Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China, Australia, India, Indonesia, Malaysia and South Korea did well. Europe is currently posting solid, across-the-board gains. Germany, Spain and France are up more than 2%; the UK, Austria, Belgium, the Netherlands, Norway, Sweden, Switzerland, Greece, Turkey, Finland, Italy and Portugal are up more than 1%. Futures in the States point towards a moderate gap up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are up.

New highs yesterday for the Nas and Nas 100; the other indexes did well but are still 1-2% below their own new highs.

After the Brexit vote, we got two intense days of selling. That’s it…two. After the ECB held off committing to more stimulus, we gone one day of intense selling. That’s it…one.

The market has underlying strength. The overall trend is up, so our default setting is to be long unless it’s blatantly obvious that’s the wrong side to be on.

The Fed held off raising rates yesterday. They won’t raise at the next meeting because it’s 6 days before the election, but December is pretty much a done deal. They have an itchy trigger finger right now, and with 3 voters preferring to raise yesterday, the market can start to price in an extra 25 basis points at the last meeting of the year. It shouldn’t be a surprise, and there shouldn’t be any debate.

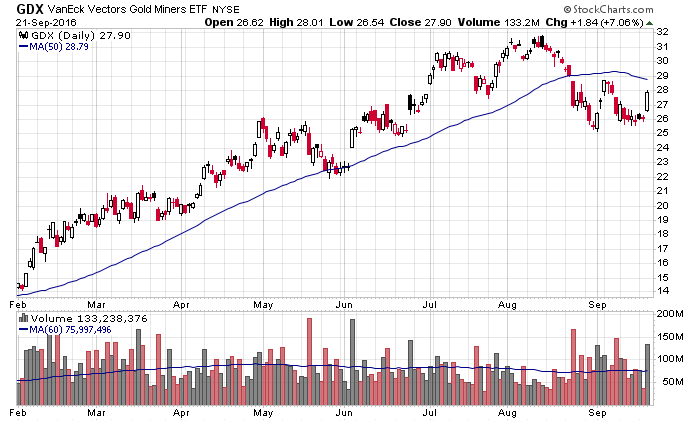

Gold and silver did great yesterday. Here’s GDX. The ETF needs to reclaim its declining 50-day MA; otherwise this 5-week pattern will resolve down and head to the low 20’s. There will continue to be a lot of money made in the group because it’s volatile and the stocks move big percentages, but its path is not yet known.

Stock headlines from barchart.com…

TransDigm Group (TDG +1.07%) was rated a new ‘Buy’ at Jeffries with a 12-month target price of $340.

Weyerhaeuser (WY +1.27%) was rated a new ‘Buy’ at Goldman Sachs with a price target of $37.

SeaWorld (SEAS +1.32%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

CorEnergy Infrastructure Trust (CORR +0.32%) was rated a new ‘Buy’ at DA Davidson with a 12-month target price of $36.

Bed Bath & Beyond (BBBY +0.14%) fell 2% in after-hours trading after it reported Q2 comparable same-store sales were down -1.2%, weaker than consensus of up +0.4%.

Herman Miller (MLHR unch) sank over 10% in after-hours trading after it reported Q1 EPS of 60 cents, below consensus of 62 cents, and said it sees Q2 adjusted EPS of 52 cents-56 cents, weaker than consensus of 60 cents.

Red Hat (RHT +1.66%) climbed 6% in after-hours trading after it raised guidance on fiscal 2017 adjusted EPS to $2.23-$2.25 from a June 22 view of $2.19-$2.23.

Jabil Circuit (JBL +2.46%) fell 4% in after-hours trading after it said it sees Q1 diversified manufacturing revenue down 12% to $2.2 billion.

Analogic (ALOG -2.51%) slid 3% in after-hours trading after it reported Q4 adjusted EPS of $1.02, below consensus of $1.14.

Chesapeake Utilities Corp. (CPK +2.52%) fell 2% in after-hours trading after it filed an automatic stock shelf of up to $52 million in shares.

Novavax (NVAX +32.88%) jumped over 10% in after-hours trading after former CEO Gail Boudreaux bought 100,000 shares of Novavax at $1.45 a share.

Ocera Therapeutics ({= OCRX=}) surged over 20% in after-hours trading after it said there were no serious safety issues at any dose level in its OCR-002 drug in a Phase 2a study to treat acute liver failure.

Wednesday’s Key Earnings

Bed Bath & Beyond (NASDAQ:BBBY) +0.4% AH boosted by digital channels.

CarMax (NYSE:KMX) -2% on dipping prices.

General Mills (NYSE:GIS) +0.9% beating earnings estimates.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Chicago Fed National Activity Index

9:00 FHFA House Price Index

9:45 Bloomberg Consumer Comfort Index

10:00 Existing Home Sales

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Sep 22)”

Leave a Reply

You must be logged in to post a comment.

New world, be careful, The global economy is being manhandled by the key global players. Yesterday was a play in the game of politics and the move is to keep things in the hands of top 5% of investors.

Small caps are lagging.

I am not really sure of this rally.

Still most other indicators are solid.

Conclusion: Go long with caution.

What happens if the Fed raises .125 instead of .25?

Seems throughout the Feds history it has been a quarter at a time.

Time to shake things up??