Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed with a lean to the upside, and as has been the case, movement was minimal. Hong Kong, Indonesia and India posted gains; Australia and China dropped. Europe is currently mostly up. The UK, France, Belgium, the Netherlands, Switzerland and Russia are doing well. Prior to the release of the latest employment figures, futures in the States point towards a flat open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is flat. Oil and copper are up. Gold and silver are flat. Bonds are down.

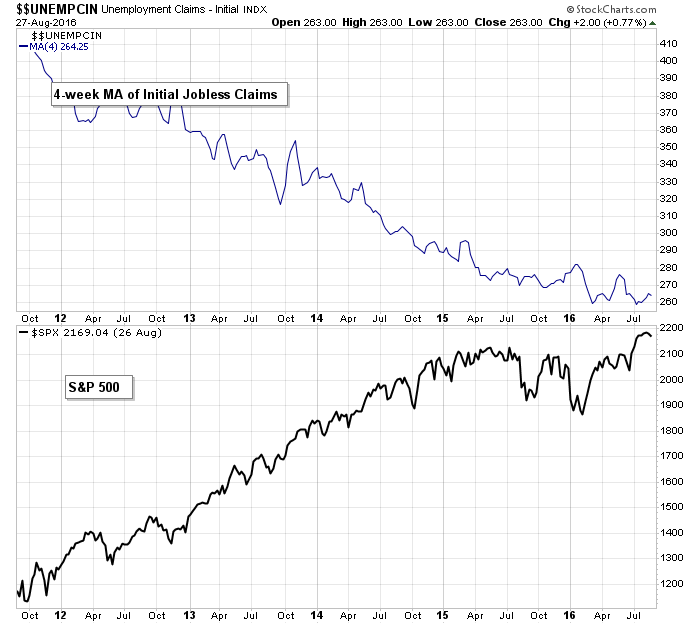

So the latest employment figures come out today. Suddenly they’re super important…so important many on Wall St. believe good numbers will result in a rate hike…as if the employment data was either the only data the Fed is keying on or the most important. But employment has been pretty darn good for many months, so in my eyes, unless there’s a huge hiccup, I don’t see why these mean much. Perhaps the media just needs something to talk about. Here a chart of the 4-week moving average of initial jobless claims. This data set is much more reliable than the monthly numbers, which often get revised multiple times, and as of now, I see no sudden improvement or deterioration. Hence why I’m a little confused today’s data is so important.

Nevertheless…

Here are the employment numbers…

unemployment rate: 4.9% (was 4.9% last month)

nonfarm payrolls: +151K

private payrolls:

average workweek: down 0.1 hour to 34.3 hours

hourly wages: up 0.1% to $25.73

labor participation rate: 62.8% (up from 62.7%)

July gain raised from 255K to 275K

June gain cut from 292K to 271K

On the news, index futures jumped, the dollar sank, and gold, silver and oil popped.

The next FOMC meeting is Sept 21. Do we really have to listen to three weeks of Fed talk?

The market is closed Monday for Labor Day, so we have a 3-day weekend ahead of us. Once things settle down after today’s open, it could turn into a pseudo 4-day weekend.

Stock headlines from barchart.com…

Ciena (CIEN +8.02%) was downgraded to ‘Hold’ from ‘Buy’ at Drexel Hamilton LLC.

Greif Inc. (GEF +6.29%) was downgraded to ‘Neutral’ from ‘Buy’ at DA Davidson with a 12-month target price of $45.

Relypsa (RLYP -0.03%) was downgraded to ‘Neutral’ from ‘Outperform’ at Wedbush.

Spark Therapeutics (ONCE +1.71%) was rated a ‘Buy” at Stifel with a 12-month price target of $73.

lululemon athletica (LULU +0.20%) dropped over 8% in after-hours trading after it said it sees Q3 adjusted EPS of 42 cents to 44 cents, weaker than consensus of 44 cents.

VeriFone Systems (PAY +1.21%) tumbled over 15% in pre-market trading after it cut its fiscal 2017 revenue forecast to down -3%, much weaker than consensus of up 5%, as CEO Galant said they are seeing “significant” EMV slowdown among U.S. small and mid-sized businesses.

Broadcom Ltd. (AVGO +0.38%) dropped 2% in after-hours trading after it said it sees Q4 adjusted net revenue of $4.10 billion +/- $75 million versus estimates of $4.06 billion.

The Gap (GPS -1.29%) lost over 2% in after-hours trading after it reported total Aug comparable sales were down -3%, a bigger decline than expectations of -2.4%.

Cooper Cos. (COO -0.30%) slid over 2% in after-hours trading after it said it expects Q4 revenue of $496 million-$509 million, below an estimated range of $498 million-$518 million.

Ambarella (AMBA -0.36%) fell 4% in after-hours trading after the company said it expects fiscal 2017 revenue of “flat to down -5%,” weaker than consensus of down -2%.

Seachange International (SEAC -5.48%) lost nearly 5% in after-hours trading after it cut its view on full-year revenue to $83 million-$88 million from a prior estimate of $110 million-$120 million.

MGT Capital Investments (MGT +0.63%) climbed 7% in after-hours trading after it withdrew its $10 million mixed securities shelf.

PetroQuest Energy (PQ -9.29%) sank over 10% in after-hours trading after it elected to not make an interest payment and said it will consider other restructuring alternatives if the company is unable to consummate exchange offers.

Thursday’s Key Earnings

Ambarella (NASDAQ:AMBA) -3.9% AH despite beating expectations.

Broadcom (NASDAQ:AVGO) -1.6% AH on solid wireless growth.

Lululemon (NASDAQ:LULU) -8.7% AH as same-store sales fell short.

Smith & Wesson (NASDAQ:SWHC) +1.9% AH raising guidance.

Today’s Economic Calendar

8:30 Non-farm payrolls

8:30 International Trade

10:00 Factory Orders

1:00 PM Baker-Hughes Rig Count

1:00 PM Fed’s Lacker speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

8 thoughts on “Before the Open (Sep 2)”

Leave a Reply

You must be logged in to post a comment.

wait till the computers take out the short stops

hmmm. at what level?

2183, or 2186?

i went short at dow 18525–spx2184–nas 4812–just closed and waiting

daily providing an evening star/hangman gap up…

Rut lookin very strong

There are TED Talks, and then, unfortunately, there is FED Talk… We could do without the latter, but Janet and co., “That’s what they do” (think Geico commercial).

The manufacturing employment is down again, they may raise rates, but they will be reversing course. Watch the dollar, hold cash, the fed and Congress are making errors consumers will pay in the near future.