Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan rallied 1.4%; India, Taiwan and Hong Kong also did well. Several markets closed with tiny losses. Europe is currently mixed; movement is minimal. Sweden, Austria, Poland, Spain and Portugal are up; Switzerland, the Czech Republic and Russia are down. Futures in the States point towards a slight up open for the cash market.

—————

Charts of Indexes and ETFs – here

—————

The dollar is flat. Oil and copper are down. Gold and silver are up. Bonds are up.

Yesterday crude oil moved to a higher high, taking out both its high from two weeks ago and June. Today it’s down 73 cents in premarket trading and will open in range.

If the group can break out and run, there will be a lot of money to be made. There are dozens of liquid oil stocks that can easily rally >20% if crude cooperates. If it doesn’t happen, oh well. That will be unfortunate because there are so many good looking charts right now.

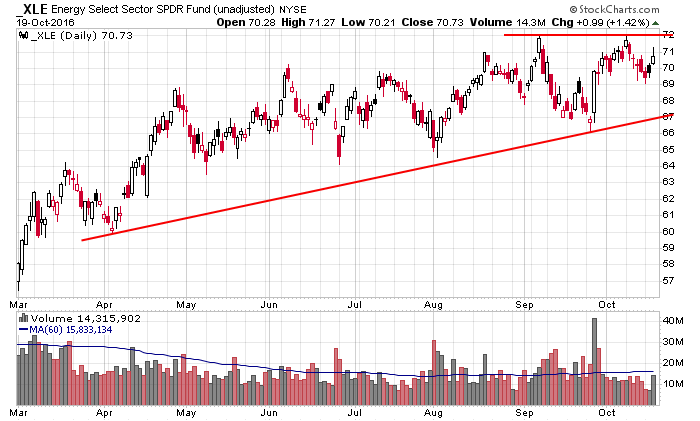

For what it’s worth, XLE, a large-cap dominated energy ETF, has not matched the movement of crude lately.

The overall the market is still range bound. Don’t get overly worked up about nothing happening. Here’s the Russell 2000, which led yesterday.

Stock headlines from barchart.com…

American Express (AXP +1.95%) jumped over 5% in pre-market trading after it reported Q3 EPS of $1.24, well above consensus of 96 cents.

United Rentals (URI -1.13%) rose nearly 5% in after-hours trading after it lifted its lower end of its 2016 revenue estimate to $5.65 billion-$5.75 billion from a July 20 view of $5.60 billion-$5.80 billion.

Mattel (MAT -0.29%) rallied over 4% in after-hours trading after it reported Q3 net sales of $1.8 billion, above consensus of $1.78 billion.

eBay (EBAY +2.78%) dropped 7% in after-hours trading after it said it sees Q4 adjusted EPS continuing operations of 52 cents-54 cents, at the lower end of consensus of 54 cents.

Kinder Morgan (KMI +2.63%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse with a target price of $26.

Manitowoc (MTW +2.37%) tumbled 8% in after-hours trading after it said orders and backlog were down double digits during Q3 and it is temporarily shutting down some mobile output lines in Q4.

BJ’s Restaurants (BJRI +0.76%) dropped 6% in after-hours trading after it reported Q3 adjusted EPS of 30 cents, below consensus of 32 cents, and said comparable restaurant sales were down -3.4%, weaker than consensus of -1.9%.

FMC Technologies (FTI +1.09%) gained over 1% in after-hours trading after it reported Q3 EPS continuing operations of 35 cents, better than consensus 23 cents.

East West Bancorp (EWBC +1.25%) rose 2% in after-hours trading after it reported Q3 EPS of 76 cents, higher than consensus of 69 cents, and then raised guidance on full-year EPS to $2.91-$2.93 from a prior view of $2.83-$2.87.

Core Laboratories NV (CLB +2.78%) fell over 1% in after-hours trading after it said it sees Q4 EPS of 38 cents-40 cents, weaker than consensus of 41 cents.

Landstar Systems (LSTR unch) climbed nearly 5% in after-hours trading after it said it sees Q4 EPS of 85 cents-90 cents, higher than consensus of 82 cents.

WD-40 Co. (WDFC -2.50%) gained over 1% in after-hours trading after it reported Q4 EPS of 99 cents, above consensus of 82 cents.

DXP Enterprises (DXPE +0.07%) sank 17% in after-hours trading after it reported preliminary Q3 sales of $228 million-$231 million, below consensus of $250.7 million.

Select Comfort (SCSS +2.13%) plunged over 15% in after-hours trading after it reported Q3 WPS of 56 cents, weaker than consensus of 57 cents, and then lowered guidance on full-year EPS to $1.15-$1.25 from a prior view of $1.25-$1.45.

Wednesday’s Key Earnings

Morgan Stanley (NYSE:MS) ends +1.9% following “expected” earnings beat

American Express +5.5% (NYSE:AXP) AH after Q3 beat, raises full-year guidance

Mattel (NASDAQ:MAT) jumps 6% AH after Q3 revenue holds up

eBay (NASDAQ:EBAY) tumbles 6% AH, with holiday-quarter guidance uninspiring

Halliburton (NYSE:HAL) closes +4.25% after surprise profit as it “relentlessly” manages costs

Citrix Systems (NASDAQ:CTXS) +5.4% AH as it Q3 tops projections

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Philly Fed Business Outlook

9:45 Bloomberg Consumer Comfort Index

10:00 Leading Indicators

10:00 Existing Home Sales

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Oct 20)”

Leave a Reply

You must be logged in to post a comment.

ECB says little that explains how the EU will go on, but is hopeful fiscal policy can be a part. WAITING in other words ..we have options. He Must have talked to Yellen recently. Frankly I am concerned and liking US cash more… while admiring gold greatly.

whidbey, uc any dumping of treasuries from china, saudi and euro?

do you know the yields on bunds (german gov’t bonds) and japanese treasuries vs. u.s. t-bills?