Good morning. Happy Monday. Hope you had a good weekend.

Several Asian/Pacific markets were closed today. The one’s that opened closed down. Japan, India, and South Korea dropped more than 1%. Europe is currently trading mixed and with an bullish bias. Austria and Italy are down, Greece is up 2.9%. Otherwise movement is minimal. Futures here in the States point towards a flat-to-up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

Today’s is Monday. Unless something big happens over the weekend, I rarely have anything to say above and beyond the weekly report. This week is no exception.

The market was weakish last week, but the bears couldn’t fully take over. They had plenty of opportunities to press the issue when bad news was announced, but in each case, the selling pressure didn’t last more than a day. I don’t think the market is extremely strong, but if the bears can’t take over when given the chance, you have to wonder how weak the market really is.

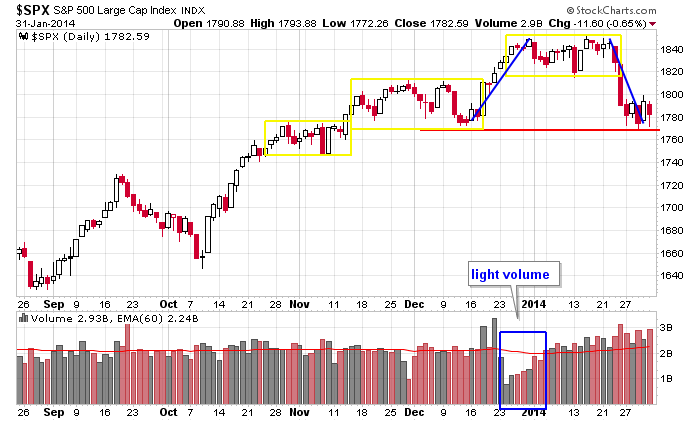

In the near term, I would not be surprised to see a move up. Most of the indexes are trading in bear flag patterns which have bearish implications, but in the very near term, a pop is what would surprise traders the most. Here’s the S&P daily. December gains have been given back; now the index rests at the December low. Volume has been much heavier on the way down than on the way up, and considering other factors, my overall bias is to the downside. But again, a quick pop would not surprise me. More after the open.

Stock headlines from barchart.com…

Goldman Sachs (GS -1.04%) was upgraded to ‘Buy’ from ‘Neutral’ at Guggenheim.

Northrop Grumman (NOC +2.03%) was upgraded to ‘Buy’ from ‘Hold’ at Drexel Hamilton.

NVIDIA (NVDA -0.13%) was upgraded to ‘Neutral’ from ‘Negative’ at Susquehanna.

Mattel (MAT -12.02%) was downgraded to ‘Neutral’ from ‘Buy’ at B. Riley and at SunTrust.

Herbalife (HLF -0.62%) raised guidance on Q4 adjusted EPS to $1.26-$1.30, higher than consensus of $1.17.

O’Reilly Automotive (ORLY -0.99%) was upgraded to ‘Buy’ from ‘Neutral’ at ISI Group.

Smith & Nephew (SNN -1.53%) to acquire ArthroCare (ARTC -0.46%) for nearly $1.7 billion.

Eaton Vance (EV -2.21%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman.

Hound Partners reported a 5.01% passive stake in Carter’s (CRI -0.69%) .

New Enterprise Associates 13 reported a 18.0% passive stake in Prosensa (RNA +4.33%) .

Camber Capital reported a 5.97% passive stake in Amarin (AMRN +1.67%) .

Texas Oil & Gas Holdings reported a 14.33% stake in EP Energy (EPE -0.92%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

8:58 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

Notable earnings before today’s open: GOLD, SYY

Notable earnings after today’s close: ADVS, AEIS, AFOP, AGNC, APC, APU, ARE, BRE, CCK, CFN, DNB, EW, GGP, HIG, HOLX, IDTI, LMNX, MDU, OHI, PFG, PRE, PSMI, SU, TMK, TTWO, UGI, YUM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 3)”

Leave a Reply

You must be logged in to post a comment.

The market is waiting for Yellen’s first congressional sojourn where shows her stuff on policy. Can corp profits replace QE to hold up GDP?? Not really. China’s PMI looks weak. The flags forming on major indexes are ominous. Still debt ceiling to go, and the questions on the affects of QE on the rest of the world are being brushed off by the FED. Bernanke joints a think tank in WASHDC. The center of the universe syndrome. T lowers rates on smartphones: is that a sign of competition? or weakness, or both? competition is something AT&T does not approve of.

Were the Hawks a surprise? The hotel rates made up for fun. Who won? Another NYC rip off.