Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Hong Kong and Indonesia rallied more than 1%. Japan, China and South Korea also did well. Australia, India and Malaysia posted small losses. Europe is currently down across-the-board. Germany, France, Austria, Norway, Stockholm, the Czech Republic, Russia, Poland, Italy and Denmark are weakest. Futures in the States point towards a positive open for the cash market.

—————

I’ll be doing a free 45-minute webinar on Tuesday at 12:15 pm est. Click here to register.

http://investorinspiration.com/live-webinar/?utm_source=InvestorInspiration&utm_campaign=JW-Leavitt_9-27

And if you’d like to attend but can’t because you’ll be at work or you live in a drastically different time zone, register anyways, and a copy will be sent to you.

—————

The dollar is up. Oil and copper are down. Gold and silver are down. Bonds are up.

Yesterday the market followed through on Friday’s weakness, but futures are up this morning. They’re not as high as they were after the debate last night, but they’re still up, which isn’t bad considering the losses in Europe. In Vegas, the odds of Clinton winning moved in her favor.

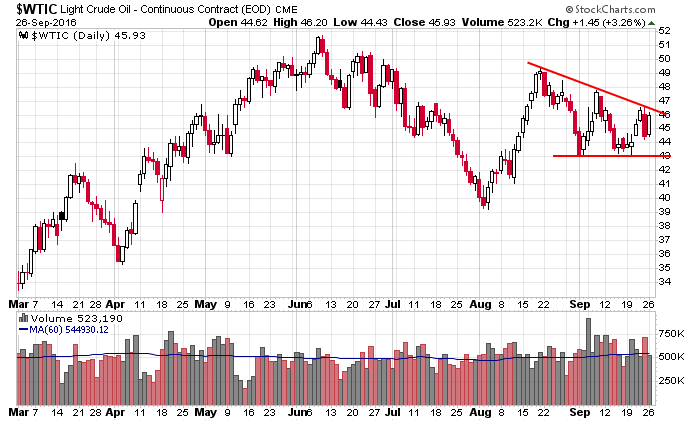

Oil is down more than a buck. News from the Middle East is Saudi Arabia and Iran will fail to agree on capping oil output. Here’s the daily. Crude is getting squeezed.

Deutsche Bank (DB) fell 7% yesterday and is down almost 3% today in premarket trading. Isolated situation or will dominos start to fall?

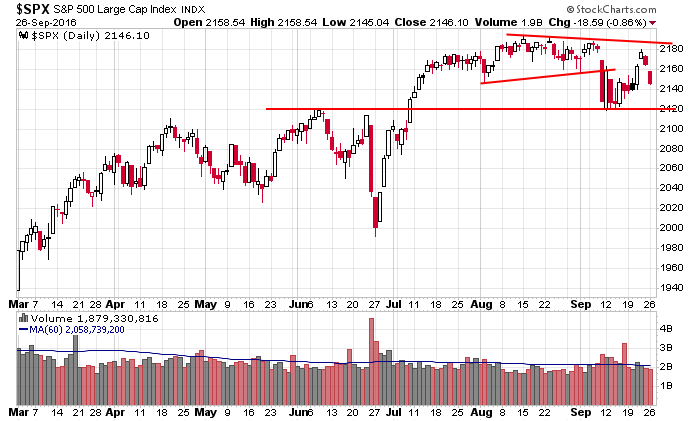

Here’s what I see forming in the S&P. A fairly tight range during the second-half of July and all of August opened up some a couple weeks ago, but the move down only tested a previous high and the subsequent move up didn’t get back to the high. I see a bigger range forming…still above the previous summer range.

A range is fine. I know it’s frustrating for short term traders, but the reality is the market spends more time trading in ranges than trading directionally. As long as the breadth indicators hold up while the range forms, I’ll maintain my bias. But if the breadth indicators start to decline, then we’re likely to get a correction. More after the open.

Stock headlines from barchart.com…

CBOE Holdings (CBOE -5.28%) was upgraded to ‘Neutral’ from ‘Underperform’ at Credit Suisse.

Electronics For Imaging (EFII -0.29%) was rated a new ‘Buy’ at Needham & Co. with a 12-month target price of $58.

Gilead Sciencies (GILD -0.92%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Leerink Partners.

AutoZone (AZO +1.88%) was upgraded to ‘Overweight’ from ‘Equalweight’ at Morgan Stanley with a price target of $840.

Consolidated Edison (ED -0.03%) was upgraded to ‘Hold’ from ‘Sell’ at Evercore ISI with a 12-month target price of $76.

Crown Holdings (CCK -0.66%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital Markets with a price target of $65.

Synnex (SNX -0.47%) jumped over 6% in after-hours trading after it reported Q3 adjusted EPS of $1.73, above consensus of $1.56, and said it sees Q4 adjusted EPS of $2.06-$2.11, higher than consensus of $1.91.

Rice Energy (RICE +0.82%) slipped 4% in after-hours trading after it announced a public offering of 40 million shares of common stock.

Sunoco Logistics Partners LP (SXL -0.38%) dropped nearly 6% in after-hours trading after offering 21 million shares to fund its Vitol Platform purchase.

Nordic American Tankers Ltd (NAT -1.57%) fell over 5% in after-hours trading after it offered 11 million shares of common stock.

Kite Pharma (KITE +0.75%) climbed 9% in after-hours trading after a study of its Zuma-1 drug showed a better-than-expected 47% complete remission rate in diffuse large B-cell lymphoma patients.

Array Biopharma (ARRY +81.10%) gained 5% in after-hours trading after the company’s binimetinib-encorafenib combo met the primary endpoint of improving progression free survival in a study of melanoma patients.

Today’s Economic Calendar

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

9:45 PMI Services Index Flash

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

11:15 Stanley Fischer speech

1:00 PM Results of $34B, 5-Year Note Auction

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Sep 27)”

Leave a Reply

You must be logged in to post a comment.

Looks like consumers and banks – world wide – have reservations on investments and government interest rate policy. we need some clarification on future policy for common folks. I am riding some dividends, tax frees and small caps. I am following the ETF actions last few days. I am scared of both candidates. The chicken.

deutsche bank has applyed to the marsian central bank to bail it out with its insolventce but been refused

it is hoping trump may bail it out with its trillions of bad debt so as usa can own germany

futures during asian trade jumped via world central bank buying but only a lower high

a nice trading pattern for a crash

instos and central banks world wide can not allow trump to win as trump will jail the lot of them

including judges for corruption including mr ponsi

sold the high in asia now sold the high in usa

the island reversals are a tell tale sign as well as the small and large terminal broadening jaws of death

should go down to at least spx 2000,then maybe a xmas reversal as trump jails all the crocks