Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Hong Kong, China and India rallied more than 1%; Malaysia, South Korea, New Zealand and Singapore also did well. Europe is currently posting solid, across-the-board gains. Germany, France, the UK, Austria, Belgium, the Netherlands, Sweden, Greece, Turkey, Denmark, Hungary, Spain, Italy and Portugal are up more than 1%. Futures in the States point towards a sizable gap up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is flat. Oil and copper are up. Gold and silver are up. Bonds are down.

Global markets are souring, and S&P futures here in the States are up a bunch – a big change in sentiment.

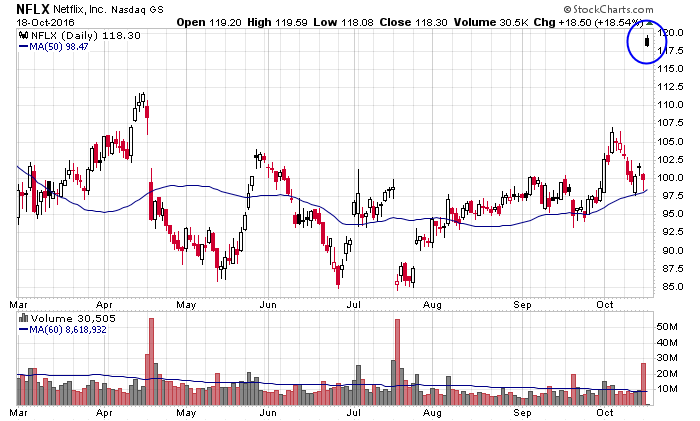

Netflix is the big story among individual companies. They did well with earnings, and the stock is being rewarded with a nearly-20% pop at today’s open that will match the highs from early-January.

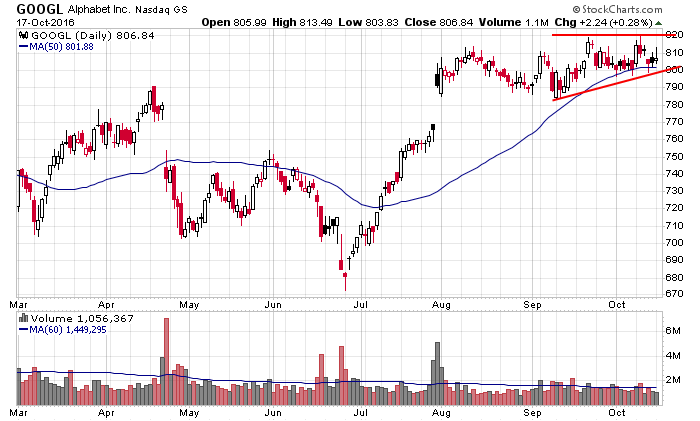

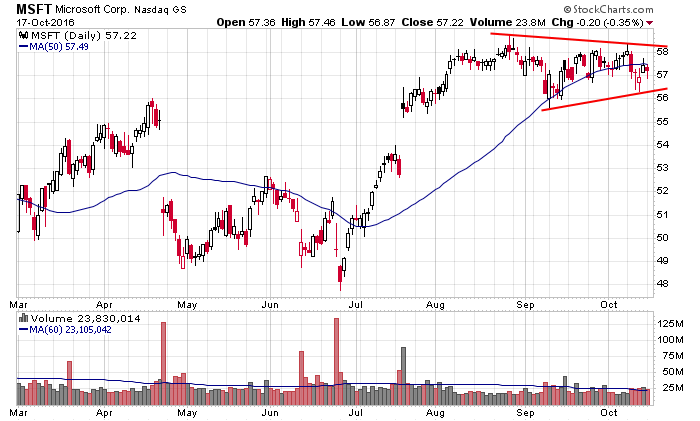

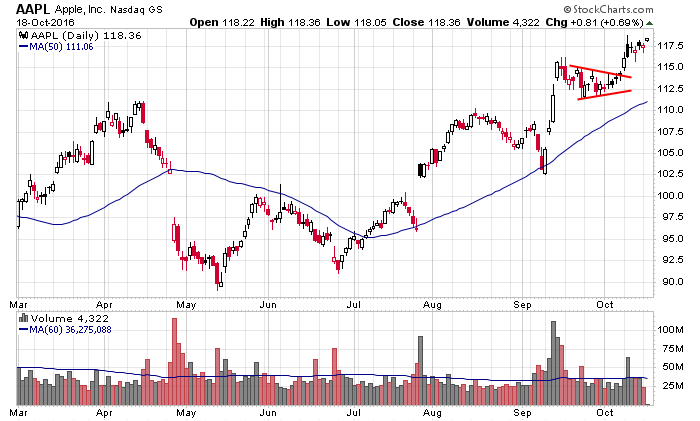

So NFLX joins other big cap tech stocks which have held up and done very well. In fact this has been the market’s brightest spot lately. While several groups have fallen off and the internals have deteriorated, big-cap tech have done great. Here are Amazon, Google, Microsoft, Facebook and Apple.

The leaders are leading, but right now the followers are not following.

Stock headlines from barchart.com…

Netflix (NFLX -1.65%) surged 19% in pre-market trading after it reported Q3 EPS of 12 cents, double expectations of 6 cents and said Q3 net streaming rose 370,000, well above consensus of 304,000.

Intel (INTC -0.43%) was upgraded to ‘Overweight’ from ‘Equalweight’ at Barclays with a price target of $45.

Texas Roadhouse (TXRH -1.27%) was upgraded to ‘Buy’ from ‘Hold’ at Maxim with a price target of $48.

Visa (V -0.36%) dropped nearly 2% in after-hours trading after CEP Scharf resigned.

International Business Machines (IBM +0.21%) fell 2% in pre-market trading after it reported Q3 operating gross profit margin of 48%, less than expectations of 50.1%.

Prologis (PLD +0.65%) was upgraded to ‘Buy’ from ‘Hold’ at Evercore ISI with a 12-month target price of $56.

Del Taco Restaurants (TACO +4.21%) climbed nearly 7% in after-hours trading after it reported Q3 EPS of 13 cents, better than consensus of 12 cents, and then raised its 2016 revenue forecast to $446 million-$449 million from a July 20 estimate of $439 million-$449 million.

Celanese (CE +0.33%) rose over 4% in after-hours trading after it reported Q3 adjusted EPS of $1.67, above consensus of $1.60.

Resources Connection (RECN -0.31%) rallied nearly 9% in after-hours trading after it entered into a credit agreement with Bank of America who is providing a $120 million secured revolving loan.

Badger Meter (BMI -0.15%) dropped over 6% in after-hours trading after it reported Q3 net sales of $96.3 million, weaker than consensus of $105.5 million.

Corrections Corp. of America (CXW +0.91%) climbed over 5% in after-hours trading after it said it sees 2017 normalized FFO/share of $2.11 to $2.21, above consensus of $2.01.

Nektar Therapeutics (NKTR -1.38%) slid 4% in after-hours trading after it announced a public offering of $175 million of common stock.

GigPeak (GIG +2.76%) gained over 1% in after-hours trading after it reported Q3 adjusted EPS of 5 cents, higher than consensus of 4 cents.

Monday’s Key Earnings

JPMorgan (NYSE:JPM) closes -0.5% despite earnings beat

Citigroup (NYSE:C) finishes flat after results top forecasts

Bank of America (NYSE:BAC) closes +0.25% following strong quarter

Wells Fargo (NYSE:WFC) ends -0.5% even though topped estimates

Hasbro (NASDAQ:HAS) finishes +5.7% following earnings beat

United Continental (NYSE:UAL) -0.3% AH despite earnings beat

Today’s Economic Calendar

8:30 Consumer Price Index

8:55 Redbook Chain Store Sales

10:00 NAHB Housing Market Index

4:00 PM Treasury International Capital Companies reporting earnings today

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Oct 18)”

Leave a Reply

You must be logged in to post a comment.

Stan Fisher says letting inflation loose means having to catch it later. Janet says skip it Stanley if you knew anything you would no be my assistant.

“The leaders are leading, but right now the followers are not following.”

Tells me it is not a great time to go long…. Yet.

Love your blog!