Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. New Zealand dropped more than 1%; Indonesia and Australia were also weak. Japan and Hong Kong did okay. Europe is currently mostly down. Portugal is down more than 1%; the Netherlands, Switzerland, Russia and Greece are also weak. Denmark and Turkey are doing well. Futures in the States point towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is flat. Oil and copper are up. Gold and silver are up. Bonds are down.

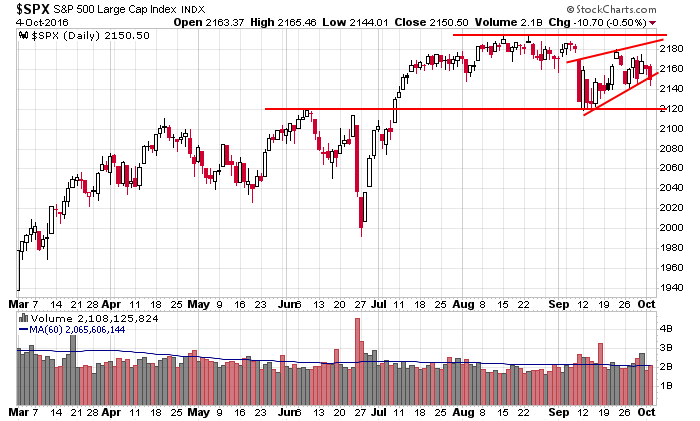

Heading into this week I was neutral in the near term, and even though we’ve started the week with two down days, I remain neutral. The S&P is pretty much sitting in the middle of its 3-month range.

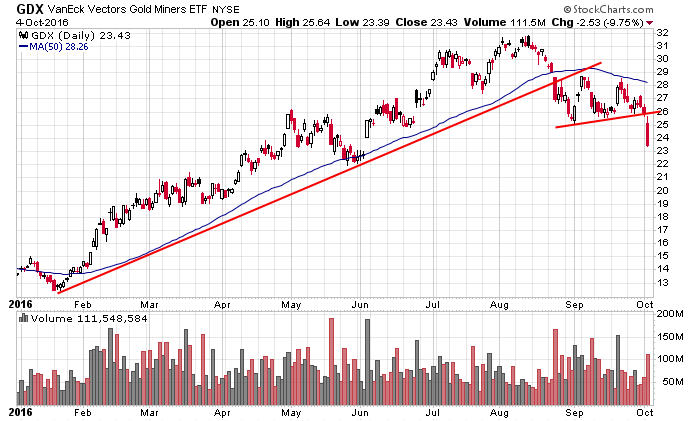

The big move has come from gold and silver. After riding big gains the first half of the year, I turned neutral on the groups at the end of August and beginning of September when GDX sliced through its 50-day moving average and then failed to rally back above it. As the days passed, it was apparent a consolidation pattern was forming below the then-declining MA.

Best case scenario was flat, range-bound trading. Worst case was the pattern would break down and continue its newly-formed downtrend. Unfortunately for the gold bugs, the latter happened. In one fell swoop, gold and silver gapped down and got clobbered yesterday. Anyone clinging to a bullish position in the face of trading below the declining 50-day got a huge wake up call. GDX is now trading at levels not seen since late May.

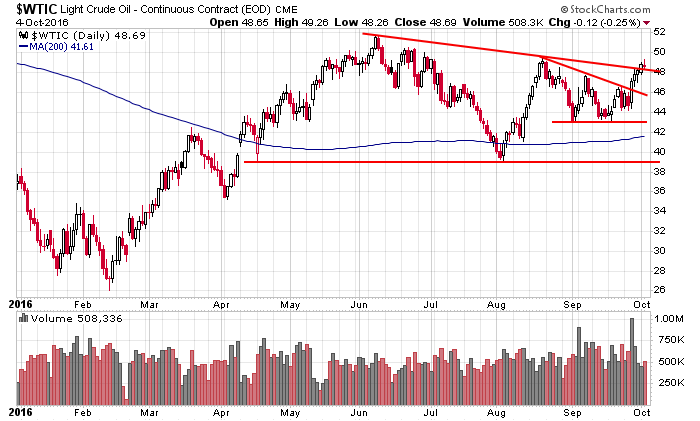

Oil, on the other hand, which has been been flat going back to last May, is trying to re-establish itself in an uptrend. If successful, there will be some huge winners in the group. Many stocks are poised for solid gains.

Stock headlines from barchart.com…

Norwegian Cruise Line Holdings Ltd. (NCLH +0.71%) was dowmgraded to ‘Neutral’ from ‘Buy’ at UBS.

Parker-Hannifin (PH -0.84%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel with a price target of $141.

State Street (STT +2.19%) was upgraded to ‘Market Perform’ from ‘Underperform’ at KBW with a price target of $69.

Gigamon (GIMO +0.33%) was downgraded to ‘Neutral’ from ‘Buy’ at DA Davidson with an 18-month target price of $59.

Twitter (TWTR -2.00%) is up over 3% in pre-market trading on heightened takeover talks from companies that include Salesforce.com, Disney and Google.

Blue Buffalo Pet Products (BUFF -0.92%) was rated a new ‘Buy’ at DA Davidson with a price target of $29.

Acacia Communications (ACIA +2.51%) jumped over 5% in after-hours trading after it raised guidance on Q3 adjusted EPS to 83 cents-90 cents from a September 26 view of 72 cents-81 cents.

Micron Technology (MU +0.39%) lost over 4% in pre-market trading after it reported Q4 gross margin of 18.0%, below consensus of 19.0%.

Team Health Holdings (TMH +16.46%) gained over 1% in after-hours trading after the WSJ reported the company is in talks with Blackstone and Bain about a possible sale.

Corbus Pharmaceuticals Holdings (CRBP +2.18%) rallied almost 7% in after-hours trading after it was rated a new ‘Buy’ at Cantor Fitzgerald with a 12-month target price of $17.

Universal Logistics Holdings (ULH -0.60%) sank over 10% in after-hours trading after it said sees Q3 EPS between 16 cents and 20 cents, well below consensus of 29 cents.

Cascadian Therapeutics (CASC +3.70%) dropped over 10% in after-hours trading after it said it plans a reverse stock split.

Tuesday’s Key Earnings

Darden Restaurants (NYSE:DRI) +0.6% boosting profit guidance.

Micron Technology (NASDAQ:MU) -4.6% AH swinging to a loss.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

8:30 International Trade

9:45 PMI Services Index

10:00 Factory Orders

10:00 ISM Non-Manufacturing Index

10:30 EIA Petroleum Inventories

5:00 PM Fed’s Lacker: “Does Federal Reserve Governance Need Reform?”

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Oct 5)”

Leave a Reply

You must be logged in to post a comment.

Jeffrey Gundlach, chief executive and chief investment officer of DoubleLine Capital, speaks during the Sohn Investment Conference in New York Thomson Reuters

Jeff Gundlach, Wall Street’s bond god, thinks the world of monetary and fiscal policy is about to pivot.

“How in the world could we be talking about rates never going up when in fact rates have bottomed?” he asked the crowd of investors at the Grant’s Interest Rates Observer conference in New York City on Tuesday.

ADP says employment looks down from trend.