Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. There were no big winners, but South Korea, Taiwan, Japan, Hong Kong and Singapore did well. Europe is currently mostly up. The UK, France, Poland, Hungary and the Netherlands are up more than 1%; Germany, Belgium, the Czech Republic and Greece are also doing well. Futures in the States point towards a slight up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil and copper are down. Gold and silver are down. Bonds are up.

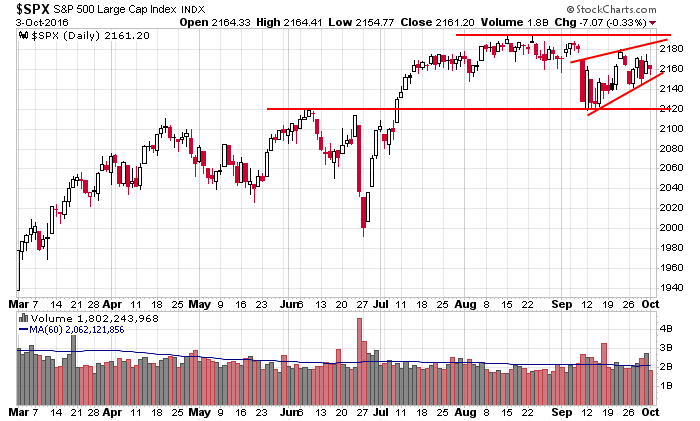

I was neutral heading into yesterday, and since nothing happened, I’m still neutral. The S&P is near the middle of its nearly-3-month range, and many of the breadth indicators have flattened out or are not suggesting anything is imminent. Here’s the daily S&P. Don’t over-analyze. There isn’t much going on.

Stock headlines from barchart.com…

Las Vegas Sands (LVS +2.31%) is up over 1% in pre-market trading after it was upgraded to a ‘Buy’ from ‘Neutral’ at Bank of America/Merrill Lynch.

Wells Fargo (WFC -1.02%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Raymond James, citing a “cloudy” outlook.

Pandora Media (P -1.19%) rose nearly 3% in pre-market trading after it was added to the ‘Conviction List’ at Goldman Sachs.

Avnet (AVT -1.36%) climbed over 1% in pre-market trading after it was upgraded to ‘Strong Buy’ from ‘Market Perform’ by Raymond James with a price target of $52.

HubSpot (HUBS -0.03%) was rated anew ‘Buy’ at DA Davidson with an 18-month target price of $76.

AmerisourceBergen (ABC -0.82%) was upgraded to ‘Market Outperform’ from ‘Market Perform’ at Avondale Partners LLC with a target price of $96.

Kinder Morgan (KMI -0.52%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Cypress Semiconductor (CY -1.32%) said it will cut 500 jobs and take a $40 million to $50 million charge as it restructures to ‘high-growth” businesses.

Fifth Third Bancorp (FITB -0.54%) lost 1% in after-hours trading after it was downgraded to ‘Market Perform’ from ‘Outperform’ at KBW.

Cousins Properties (CUZ -2.68%) will replace Community Health Systems in the S&P MidCap 400 after the close of trading Wednesday, October 5.

Brocade Communications Systems (BRCD +0.87%) was rated a new ‘Buy’ at DA Davidson with a 12-month target price of $12.

Soroban Capital reported that it raised its stake in Autodesk (ADSK -1.59%) to 8% from 4.66% and is now the third largest holder in the company.

Marchex (MCHX -0.72%) CEO Pete Christothouou resigned immediately after the company said its Q3 adjusted Ebitda would be a loss of -$2.5 million to -$3.5 million, wider than a -1$ million to -$3 million loss than estimated in August.

Today’s Economic Calendar

8:05 Fed’s Lacker: Monetary Policy

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Oct 4)”

Leave a Reply

You must be logged in to post a comment.

The Fed comes center stage, Now Nov or Dec? How will the money move? I suspect it does not change much, but it could give the stocks a case of dropsy … Cash is good.

is this the end of the universe