Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Japan dropped 1.3%; South Korea was also weak. New Zealand did well to the upside; everything else was quiet. Europe is currently mostly up. Germany, Denmark, Spain, Italy and France are up more than 1%; the UK, Austria, Belgium, the Netherlands, Norway, Switzerland, Russia, Greece and Portugal are also doing well. Futures in the States point towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is flat. Oil and copper are up. Gold is flat; silver is up. Bonds are down.

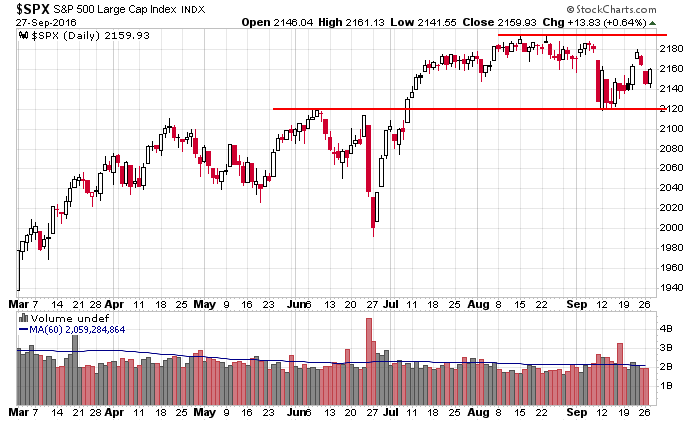

The market has been very inconsistent lately…two up days, two down days, then another up day followed by a gap up. But unlike August when alternating up and down days stayed in a tight range, we’re actually getting some movement. The S&P moved up 40, then down almost the same. Now it’s already 20+ points off yesterday’s opening low. Overall the index is trading in a range, but within the range we’re getting tradable moves for short term traders.

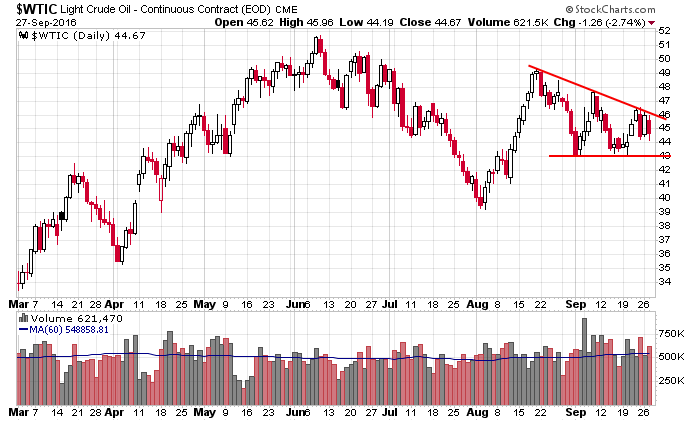

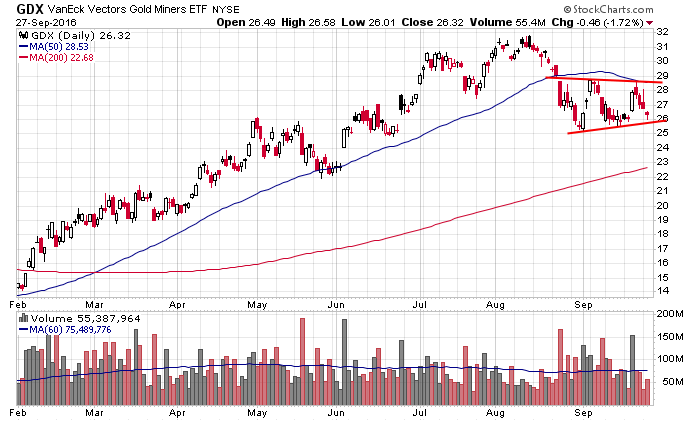

The two groups that have produced most of our biggest wins this year are both coiling. Oil is flat going back five months but is currently getting squeezed by converging trendlines. Several stocks have stepped forward and declared themselves leaders within the group. I’m kind of hoping oil legs down, so we can buy some quality names at lower prices. Gold and silver broke their uptrends in August and have traded in a range since. I like the groups overall and am hoping there’s one more leg down here too. Here’s $WTIC and GDX.

There are several groups doing well right now. Semiconductors are one…there have been a handful of good set-up to play.

Three more days of the month and quarter. September is supposed to be the weakest month of the year. As of now the S&P is down 11 points, or 0.5%. Not horrible.

Stock headlines from barchart.com…

AT&T (T +0.78%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Macy’s (M +0.99%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

Amazon.com (AMZN +2.12%) was rated a new ‘Buy’ at Nomura with a price target of $950.

Coty (COTY -0.51%) jumped nearly 5% in after-hours trading after it was announced that it will replace Diamond Offshore Drilling in the S&P 500

at the close of trading Friday, September 30.

Nike (NKE +1.73%) fell over 3% in pre-market trading after it reported worldwide futures orders ex-forex were up +7%, weaker than consensus of +8%.

Alphabet (GOOGL +1.01%) fell 1% in after-hours trading after it was downgraded to ‘Underperform’ from ‘Neutral’ at Wed bush.

Cintas (CTAS +0.21%) rose 3% in after-hours trading after it boosted its full-year EPS continuing operations estimate to $4.55-$4.63 from a July 19 view of $4.35-$4.45.

Sonic (SONC +0.18%) slid 2% in after-hours trading after it said Q4 adjusted EPS will be 43 cents-45 cents, below consensus of 48 cents as preliminary system-wide same-store sales were down -2%.

Landec (LNDC +1.81%) reported Q1 EPS of 12 cents, above consensus of 10 cents, although Q2 revenue of $132.4 million was below consensus of $134.5 million.

Tempur Sealy International (TPX -0.07%) plunged over 20% in pre-market trading after it lowered guidance on full-year net sales to down -1% to -3% from a prior view of growth in the low single-digit range.

Harmonic (HLIT +1.30%) rose 4% in after-hours trading after a warrant agreement with Comcast will give Comcast the opportunity to acquire Harmonic shares based on specific HLIT product sales and deployment milestones.

Fiesta Restaurant Group (FRGI -0.65%) climbed 2% in after-hours trading after it suspended the separation of Taco Cabana on “challenging market conditions.”

Origin Agritech Ltd. (SEED -0.43%) surged nearly 30% in after-hours trading after it announced plans to sell its commercial seed production and distribution business for $60 million to Beijing Shihui Agricultural Development.

Tuesday’s Key Earnings

Nike (NYSE:NKE) -2.8% AH on disappointing orders.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Durable Goods

10:00 Yellen delivers semi-annual testimony

10:15 Fed’s Bullard speech

10:30 EIA Petroleum Inventories

11:30 Results of $13B, 2-Year FRN Auction

1:00 PM Results of $28B, 7-Year Note Auction

1:30 PM Fed’s Evans speech

4:35 PM Fed’s Mester: Economic Outlook

7:15 PM Fed’s George speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Sep 28)”

Leave a Reply

You must be logged in to post a comment.

Saudi Arabian stocks lost the most in the world for a second straight day amid waning hopes for an oil production deal that may buoy up the nation’s finances. This should explain a great deal. WTI leads the US markets. Understand WSJ that Fed is not permitted to raise rates, check today’s paper.