00 Existing Home Sales

10:30 EIA Petroleum Inventories

11:30 Results of $13B, 2-Year FRN Auction

1:00 PM Results of $34B, 5-Year Note Auction Companies reporting earnings

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Aug 24)”

Leave a Reply

You must be logged in to post a comment.

For much of the post-financial-crisis era, U.S. Federal Reserve officials have held to a belief that they could get back to their old way of doing things. Growth would resume at a modest pace, annual inflation would climb to 2% and interest rates would gradually rise from near zero to a normal level near 4% or higher. As they prepare to gather at their annual retreat in Jackson Hole, Wyo., officials are grimly coming to a view that it isn’t going to happen that way. WSJ 8/23

Jim Grant told Swiss business paper Finanz und Wirtschaft in a Q&A published on Monday that he’s scooping up shares of gold GCZ6, -0.79% and gold miners GDX, -0.93% because he fears that the world will lose faith in central banks, or as he terms it “monetary management.”

Quick question. With BBands pinching and overbought readings reset how would you recommend being positioned for a Yellen shortsqueeze that we all know is coming? Even if we get a sell off the 70% underinvested PMs, hedgies and retail will salivate to put record high cash levels to work. Just buy the RSP and Qs or what? Thanks in advance.