Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mostly up. Japan, South Korea, New Zealand, Taiwan, Australia and Malaysia posted solid gains. Europe is currently mostly up. Poland, France, Turkey, Germany, Greece, Denmark, Hungary, Spain, the Netherlands, Italy, Belgium, Austria and Sweden are doing very well. Futures in the States point towards a moderate gap up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up a small amount. Oil and copper are down. Gold and silver are down. Bonds are up.

Here are the employment numbers:

unemployment rate: 4.3% (was 4.4% last month)

nonfarm payrolls: +138K

private payrolls:

average workweek: flat at 34.4 hours

hourly wages: up 0.2% to $26.22/hour

labor participation rate:

March job gain reduced from 79K to 50K.

April job gain cut from 211K to 174K.

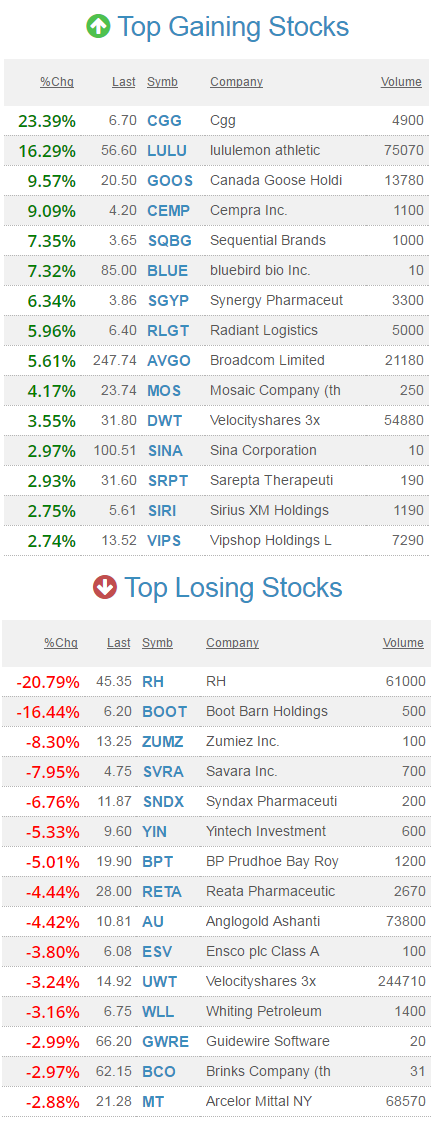

Premarket movers from thestockmarketwatch.com…

Stock headlines from barchart.com…

Broadcom Ltd (AVGO -2.04%) rose nearly 3% in after-hours trading after CEO Tan said an increase in Iphone parts orders will come in Q4 and “don’t believe what you read” on rumors that it may bid for Toshiba’s chip unit.

Lululemon Athletica (LULU +0.83%) surged 15% in after-hours trading after it reported Q1 adjusted EPS of 32 cents, better than consensus of 28 cents, and said it will revamp its Ivivva girl’s line of apparel.

Fastenal (FAST +1.02%) was upgraded to ‘Buy’ from ‘Neutral’ at Longbow Research with a 12-month target price of $55.

Jack in the Box (JACK +0.26%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo Securities with a 12-month target price of $125.

VMware (VMW +0.26%) fell over 1% in after-hours trading after it forecast fiscal 2018 revenue of $7.61 billion, right on expectations.

Restoration Hardware (RH +2.03%) plunged over 20% in after-hours trading after it said it sees full-year adjusted EPS of $1.67 to $1.84, well below consensus of $2.17.

Five Below (FIVE +1.27%) gained almost 2% in after-hours trading after it reported Q1 EPS of 15 cents, better than consensus of 14 cents, and then said it sees full-year net sales of $1.23 billion-$1.24 billion, above consensus of $999.93 million.

Zumiez (ZUMZ +1.40%) dropped 8% in after-hours trading after it said it sees a Q2 loss per share of -6 cents to -11 cents, much weaker than consensus of EPS of 1 cent.

Reata Pharmaceuticals (RETA +6.04%) dropped nearly 10% in after-hours trading after it said it failed to reach its primary endpoint in part 1 of a Phase 2 trial of its omaveloxolone in patients with Friedreich’s ataxia.

ShoreTel (SHOR +0.86%) gained nearly 2% in after-hours trading after RGM Capital reported a 6.13% stake in the company and said it began a dialogue with ShoreTel management and board regarding opportunities to increase shareholder value.

Agilysys (AGYS +1.41%) tumbled 9% in after-hours trading after it reported a Q4 EPS loss of -23 cents a share, wider than consensus of -11 cents.

Boot Barn Holdings (BOOT -4.75%) sank over 15% in after-hours trading after it reported Q4 adjusted EPS of 12 cents, well below consensus of 18 cents.

Savara (SVRA +9.55%) slumped over 10% in after-hours trading after it announced that it intends to offer shares of its common stock in an underwritten public offering, although no size was given.

Thursday’s Key Earnings

Broadcom (NASDAQ:AVGO) +4.7% AH after impressive profits.

Dollar General (NYSE:DG) +6.5% topping expectations.

Lululemon (NASDAQ:LULU) +16.1% AH on a strong outlook.

Mobileye (NYSE:MBLY) flat after beating estimates.

VMware (NYSE:VMW) -0.5% AH with weak billings guidance.

Workday (NYSE:WDAY) -1.2% AH despite raising its outlook.

Today’s Economic Calendar

8:30 Non-farm payrolls

8:30 International Trade

12:45 PM Fed’s Harker: Economic Outlook

1:00 PM Baker-Hughes Rig Count

1:00 PM Fed’s Kaplan speech

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jun 2)”

Leave a Reply

You must be logged in to post a comment.

The calls on precious metals are in the money today. The employment data is down, but tis the summer. Jason reports that MAR is an exhausted stock…but i’m holding it for a while, it is up 50% for me so we will see. best to all.