Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the upside, but movement was minimal. Singapore, Australia and Taiwan did the best. Hong Kong, India and Indonesia fell. Europe currently leans to the downside, but movement is minimal there too. Poland, Turkey, Portugal, Norway, and the Czech Republic are up; Germany, Belgium, Sweden and Italy are down. Futures in the States point towards a flat open.

—————

My podcast – with Trading Story

—————

The dollar is down a small amount. Oil is up; copper is down. Gold and silver are up. Bonds are down.

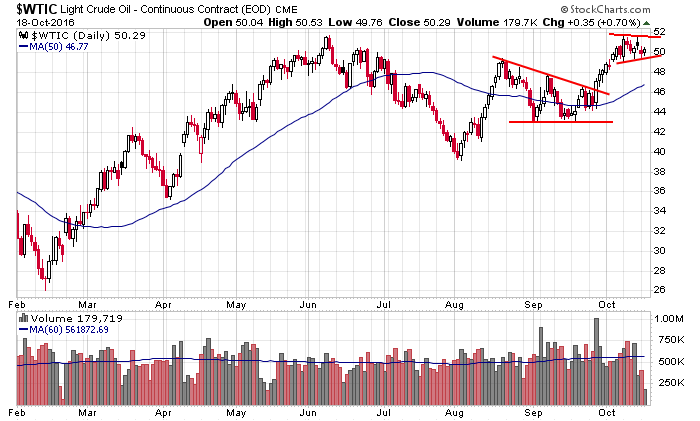

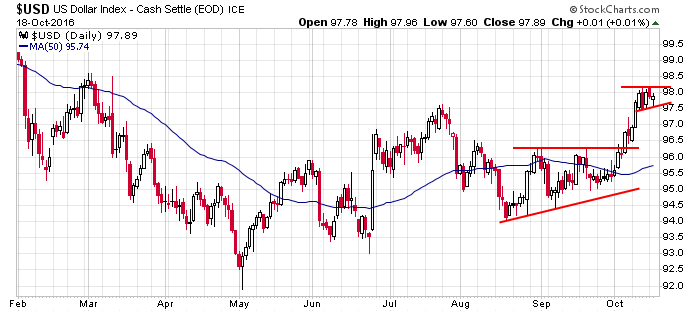

Two very interesting charts right now are oil and the dollar. Both are trading in tight patterns near their highs. Can they both breakout and run together? It’ll be good for the market if oil moves up, and it’ll give us many very good stocks to play on the long side. But it would not be good if the dollar broke out – especially if it got above 100. Everything would have to be re-evaluated.

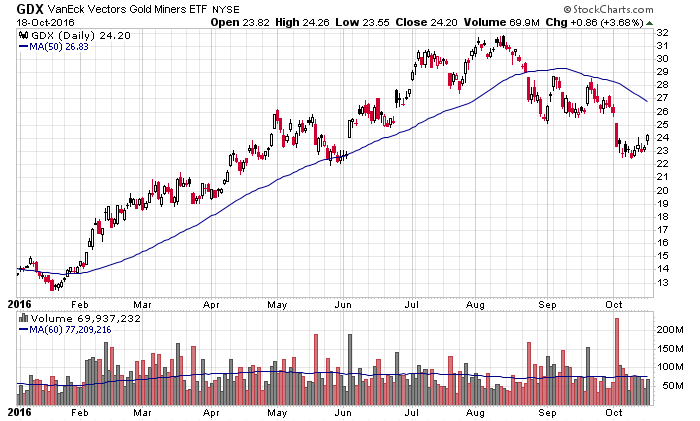

Gold and silver stocks are bouncing. There’s space before GDX runs into its declining 50-day MA.

Earnings season is heating up. AA gapped down big. NFLX gapped up a bunch. Today INTC is going to gap down. Be careful out there.

Stock headlines from barchart.com…

Intel (INTC +1.23%) is down nearly 5% in pre-market trading after it forecast Q4 revenue of $15.2 billion-$16.2 billion, and the midpoint trailed estimates of $15.9 billion.

Norwegian Cruise Line Holdings Ltd. (NCLH +2.08%) was downgraded to ‘Hold’ from ‘Buy’ at SunTrust.

EI du Pont de Nemours (DD +1.22%) was rated a new ‘Buy’ at Nomura with a 12-month target price of $78.

GoDaddy (GDDY +0.82%) was rated a new ‘Buy’ at Cantor Fitzgerald with a 12-month price target of $42.

Yahoo! (YHOO -0.26%) gained over 1% in after-hours trading after it reported Q3 adjusted EPS of 20 cents, higher than consensus of 14 cents.

Cree (CREE +1.61%) sold-off over 9% in after-hours trading after it reported Q1 adjusted EPS of 9 cents, below consensus of 11 cents, and forecast Q2 adjusted EPS continuing operations of 4 cents-10 cents, well below consensus of 14 cents.

Intuitive Surgical (ISRG +1.73%) fell 2% in after-hours trading on disappointment that it reported Q3 worldwide procedure growth of 14%, right on expectations.

Manhattan Associated (MANH +1.92%) tumbled 9% in after-hours trading after it lowered guidance on full-year revenue to $603 million-$609 million from a July view of $615 million-$620 million.

Interactive Brokers Group (IBKR +1.33%) lost almost 1% in after-hours trading after it reported Q3 comprehensive EPS of 30 cents, below consensus of 32 cents.

Meridian Bioscience (VIVO +0.27%) sank 10% in after-hours trading after it forecast fiscal 2017 adjusted EPS of 81 cents-85 cents, weaker than consensus of 91 cents.

Puma Biotechnology (PBYI +0.67%) dropped 5% in after-hours trading after it proposed an offering of $150 million of stock.

Sunesis Pharmaceuticals (SNSS -2.86%) slid nearly 7% in after-hours trading after it proposed an offering of common stock and preferred stock, although no size was given.

Tuesday’s Key Earnings

Goldman Sachs (NYSE:GS) closes +2.15% after earnings beat, helped by jump in trading revenue

Cree (NASDAQ:CREE) collapses 9.7% AH following FQ1 earnings miss

Johnson & Johnson (NYSE:JNJ) ends -2.6% despite earnings beat, improved EPS guidance

UnitedHealth (NYSE:UNH) finishes +6.9% following strong Q3 report

Domino’s Pizza (NYSE:DPZ) closes +4.9% after blazing sales growth

Harley-Davidson (NYSE:HOG) ends +9%, boosted by new engine, cost cuts

Philip Morris (NYSE:PM) finishes +1.1% as profit rises despite volume fall

United Continental (NYSE:UAL) closes +1.3% as earnings top expectations

Intuitive Surgical (NASDAQ:ISRG) -2.5% AH despite sales up 2%, net income up 14%

BlackRock (NYSE:BLK) finishes +0.6% following mixed results

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Housing Starts

10:00 Atlanta Fed’s Business Inflation Expectations

10:30 EIA Petroleum Inventories

2:00 PM Fed’s Beige Book

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Oct 19)”

Leave a Reply

You must be logged in to post a comment.

Very little is evident,but expect an up move after the debate this AM. My China holdings look promising, but I have felt that way before. Starbucks looks very promising in China.