Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Hong Kong did well, but China, Indonesia and Taiwan were weak. Europe is currently up across-the-board. France, Austria, Spain, Italy and Belgium are up more than 1%. The Netherlands, Finland, Sweden and the Czech Republic are also doing well. Poland is weak. Futures in the States point towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is flat. Oil is down; copper is up. Gold and silver are down. Bonds are down.

August is in the books. Buy many measures it was one of the slowest months on record. The lack of intraday movement, and the lack of close-over-close movement rank it near the top (or bottom) of active months in history.

Some will say September is the worst month of the year. Others will counter and say it’s not so bad during an election year. Then others will say: “Yes but what about the 8th year of a presidential term?” And the argument will go on. In today’s world where data is cheap and programming is not hard to come by, it’s fairly easy to play with the numbers and find evidence to support your opinions, which of course is dangerous – starting with an opinion and then looking for support instead of just reading what the situation is without a bias.

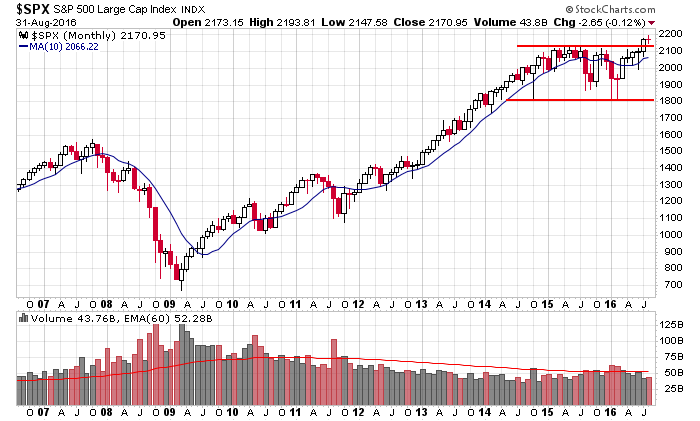

Here’s the big picture S&P monthly with a 10-month MA. The index traded through resistance last month on light volume and then just sat there in August. Officially the index posted a small loss for the month, but it closed very close to where it opened, and I’m will to just call this a Doji candle with approx. equal wicks on both sides.

Tomorrow we get the latest employment figures. I don’t know why these numbers are any more important than the previous several months, but for some reason Wall St. is on edge ahead of them. Unless something leaks today, we’re likely to get another slow day. More after the open.

Stock headlines from barchart.com…

Charter Communications (CHTR +0.46%) rose nearly 4% in after-hours trading after it was announced that it will replace EMC in the S&P 500 after the close of trading on Wednesday, September 7.

Wynn Resorts (WYNN -0.92%) is up over 3% and Las Vegas Sands (LVS -1.47%) is up nearly 2% in pre-market trading after data showed Macau gross gaming revenue unexpectedly rose +1.1% in Aug, better than expectations of a -1.5% decline.

Ctrip.com International Ltd (CTRP unch) reported Q2 revenue of $683.5 million, above consensus of $656.7 million.

Box (BOX +3.15%) rallied 4% in after-hours trading after it raised guidance on full-year revenue to $394 million-$396 million from a prior view of $391 million-$395 million.

Semtech (SMTC +1.29%) gained over 2% in after-hours trading after it reported Q2 adjusted EPS of 35 cents, higher than consensus of 33 cents.

Ollie’s Bargain Outlet Holdings (OLLI -1.17%) climbed 6% in after-hours trading after it reported Q2 adjusted EPS of 21 cents, better than consensus of 18 cents, and then raised guidance on full-year adjusted EPS to 88 cents-90 cents from a prior view of 85 cents-87 cents.

salesforce.com (CRM -0.51%) tumbled over 8% in after-hours trading after it said it sees Q3 adjusted EPS of 20 cents-21 cents, below consensus of 24 cents.

Shoe Carnival (SCVL +0.64%) fell nearly 6% in after-hours trading after it reported Q2 EPS of 22 cents, weaker than consensus of 27 cents, and then said it sees fiscal year comparable sales up +1.5% -2.0%, below a May 19 view of up 1% to 3%.

Impinj (PI +0.31%) rose 5% in after-hours trading after it reported Q2 adjusted EPS of 6 cents, double consensus of 3 cents.

Five Below (FIVE -0.56%) slid over 4% in after-hours trading after it reported Q2 comparable sales rose +3.1%, below consensus of +3.4%.

Oxford Industries (OXM -2.01%) jumped nearly 10% in after-hours trading after it reported Q2 adjusted EPS continuing operations of $1.48, better than expectations of $1.38.

Wednesday’s Key Earnings

Salesforce (NYSE:CRM) -7% AH following a disappointing outlook.

Today’s Economic Calendar

Auto Sales

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Productivity and Costs

8:30 Gallup Good Jobs Rate

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

4 thoughts on “Before the Open (Sep 1)”

Leave a Reply

You must be logged in to post a comment.

wow, oil had no support on the daily 50ma….

never saw that coming

The confusion on Fed rates will cause another slow down in productivity in the US. Likely action after a silly .25bp is not clear, but I suspect we take another ride down below 2100 SP. How far? Unknown, Maybe more QE. Mess? Yes and mad man Vice Chair Of Fed thinks negative interest rates not bad. Hold cash, get a safe.

the doji before the crash

current range spx 2160 -80–it will be broken tomorrow–maybe out side range break

position on tomorrow jobs spike above 2080 possible

the big ponsi–fed has to raise rates to 20 % to help banks

most world debt is written in USD’S

KILL GROWTH TO SAVE THE WORLD–BANKRUPT EVERYONE –SAVE THE BANKS …??????????????????/

ITS A DICOTOMY

im getting all these brokerage messages about market order entries, stop orders etc…hmmm something is up…