Good morning. Happy Friday.

Empolyment numbers are out. Here are the headline numbers.

unemployment rate is 10% (same as last month).

hours worked moved up 0.2% (also same as last month).

The initial reaction was down – not a forceful move…just a couple points for the S&P futures.

Did you see the football game last night…sponsored by Citigroup…and there were at least 10 GM commercials. It’s nice to know my tax dollars are being well spent.

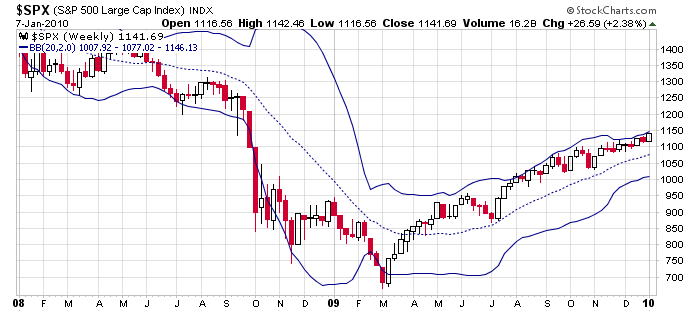

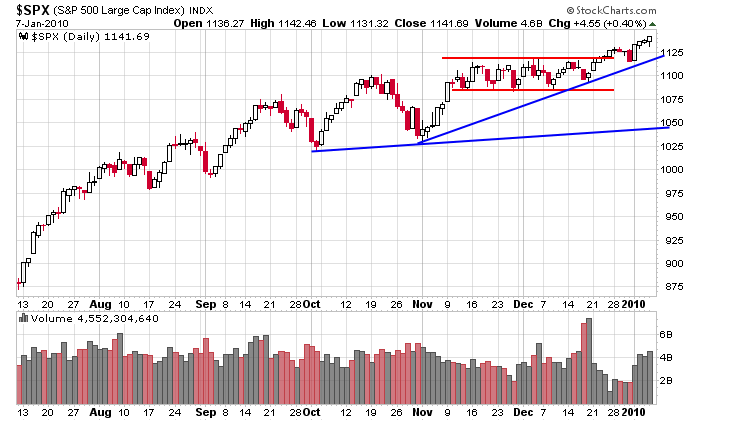

We entered this week with the market being in an uptrend, and that’s how we’ll end it – even if the indexes move down today. The movement hasn’t exactly been exciting, but it’s been effective. New highs continue to be registered, and volume has picked up. But we’re due for a correction – at least a mini one. The S&P has been up 11 of 13 days and 4 consecutive.

I’m only interested in the long side right now, but as the market goes up, I become less interested in initiating new positions. The charts will soon need to rest. A breakout at the beginning of a leg up has very high odds of working out; the same breakout towards the end of a leg up has low odds. It has more to do with the overall market and less to do with the individual stock. Here are the S&P weekly and daily.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports and Economic Numbers