Good morning. Happy Friday.

The Asian/Pacific markets closed mixed and mostly little changed. Japan, Hong Kong, China, and India dropped while Singapore, Australia and Taiwan moved up. Europe is currently mostly down. Russia, Poland, Denmark, Spain and Italy are down more than 1%; France, Sweden, Switzerland and Portugal are also weak. Futures in the States point towards a down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is flat. Oil and copper are down. Gold and silver are down. Bonds are up.

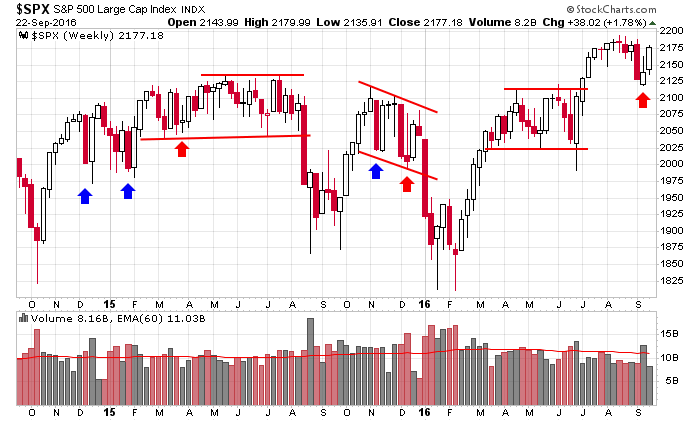

The S&P is posting a 1.8% gain for the week. After the stiff down day following the ECB news two Friday’s ago, I warned not to get overly bearish because there have been many instances where big down weeks were either followed by big up weeks or followed by big up weeks, a week delayed. It looks like we got the latter this time around. This of course assumes the market doesn’t fall hard today.

The index is about 16 points from its all-time high. The Nas and Nas 100 are already at new highs. The Russell 2000 closed at a new high yesterday. The mid caps aren’t far behind.

The trend remains up, so my bias naturally stays on the long side. The overall market hasn’t been easy to deal with lately because it spent many weeks trading in a tight range with little activity. Then it suddenly dropped and recovered. But the overall trend has remained in place, and most indicators have told us to stay the course. More after the open.

Stock headlines from barchart.com…

Yahoo! (YHOO +0.02%) is down over 1% after it said at least 500 million users had their personal information stolen when its website was hacked in 2014.

Facebook (FB +0.11%) is down nearly 2% in pre-market trading after it said it gave advertisers an inflated metric for the average time users spent watching a video.

Transocean Ltd. (RIG +5.58%) was upgraded to ‘Neutral’ from ‘Underperform’ at Credit Suisse.

Wal-Mart (WMT +0.11%) was upgraded to ‘Overweight’ from Equalweight’ at Barclays with a 12-month price target of $87.

Bats Global Markets (BATS +0.26%) surged over 20% in after-hours trading after people familiar with the matter said CBOE Holdings is in talks to acquire the company.

AAR Corp. (AIR +3.50%) rose 3% in after-hours trading after it reported Q1 EPS from continuing operations of 29 cents, better than consensus of 26 cents.

Twitter (TWTR +0.76%) fell over 2% in pre-market trading after it was downgraded to ‘Underperform’ from ‘Sector Perform’ at RBC Capital Markets.

Imperva (IMPV +0.91%) jumped over 10% in after-hours trading after a Bloomberg News report that the company has drawn interest from several companies including Cisco Systems and IBM.

8Point3 Energy Partners LP (CAFD -1.11%) slid over 2% in after-hours trading after it reported an offering of 7 million class A shares.

Glu Mobile (GLUU +0.45%) rose over 4% in after-hours trading after it said it extended a pact with Kardashian West’s business, Kimsaprincess, and may make more Kim Kardashian games.

Novatel Wireless (MIFI +3.04%) surged over 25% in after-hours trading after it said it was in a pact to sell mobile broadband unit to T.C.L, Industries Holdings for $50 million.

Enphase Energy (ENPH +12.84%) plunged 18% in after-hours trading after it said it will cut 11% of its workforce and proposed a public offering of common stock.

Thursday’s Key Earnings

AutoZone (NYSE:AZO) -0.4% following a mixed quarter.

Rite Aid (NYSE:RAD) hardly moved AH after in-line earnings.

Today’s Economic Calendar

9:45 PMI Manufacturing Index Flash

10:00 Atlanta Fed’s Business Inflation Expectations

12:20 PM Regional Fed Presidents panel

12:30 PM Fed’s Kaplan speech

1:00 PM Baker-Hughes Rig Count

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Sep 23)”

Leave a Reply

You must be logged in to post a comment.

Check today’s WSJ section c4, which says fed adds fuel. Too true and soon to hurt like hell. Bonds fall in yield, stocks want to rise, but not much buying interest. The yen is strengthening ,JCB owns 10% of the ETFs in Japan, while the ECB is unable to find bonds to buy. Care is due if one wants to walk home. Then the Dems want new taxes, Trump says end taxes. Winter could be deadly.