Good morning. Happy Thursday.

The Asian/Pacific closed mostly up. Japan, Singapore and Australia rallied more than 1%; Hong Kong, New Zealand, South Korea and Taiwan also did well. India fell more than 1%. Europe is currently up across-the-board. Norway is up more than 2%; the UK, France, Austria, the Czech Republic, Hungary, Spain and Italy are up more than 1%; Germany, the Netherlands, Russia and Greece are also doing well. Futures in the States point towards a down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up a small amount. Oil is down; copper is up. Gold and silver are flat. Bonds are down.

Big news came out of OPEC yesterday. The group met to discuss production cuts or simply an output freeze, and the belief was nothing would be agreed upon at this meeting, but hopes were high the November gathering would result in something.

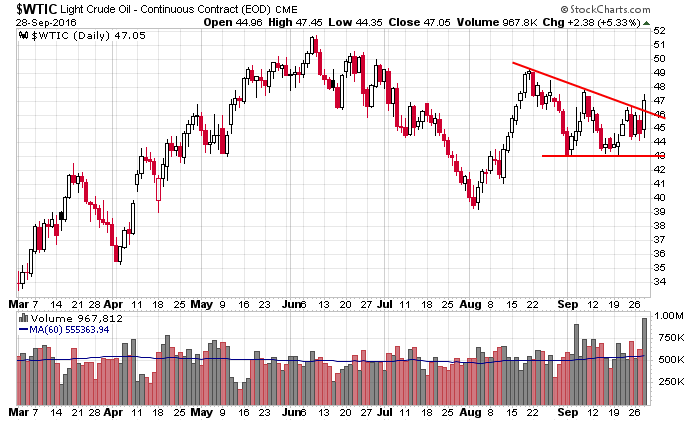

Then, unexpectedly, news surfaced OPEC agreed to reduce its output by one million barrels per day. This is the first cut in eight years. Crude oil rallied about $2.50 off its intraday low and posted and posted a $2.38 gain for the day. Volume was huge. Oil has been up and down for many months, with the recent swings getting smaller and smaller. Yesterday’s daily candle was the biggest in a while, so perhaps this breaks the commodity out of its funk.

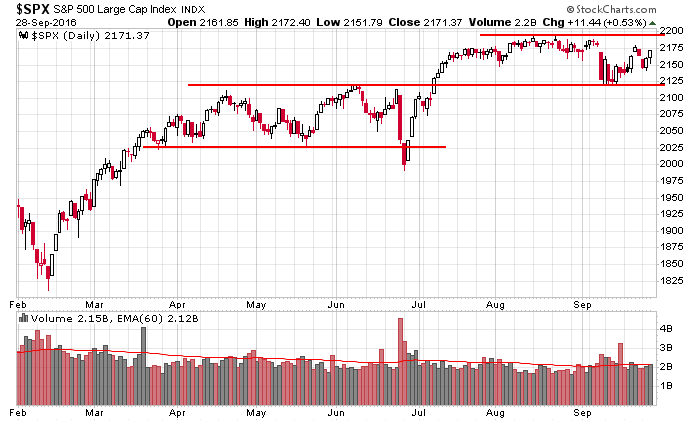

A big move up from oil helps the S&P 500. The index posted a moderate gain but remains range bound overall.

Two more days of the month and quarter. September is supposed to be the weakest month of the year, right. Well the market is working on a 3-week winning streak and is currently flat on the month. In fact other than the single down day after the ECB news, the market has been trending up. I hate historical tendencies. I look at them, but I never make decisions off them. Right now the market is in decent shape. More after the open.

Stock headlines from barchart.com…

Fitbit (FIT +1.03%) fell 3% in pre-market trading after it was dowmgraded to ‘Underweight’ from ‘Sector Weight’ at Pacific Crest.

Targa Resources (TRGP +4.90%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Incyte (INCY +4.64%) was upgraded to ‘Outpeform’ from ‘Market Perform’ at Raymond James with a 12-month target price of $115.

eBay (EBAY -0.28%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Progress Software (PRGS +1.61%) tumbled 10% in after-hours trading after it reported Q3 adjusted EPS of 44 cents, below consensus of 45 cents, and said it sees Q4 adjusted EPS of 55 cents-58 cents, on the low end of consensus of 58 cents.

Vertex Pharmaceuticals (VRTX -0.31%) lost 2% in after-hours trading after it cut its Orkambi revenue view to $950 million-$990 million from a prior view of $1.0 billion-$1.1 billion.

Transocean (RIG +6.37%) may open lower today after Carl Icahn said he reduced his position in the company to 5.45 million shares from 21.5 million shares on June 30 for tax purposes.

Vulcan Materials (VMC +1.26%) slipped almost 1% in after-hours trading after it said it sees 2016 adjusted Ebitda trending toward $1 billion, below consensus of $1.09 billion.

Himax Technologies (HIMX -6.85%) gained nearly 2% in after-hours trading after it was rated a new ‘Buy’ at Roth Capital with a price target of $10.

Pier 1 Imports (PIR +2.15%) lost 1% in after-hours trading after it cut its view on full-year adjusted EPS to 24 cents-32 cents from a June 29 view of 32 cents-40 cents.

Globalstar (GSAT unch) rose over 3% in after-hours trading after it said initial test flight results “indicated continuous communication” in the testing of its ADS-B Link Augmentation System in a NASA test flight.

Aegerion Pharmaceuticals (AEGR -9.45%) jumped over 20% in after-hours trading after Japan’s Ministry of Health, Labor & Welfare approved Aegerion’s Juxtapid capsules for patients with homozygous familial hypercholesterolemia.

wednesday’s Key Earnings

BlackBerry (BBRY) +5.7% outsourcing its handset business.

Today’s Economic Calendar

5:00 Fed’s Harker speech

8:30 GDP Q2

8:30 Corporate Profits

8:30 Initial Jobless Claims

8:30 International trade in goods

8:50 Fed’s Lockhart speech

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:00 Fed’s Powell speech

10:30 EIA Natural Gas Inventory

2:30 PM Fed’s Kashkari speech

3:00 PM Farm Prices

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

5:10 PM Janet Yellen speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Sep 29)”

Leave a Reply

You must be logged in to post a comment.

This morning, Commerzbank said it plans a wide-ranging business restructuring that includes scrapping the bank’s dividend for the rest of the year, terminating nearly 10,000 jobs – roughly 20% of its workforce – and merging two large units. Second German bank in trouble.

Banking is going to hell from Wells in US to DB in the EU. The US fed has no authority pay IOR as a way of keeping US banks from financial ruin. We are in trouble CARE…..

hmmm…testing the 2151 again….

DB clients are reducing collateral on their trades. another Bear Stearns…