Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed with a lean to the upside. South Korea, New Zealand, Taiwan, Malaysia and the Philippines did well; China and Australia dropped. Europe is currently mixed. Germany, Greece, Denmark and Hungary are doing well; Poland, France, Italy and Portugal are weak. Futures in the States point towards a down open for the cash market.

—————

SUBSCRIBE to LB Weekly – it’s only $12.40/month when you sub for a year.

—————

The US dollar is up. Oil and copper are down. Gold and silver are up. Bonds are down.

We enter this new week with the Dow, Dow Composite, Nas, Nas 100, NYSE, Russell 1000, Russell 3000, S&P 100, S&P 500 and Wilshire 5000 having moved to new all-time highs, and the Russell 2000, S&P 600 and S&P 400 being pretty close.

Many of the market’s breadth indicators have improved the last couple weeks.

The trend is solidly up. It’s strong. It’s healthy. And although there will be disruptions along the way there’s no reason to believe it won’t continue. This is what I’ve been saying for a long time. I occasionally get made fun of, and here we are at the highs. The only side of the market to be on is the long side.

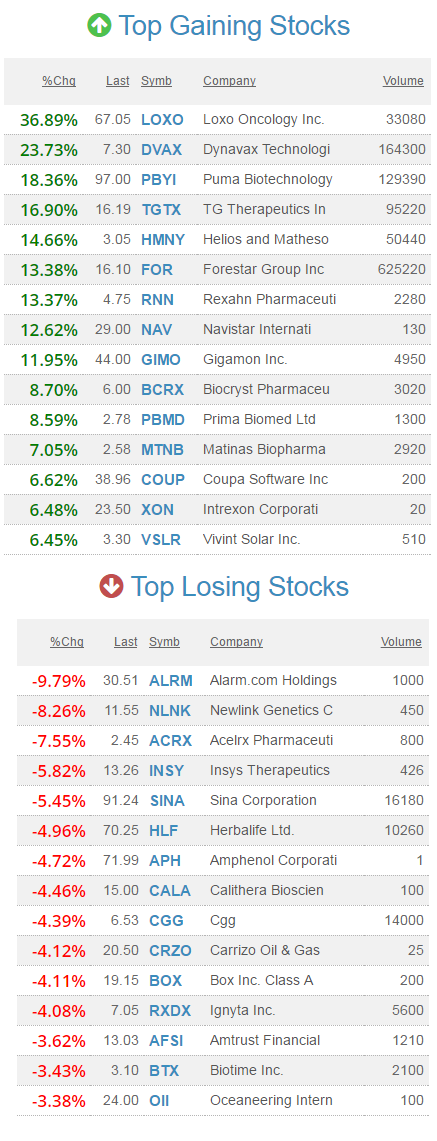

Premarket movers from thestockmarketwatch.com…

Stock headlines from barchart.com…

Apple (AAPL +1.48%) was downgraded to ‘Sector Weight’ from ‘Overweight’ at Pacific Crest Securities.

Perrigo (PRGO -1.73%) was downgraded to ‘Underperform’ from ‘Sector Perform’ at RBC Capital Markets.

Navistar (NAV -2.09%) was upgraded to ‘Outperform’ from ‘Neutral’ at Baird with a price target of $33.

Skechers (SKX +0.72%) was upgraded to ‘Positive’ from ‘Neutral’ at Susquehanna with a price target of $32.

Yelp (YELP -0.14%) was upgraded to ‘Buy’ from ‘Neutral’ at Bank of America/Merrill Lynch with a price target of $37.

Veeva Systems (VEEV +2.82%) was downgraded to ‘Equalweight’ from ‘Overweight’ at Morgan Stanley.

Hilton Worldwide Holdings (HLT +1.16%) was rated a new ‘Buy’ at Argus Research with a price target of $80.

State Street (STT -0.17%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS with a price target of $92.

NewLink Genetics (NLNK -1.25%) dropped over 8% in after-hours trading after it said a combination of its indoximod with chemotherapy failed to show a significant difference in a Phase 2 study.

Dynavax Technologies (DVAX +4.42%) surged 18% in after-hours trading after it said a combo of its SD-101 plus Merck’s Keytruda resulted in a 100% response rate and 29% complete response in 7 melanoma patients and that SD 101 also helped shrink tumors in 42% of 12 patients who had previously failed PD-1 treatment.

Today’s Economic Calendar

8:30 Productivity and Costs

8:30 Gallup US Consumer Spending Measure

9:45 PMI Services Index

10:00 Labor market condition index

10:00 Factory Orders

10:00 ISM Non-Manufacturing Index

12:30 PM TD Ameritrade IMX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

4 thoughts on “Before the Open (Jun 5)”

Leave a Reply

You must be logged in to post a comment.

Gold going to move????? If you look around the the table and cannot spot the sucker….. its you.

I have not commented recently, but many of you know I am not happy about a market going up on euphoria.

The dangers of the market are real.

This year sounds a lot like 1928.

If you have extraordinary profits, spread them off.

markets top on buyer exhustion and euphoria

and do a ”V ” crash

the marsians have created bull disintigrator

crewated by the informous DR TEDDY BEAR

a possible doji indecision day

germany and some of europe was closed

but credit due where warranted

Jason was right with spx 2400 and like 1929 and 1987

could go to a 50 % fib extention spx 2550

but then a massive jaws of death crash lasting many years

as a bear i like making fun of bulls

,but as a day trader i like them and bears equally