Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed with a lean to the downside, but movement was minimal. Japan, Singapore and South Korea fell; China moved up. Europe is currently mixed and also little changed. The UK, Norway, the Czech Republic, Poland and Denmark are up; Belgium, Switzerland, Turkey and Portugal are down. Futures in the States point towards a down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil is up; copper is flat. Gold and silver are down small amounts. Bonds are mixed.

We’re starting to get more intraday movement, but the net change isn’t much.

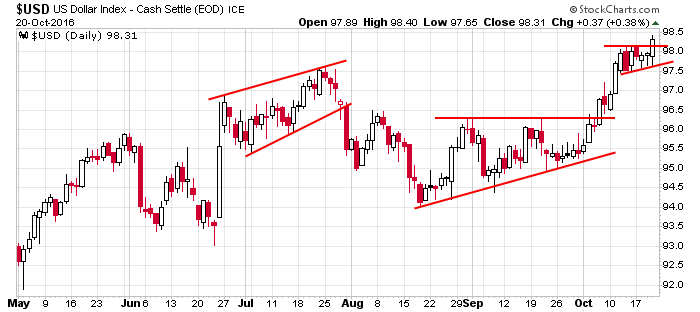

The dollar broke out yesterday. I don’t think anything truly gets urgent until it gets above $100, but with less than a $1.50 to go (at today’s open), things are starting to get interesting.

Oil broke out Wednesday but pulled back into its pattern yesterday. Instead of running, it’s just grinding up – 2 steps forward, 1 step back. I keep coming back to the group because it’s big and liquid and offers a lot very good trades.

When considering dividends, MSFT is at an all-time high.

Overall the indexes remain in range. Nothing else to say right now. More after the open.

Stock headlines from barchart.com…

Advanced Micro Devices (AMD +2.81%) is down over 7% in pre-market trading after it predicted Q4 revenue will fall 18%, plus or minus 3%, to $1.03 billion, below consensus of $1.1 billion.

Microsoft (MSFT -0.49%) rose over 5% in pre-market trading after it reported Q1 adjusted EPS of 76 cents, above consensus of 68 cents.

Proofpoint (PFPT +0.09%) rallied 10% in after-hours trading after it reported Q3 adjusted EPS of 19 cents, well above consensus of 5 cents, and then raised guidance on full-year EPS to 28 cents-33 cents from a July 21 view of 6 cents-10 cents.

VeriSign (VRSN +0.87%) jumped over 6% in after-hours trading after it amended and extended its registry pact for its .com domain name through Nov 2024.

PayPal Holdings (PYPL -0.37%) had dropped 4% in after-hours trading after it forecast Q4 adjusted EPS of 40 cents-42 cents, weaker than consensus of 42 cents, but then recovered its losses and moved up 4% after it said it sees 16%-17% revenue growth in 3 years, up from a prior forecast of 15% growth.

Boston Beer Co. (SAM -2.74%) lost nearly 3% in after-hours trading after it reported Q3 EPS of $2,48, weaker than consensus of $2.57, and then lowered guidance on full-year EPS to $6.30-$6.70 from a prior view of $6.40-$7.00.

Red Robin Gourmet Burgers (RRGB -0.23%) dropped over 6% in after-hours trading after it reported Q3 adjusted EPS of 38 cents, well below consensus of 48 cents.

SEI Investments (SEIC +0.71%) gained almost 2% in after-hours trading after it reported Q3 EPS of 53 cents, better than consensus of 49 cents.

Athenahealth (ATHN -1.76%) slipped almost 3% in after-hours trading after it reported Q3 revenue of $276,7 million, below consensus of $280.3 million.

KLA-Tencor (KLAC +0.07%) rose nearly 3% in after-hours trading after it reported Q1 adjusted EPS of $1.16, higher than consensus of $1.04.

Sonic (SONC -2.61%) gained over 1% in after-hours trading after it boosted its quarterly dividend to 14 cents from 11 cents and increased its stock buyback plan by $40 million.

Brown & Brown (BRO -0.96%) rose +0.5% in after-hours trading after it reported Q3 adjusted EPS of 52 cents, better than consensus of 49 cents.

Skechers (SKX +0.09%) tumbled 12% in after-hours trading after it reported Q3 EPS of 42 cents, weaker than consensus of 46 cents, and said it sees Q4 net sales of $710 million-$735, million, below consensus of $800 million.

Apollo Education Group (APOL -0.12%) climbed 3% in after-hours trading after it reported Q4 net revenue of $492.5 million, higher than consensus of $466 million.

Thursday’s Key Earnings

Verizon (NYSE:VZ) closes -2.5% after postpaid subscriber numbers disappoint

VeriSign (NASDAQ:VRSN) +7.1% AH following earnings beat

Advanced Micro Devices (NYSE:AMD) sinks 5.75% AH following weak guidance

PayPal (NASDAQ:PYPL) +4.5% AH as revenues rise 20% and top estimates

Walgreens Boots (NASDAQ:WBA) ends +5% as non-GAAP net income jumps 20%

American Airlines (NASDAQ:AAL) finishes -0.1% despite earnings beat

Dunkin’ Brands (NASDAQ:DNKN) closes -3.2% after missing on revenue

Schlumberger (NYSE:SLB) flat post-market after mixed Q3

Today’s Economic Calendar

10:15 Daniel Tarullo speech

1:00 PM Baker-Hughes Rig Count

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Oct 21)”

Leave a Reply

You must be logged in to post a comment.

The dollar and oil are in whirl. The energy is in high finance and the dollar is the road to new stock manipulation. We must look at other exchange medium like bitcoin which is not government controlled. Bitcoin is a digital currency distributed worldwide in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds. Unlike traditional currencies such as dollars, bitcoins are issued and managed without any central authority whatsoever : there is no government, company, or bank in charge of Bitcoin. If we survive it will be our own doing.

the world as we know it will be destroyed by greed and coruption

these are false gods and IMPLANTED PURPOSES [not our own]

when there are no more dicotomys and positive and negative become one

then a new spiritual dawning will be at hand

but the people [the masses] must ask for it

the started with the britex will they continue with the election and reforemdums

reform and change ,till then have fun daytrading and capturing many scalps