Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Japan dropped 4.2%; Australia, Malaysia, New Zealand, South Korea and Taiwan dropped more than 1%. Europe is currently down across the board. Germany is posting the biggest loss; Austria, Belgium, Norway and Stockholm are also down noticeably. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil and copper are up. Gold is down, silver up.

The market got clobbered yesterday. There are no two ways about it. After a flat open, steady and intense selling pressure followed all day. It was one of the worst single days of the last year, and the third big down day in the last three weeks. In the past, a big down day would play out once in a while. Now, as noted last week, they’re happening with more often and in closer succession. Not a good sign.

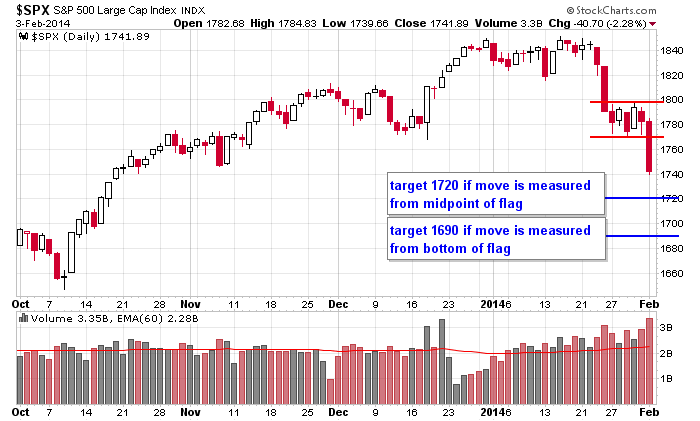

Here’s the S&P daily…classic flag pattern within a newly formed, short term downtrend. If the move out matches the move in, we’ll get a drop to either 1720 or 1690 depending on whether you measure from the midpoint of the flag or the bottom.

The warning signs have been everywhere. Numerour retails stocks have taken big hits (see here and here), and all the breadth indicators warning of beneath-the-surface weakness.

Don’t be a hero out there. The tide has changed. If you missed last year’s rally, I don’t think it’s a good idea to blindly get long some of your favorite names…at least not year. More after the open.

Stock headlines from barchart.com…

Archer-Daniels Midland (ADM -1.44%) reported Q4 EPS of 95 cents, well ahead of consensus of 83 cents.

CME Group (CME -2.11%) reported Q4 EPS of 64 cents, below consensus of 67 cents.

Church & Dwight (CHD -3.90%) reported Q4 EPS of 65 cents, weaker than consensus of 66 cents, and then it cut guidance on fiscal 2014 EPS to $2.96-$3.07, below consensus of $3.10.

PartnerRe (PRE -0.66%) reported Q4 operating EPS of $2.91, above consensus of $2.77.

Crown Holdings (CCK -1.90%) reported Q4 EPS ex-items of 48 cents, below consensus of 49 cents.

Northrop Grumman (NOC -1.99%) has been awarded a $350 million contract by the Department of Homeland Security to provide operational services to the United States Computer Emergency Readiness Team.

Yum! Brands (YUM -1.47%) gained 4% in after-hours trading after it reported Q4 adjusted EPS of 86 cents, better than consensus of 80 cents, although the company said that Q4 same-store-sales at its China division were down 4% y/y.

Dun & Bradstreet (DNB -3.22%) reported Q4 EPS of $2.75, lower than consensus of $2.82.

Hartford Financial (HIG -3.22%) reported Q4 EPS of 94 cents, stronger than consensus of 90 cents.

MDU Resources (MDU -2.90%) reported Q4 adjusted EPS of 48 cents, higher than consensus of 41 cents.

UGI Corporation (UGI -2.83%) reported Q1 adjusted EPS of $1.06, better than consensus of $1.03.

Anadarko (APC -3.12%) reported Q4 EPS of 74 cents, weaker than consensus of 91 cents.

Take-Two (TTWO -1.46%) reported Q3 EPS of $1.70, well above consensus of $1.37, and then raised its fiscal 2014 EPS outlook to $4.15-$4.25, well ahead of consensus of $3.80.

Principal Financial Group (PFG -4.27%) reported Q4 operating EPS of 96 cents, higher than consensus of 93 cents.

Hologic (HOLX -4.17%) rose 3% in after-hours trading after it reported Q1 adjusted EPS of 34 cents, better than consensus of 31 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

10:00 Factory Orders

Notable earnings before today’s open: ABG, ACI, ACM, ADM, AGCO, AMG, ARMH, ARRY, AXE, BDX, BHE, BP, BSX, CHD, CLX, CME, CNC, DLPH, DWSN, EMR, ENTG, ETN, FIS, GCI, HCA, HW, IDXX, IP, KORS, LG, LIOX, LRN, LRY, MHFI, R, SE, SEP, SIRI, ST, TDG, TECH, UBS, UDR, VSH, WDR, XYL

Notable earnings after today’s close: ACLS, AEC, AFL, AMP, ATO, ATW, AXS, BWLD, CBL, CENT, CERN, CHRW, CODE, CVD, DATA, DV, EQR, EXP, GAS, GHDX, GILD, GIMO, GNW, HAIN, HCSG, HI, JKHY, KEYW, MAC, MWA, MX, MYGN, NANO, OCLR, OMCL, PACB, PIKE, TDW, THOR, ULTI, UNM, USNA, VASC, VOCS, XOOM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers