Good morning. Happy Wednesday.

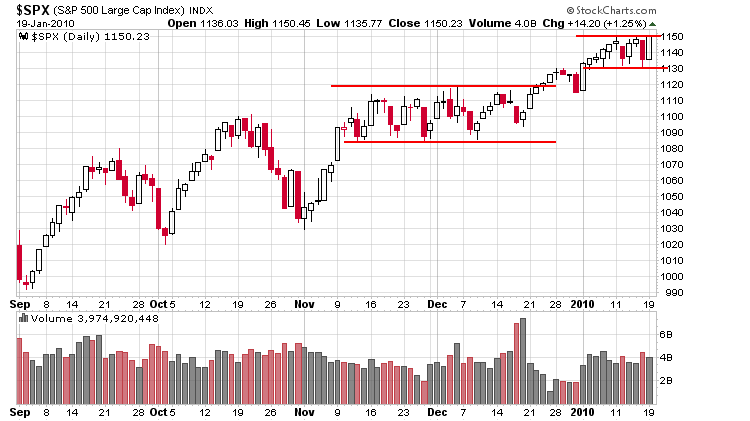

When the range is tight, the market can quickly oscillate between a period of no bias (when the indexes are smack in the middle of their ranges) to a “moment of truth” scenario. Such is the current situation. When the market opened yesterday, the S&P had been trading within a 20-point range for two weeks, and price was lower half of the range. There was no strong short term bias because price could have moved up or down within the range and not penetrated a boundary. Here we are one day later, and price is at the upper boundary, so suddenly everyone pays closer attention. Will we get a breakout and surge? A false breakout? An outright rejection at resistance? These questions weren’t even considered yesterday. How quickly things change when the range is tight.

Here’s the daily SPX…16 of the last 20 days have been up, and we’re right at resistance. The size of the pattern says we get 20 points up to 1170; the move into the pattern says we get 50 up to 1200.

The Asian/Pacific markets closed mostly down – China lost almost 3%. Europe is currently down across the board. Futures here in the States point towards a weakish open.

Bank of America (BAC) is out with earnings. Despite free money from the government, their loss widened. Citigroup reported a loss yesterday, so the nation’s two largest banks which would have no doubt gone under had the government not given them billions of dollars and interest-free loans are still losing money.

It should be a telling day…or a very boring day within the exiting range.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers