Good morning. Happy Thursday.

The Asian/Pacific closed mixed. Hong Kong, Australia and South Korea did well. New Zealand and India were weak. Europe currently leans to the downside, but movement is minimal. Greece, Switzerland, Austria, Denmark, Finland and Portugal lead to the downside; the Czech Republic and Turkey are doing relatively well. Futures in the States point towards a flat open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil and copper are flat. Gold is down; silver is up. Bonds are up.

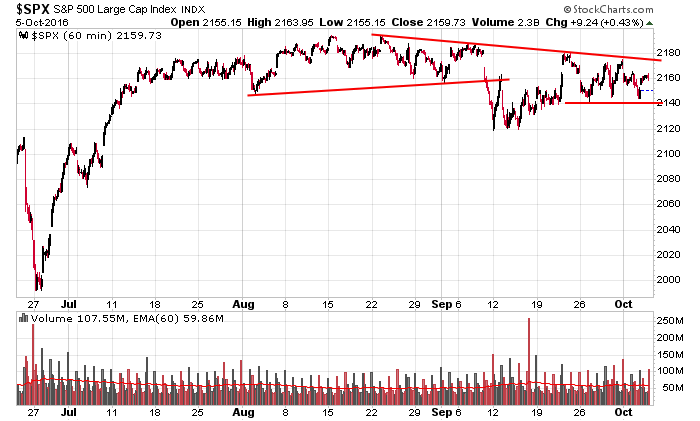

The market isn’t in a hurry to do anything. The S&P has moved in a 70-point range the last three months. I can’t even say rallies get sold and dips get bought because there haven’t been many rallies or dips. We’re just getting a lot of grinding movement and lots of overlapping candles on the daily charts. Here’s the 60-min chart.

There’s news out both Disney and Google are no longer interested in acquiring Twitter. TWTR is down about 16% in premarket trading. This leaves Salesforce.com as the loan interested buyer…and their stock is paying the price. It has always seemed like Twitter was run by a bunch of amateurs. The best M&A deals are completely unknown by the public. They don’t show up in the charts, and they certainly don’t show up in the press. The fact that Twitter has been virtually bragging about being acquired smelled funny. I’m not surprised potential buyers are walking away.

Stock headlines from barchart.com…

Twitter (TWTR +5.74%) tumbled 13% in pre-market trading after Alphabet said it is not interested in acquiring the company.

Trade Desk (TTD +3.99%) was rated a new ‘Buy’ at Cantor Fitzgerald with a 12-month target price of $30.

Raytheon (RTN -0.03%) was rated a new ‘Outperform’ at Baird with a 12-month target price of $170.

Walgreens Boots Alliance (WBA +0.34%) was rated a new ‘Buy’ at UBS with a price target of $94.

Yum! Brands (YUM -1.84%) slid over 2% in pre-market trading after it reported Q3 adjusted EPS of $1.09, less than consensus of $1.10, and said Q3 China comparable sales fell -1%, weaker than expectations of +4.1%.

Athenahealth (ATHN +0.58%) was rated a new ‘Buy’ at UBS with a price target of $147.

Zumiez (ZUMZ -1.03%) rallied over 10% in after-hours trading after it said Sep comparable sales were up +6.3%, stronger than expectations of down -0.4%, and after it raised its view on Q3 EPS to 29 cents-30 cents from a prior view of 21 cents-26 cents.

Resources Connection (RECN +1.35%) fell 3% in after-hours trading after it reported Q1 EPS of 15 cents, below consensus of 16 cents.

JD.com (JD +1.60%) jumped nearly 7% in after-hours trading after Wal-Mart raised its stake in the company to 10.8% from 5.9%.

Alnylam Pharmaceuticals (ALNY +2.52%) plunged nearly 40% in after-hours trading after the company said it will discontinue development of its reusiran saying the benefit-risk profile no longer supported continued dosing.

Scynexis (SCYX +6.90%) surged over 15% in after-hours trading after it reported full results from Phase 2 studies on patients using its SCY-078 for candida infections.

Idera Pharmaceuticals (IDRA +2.35%) slumped over 10% in after-hours trading after offering up to $50 million in shares of common stock.

Wednesday’s Key Earnings

Monsanto (NYSE:MON) +1.6% after beating expectations.

Yum! Brands (NYSE:YUM) -2.2% AH on poor Chinese sales.

Today’s Economic Calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Gallup Good Jobs Rate

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

4:30 Money Supply

4:30 Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Oct 6)”

Leave a Reply

You must be logged in to post a comment.

“This year could be particularly volatile in the fourth quarter, with employers holding off on significant moves until they see election results. It’s not simply who wins the White House, but there are Senate races and countless ballot initiatives on issues like minimum wages that will influence business strategies going forward,” said John Challenger, chief executive officer of Challenger, Gray & Christmas.

The CAPE stock indicator seems to indicate that stocks are not high in valuation, but there are others who say stocks are barely reasonably priced. Me ? Avoiding dividends, got killed yesterday in tax-frees, holding ETFs in consumer goods. Not confident.