Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Taiwan dropped 2.3%; Australia, China and Hong Kong dropped noticeably. Japan rallied 1.2%. Europe is currently trading mixed. Greece is up 3.5%; Stockholm and the Czech Republic are up nicely. Most other indexes are little changed. Futures here in the States point towards a down open for the cash market.

The dollar is flat. Oil is up, copper down. Gold and silver are up.

The market bounced yesterday, but it was an unconvincing move. Volume was lighter than it was on the recent down days, and there didn’t seem to be much oomph behind the move. In fact half the day’s gains were due to an opening gap up.

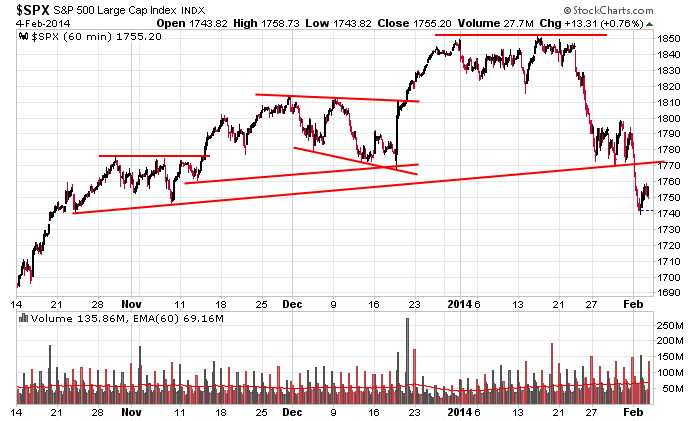

Here’s the 60-min SPX chart. The index recently took out a support level that extended back to October and November and was the bottom of a little flag pattern. That level can now be resistance on the way back, but as I stated yesterday the market doesn’t often act so “cleanly.” More likely the S&P will come up short of 1770 or it’ll overshoot the level by enough to give the bears second thoughts. In either case, I don’t think the selling is done. I’m betting on lower lows.

Stock headlines from barchart.com…

Merck (MRK +2.75%) reported Q4 EPS of 88 cents, below consensus of 89 cents.

NASDAQ OMX Group (NDAQ +1.78%) reported Q4 EPS of 72 cents, better than consensus of 67 cents.

Humana (HUM +1.15%) reported Q4 EPS of 80 cents, well below consensus of 92 cents.

Time Warner (TWX +1.43%) reported Q4 EPS of $1.17, higher than consensus of $1.15.

The WSJ reported that oil firms Hess (HES +1.14%) , Whiting Petroleum (WLL +0.99%) and Marathon Oil (MRO +0.87%) all face civil penalties for crude-by-rail violations.

Genworth (GNW +1.61%) reported Q4 EPS of 38 cents, well above consensus of 30 cents.

BlackRock reported a 5.3% passive stake in LinkedIn (LNKD -1.43%) and a 5.5% passive stake in General Motors (GM +1.62%) .

C.H. Robinson (CHRW +1.58%) fell 9% in after-hours trading after it reported Q4 EPS of 62 cents, below consensus of 68 cents.

DeVry (DV +2.24%) reported Q2 EPS ex-items of 80 cents, above consensus of 73 cents.

Aflac (AFL +1.24%) reported Q4 EPS of $1.40, better than consensus of $1.39.

Ameriprise (AMP +2.04%) reported Q4 operating EPS of $1.87, higher than consensus of $1.81.

Myriad Genetics (MYGN -0.88%) jumped 18% in after-hours trading after it reported Q2 EPS of 66 cents, well above consensus of 46 cents, and then raised guidance on fiscal 2014 EPS view to $2.09-$2.14 from $1.92-$1.97, above consensus of $1.97.

Gilead (GILD +4.05%) reported Q4 adjusted EPS of 55 cents, stronger than consensus of 50 cents.

CSG Systems (CSGS +0.14%) lowered guidance on fiscal 2014 adjusted EPS to $2.05-$2.17, below consensus of $2.27.

Buffalo Wild Wings (BWLD +3.46%) reported Q4 EPS of $1.10, better than consensus of $1.07.

Unum Group (UNM +1.92%) reported Q4 EPS of 85 cents, higher than consensus of 84 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

9:00 PMI Services Index

9:00 Treasury Refunding Quarterly Announcement

10:00 ISM Non-Manufacturing Index

10:30 EIA Petroleum Inventories

Notable earnings before today’s open: ADP, AGN, ARW, CCE, CKSW, COCO, CTSH, CVG, EL, EXTR, GRA, GWPH, HPY, HUM, IACI, LAZ, LII, LVLT, MDC, MMP, MRK, MTH, NDAQ, NICE, NS,RDN, RL, STE, TSRA, TWX

Notable earnings after today’s close: AFFX, AIZ, AKAM, ALL, ARMK, ATML, AVNR, BDN, BKD, BMR, BOFI, CALD, CBG, CINF, CNW, DIS, DRIV, EDMC, ENS, ENTR, FEIC, FISV, FLT, FMC, FORM,GEOS, GIL, GLUU, GMCR, GPRE, IRBT, KIM, LNC, MAA, MRO, MTD, MTGE, NXPI, OESX, ONVO, ORLY, OSUR, P, PAA, PMT, PNNT, PRU, QUIK, RE, RLD,SCSS, SFLY, SNCR, SPF, SRCL, SWI, SWIR, SWM, THG, TQNT, TSO, TTMI, TWO, TWTR, TYL, UHAL, WGL, WNC, XL, YELP

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 5)”

Leave a Reply

You must be logged in to post a comment.

Numbers mixed. Buy puts. Friday looks disappointing. Gold may be getting ready for a run. Defensive is the way. Want to own something? Utilities XLU, Bio techs, Indexes closed.

i feel all funny— i have grown large sharp horns and breath fire from my nostrals

i do not stand upright any more and charge on all four feet

someone has just told me im full of bull

the spx is not a isolated index and all world indexes look like they may have put in a bottom to a ist volitile wave down,–if so their should be a violient up corrective wave 2

but not be able to reach the highs of december/jan

if nas 100 breaches it y/day high could be a sign

going into todays close may be important

i have closed all shorts but will still play the intraday swings and trend