Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Japan, Hong Kong and Australia did well; South Korea and Indonesia posted losses. Europe is currently mostly down, but movement is minimal. Greece and Russia are down more than 1%. Norway and Denmark are also weak. The Czech Republic and Turkey are doing well. Futures in the States point towards a negative open for the cash market.

—————

VIDEO: LeavittBrothers.net Overview

—————

The dollar is up. Oil is down; copper is up. Gold and silver are up. Bonds are up.

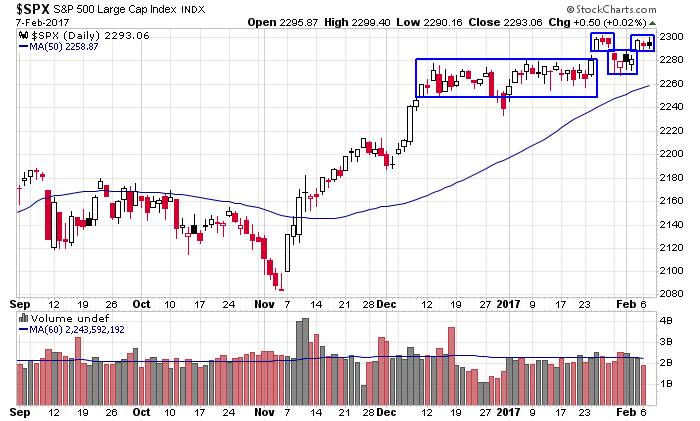

The market continues to make no intraday progress. It gaps and sits in a small range…or it just continues the range from the prior days. There have been no trending moves since early December. Here’s the S&P daily chart.

Of course beneath the surface there are trending moves. Gold and silver continue to do well. Semiconductors put in another new high yesterday. There are others. It’s the key to making money. Most groups will be on par with the market – doing a little better or a little worse. A few groups will the obvious leaders at any given time. The key is to find those groups and play them. There’s a bull market somewhere. Finding them and playing them are the keys to out-performing.

Stock headlines from barchart.com…

Twitter (TWTR +1.84%) rose 3% in pre-market trading after it was upgraded to ‘Buy’ from ‘Neutral’ at BTIG LLC with a $25 price target.

Disney (DIS -0.52%) fell 1% in after-hours trading after it reported Q1 revenue of $14.8 billion, below consensus of $15.3 billion.

Cooper Tire & Rubber (CTB -3.61%) gained more than 3% in after-hours trading after it was named to replace ComScore in the S&P 400 Midcap index as of the close of trading Friday, Feb 10.

Akamai Technologies (AKAM +2.02%) dropped 3% in after-hours trading after it projected Q1 revenue of $596 million-$610 million, the midpoint below consensus of $604.8 million.

Buffalo Wild Wings (BWLD -0.89%) fell nearly 4% in after-hours trading after it forecast 2017 EPS of $5.60 to $6.00, well below consensus of $6.47.

Panera Bread (PNRA -0.56%) gained 2% in after-hours trading after it reported Q4 adjusted EPS of $2.05, better than consensus of $2.00.

Gilead Sciences (GILD +1.02%) slid 5% in after-hours trading after it said it expects 2017 sales of $22.5 billion to $24.5 billion, below consensus of $27.9 billion.

Coherent (COHR +2.46%) surged 14% in after-hours trading after it reported Q1 net sales of $346.1 million, well above consensus of $216.2 million.

DR Horton (DHI -0.24%) was rated a new ‘Buy at BTIG LLC with a 12-month target price of $38.

Lennar (LEN -0.34%) was rated a new ‘Buy’ at BTIG LLC with a 12-month target price of $56.

Urban Outfitters (URBN -0.76%) lost nearly 3% in after-hours trading after it reported Q4 net sales of $1.03 billion, below consensus of $1.04 billion.

Tucows (TCX -0.41%) slumped 13% in after-hours trading after it reported Q4 revenue of $48.8 million, below consensus of $50.4 million.

Pier1 Imports ({=PIR =}) rose almost 4% in after-hours trading after it reported comparable sales in the quarter to date through Jan were up +0.6%.

Coherus Biosciences (CHRS -1.11%) dropped 6% in after-hours trading after it announced a public offering of $125 million of common stock.

Jive Software (JIVE unch) jumped over 7% in after-hours trading after it said it sees Q1 adjusted EPS of 4 cents to 5 cents, above consensus of 3 cents.

Genworth Financial (GNW -0.57%) fell 5% in after-hours trading after it reported an unexpected -27 cent loss per share, weaker than consensus of 19 cents EPS.

Tuesday’s Key Earnings

Buffalo Wild Wings (NASDAQ:BWLD) -4.6% AH under sales pressure.

Disney (DIS) -0.3% AH following weakness at ESPN.

General Motors (NYSE:GM) -4.7% on profit concerns in Europe.

Gilead (NASDAQ:GILD) -6.3% AH slumping on weak guidance.

Michael Kors (NYSE:KORS) -10.8% warning on 2017 headwinds.

Mondelez (NASDAQ:MDLZ) +1.9% AH after missing expectations.

Panera Bread (NASDAQ:PNRA) +2.6% AH with strong profit guidance.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

10:30 EIA Petroleum Inventories

1:00 PM Results of $23B, 10-Year Note Auction

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

3 thoughts on “Before the Open (Feb 8)”

Leave a Reply

You must be logged in to post a comment.

VT,VBR : some kind of correction in the offing???

Yes 5-10 percent

bonds are trying to confirm a bottom while DX is trying to bounce off its polarity support at 100. if both succeed, things will start falling in place.