Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. China, Hong Kong and Singapore did well; Japan, Taiwan and the Philippines posted losses. Europe, Africa and the Middle East are currently mixed. Turkey, Greece and Switzerland are up; the UK, Poland, Finland and Hungary are down. Futures in the States point towards a moderate gap up open for the cash market.

The dollar is down. Bitcoin is up. Oil and copper are up. Gold and silver are up. Bonds are down.

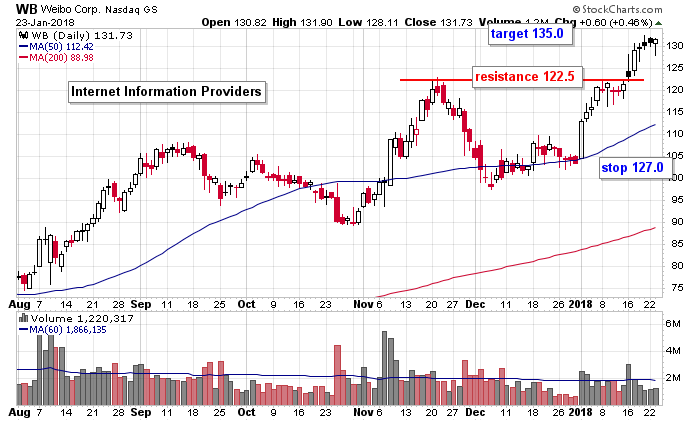

WB is a trade of ours from last week that continues to work well for us.

Stock headlines from barchart.com…

McKesson (MCK -1.36%) was upgraded to ‘Buy’ from ‘Hold’ at Jeffries with a price target of $205.

United Continental Holdings (UAL +1.43%) gave up a 3% advance in after-hours trading and dropped 6% after it forecast capacity growth of as much as 6% this year, which may expand seat supply and cut gains in a gauge of pricing power by half a percentage point. UAL had initially moved higher after it reported Q4 adjusted EPS of $1.40, higher than consensus of $1.34.

Total System Services (TSS +0.20%) rose over 2% in after-hours trading after it reported Q4 adjusted EPS of 82 cents, above consensus of 79 cents, and then said it sees full-year adjusted EPS from continuing operations of $4.10 to $4.20, better than consensus of $3.94.

Capital One Financial (COF +0.21%) slid almost 2% in after-hours trading after it reported Q4 adjusted EPS of $1.62, weaker than consensus of $1.87.

Texas Instruments (TXN +0.38%) fell over 5% in after-hours trading after it said it sees Q1 EPS of $1.01 to $1.17, the midpoint below consensus of $1.15.

Puma Biotechnology (PBYI -3.25%) plunged over 28% in after-hours trading after the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) communicated a negative trend vote after meeting to discuss the Marketing Authorization Application for Puma’s Neratinib for treatment of early stage HER2-positive breast cancer.

Qiagen NV (QGEN +1.51%) gained almost 2% in after-hours trading after it received clearance from the FDA for expanded use of its Jak2 test in diagnosis of myeloproliferative neoplasms.

Arrie Pharmaceuticals (AERI +1.75%) lost over 1% in after-hours trading after it proposed to sell $75 million of shares of its common stock in an underwritten public offering.

Mercury Systems (MRCY -0.45%) slid almost 6% in after-hours trading after it reported Q2 adjusted EPS of 28 cents, below consensus of 30 cents, and said it sees full-year adjusted EPS of $1.33 to $1.37, the midpoint below consensus of $1.37.

Audentes Therapeutics (BOLD -0.16%) fell 3% in after-hours trading after it proposed to sell $150 million of shares of its common stock in an underwritten public offering.

Five Prime Therapeutics (FPRX +0.63%) lost over 6% in after-hours trading after it proposed to sell $75 million of shares of its common stock in an underwritten public offering.

Rocket Pharmaceuticals (RCKT +14.47%) fell almost 8% in after-hours trading after it proposed an offering of $50 million in shares of its common stock.

Teekay Corp (TK +0.47%) dropped 7% in after-hours trading after it proposed a stock offering of 10 million shares of its common stock.

Accuray (ARAY +0.97%) rallied nearly 8% in after-hours trading after it reported a Q2 loss of -6 cents a share, narrower than consensus for -11 cents a share loss.

Sirius XM Holdings (SIRI +0.53%) gained 1% in after-hours trading after it added $2 billion to its stock buyback program.

Cerus (CERS +3.34%) surged 20% in after-hours trading after it said a Phase 3 transfusion study of chronic anemia evaluating INTERCEPT-treated red blood cells in thalassemia patents met primary endpoints.

Monday’s Key Earnings

Johnson & Johnson (JNJ) -4.3% on sweeping U.S. tax changes.

Kimberly-Clark (NYSE:KMB) +0.8% topping profit expectations.

Procter & Gamble (NYSE:PG) -3.1% with pricing still an issue.

Texas Instruments (NYSE:TXN) -6.9% AH amid a revenue growth slowdown.

United Continental (NYSE:UAL) -6.4% AH on plans to hike capacity.

Verizon -0.4% (NYSE:VZ) missing earnings estimates.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

9:00 FHFA House Price Index

9:45 PMI Composite Flash

10:00 Existing Home Sales

10:30 EIA Petroleum Inventories

11:30 Results of $15B, 2-Year FRN Auction

1:00 PM Results of $34B, 5-Year Note Auction

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

One thought on “Before the Open (Jan 24)”

Leave a Reply

You must be logged in to post a comment.

The thesis for buying TGP is that as growth comes online, between Q4-17 and Q1-2020, TGP’s DCF will surge and they will eventually restore their distributions and revenues. Energy is the focus for the near future.