Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. South Korea, New Zealand and the Philippines moved up; Japan, Hong Kong, Singapore and Thailand moved down. Europe, Africa and the Middle East are currently mixed. France, Russia, Italy, Portugal and Saudi Arabia are doing well; Poland, Kenya, Hungary, Austria, Sweden and the Czech Republic are down. Futures in the States point toward another moderate gap up open for the cash market.

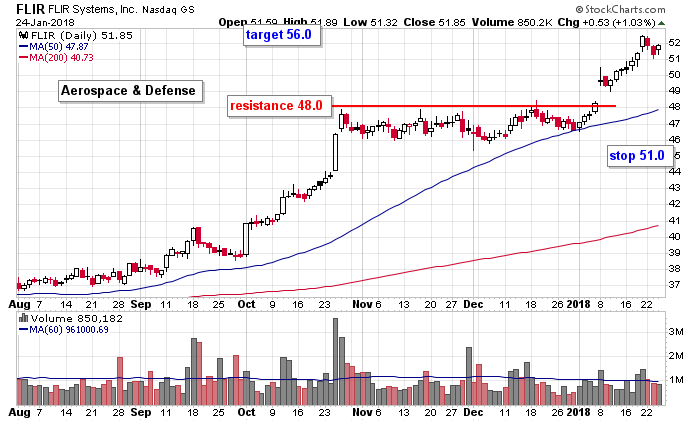

FLIR is one of our trades from two weeks ago. It remains in good shape.

The dollar is down a small amount. Bitcoin is down. Oil and copper are up. Gold and silver are up small amounts. Bonds are up.

Stock headlines from barchart.com…

Dollar General (DG -0.47%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Telsey Advisory Group with a price target of $120.

Lam Research (LRCX -2.48%) rallied over 4% in after-hours trading after it reported Q2 adjusted EPS of $4.34, well above consensus of $3.69.

Whirlpool (WHR +4.06%) lost almost 1% in after-hours trading after it reported Q4 net sales of $5.70 billion, below consensus of $5.84 billion.

F5 Networks (FFIV -0.32%) climbed almost 3% in after-hours trading after it reported Q1 net revenue of $523.2 million, better than consensus of $521.1 million, and then said it sees Q2 revenue of $525 million to $535 million, the midpoint above consensus of $528.3 million.

Varian Medical Systems (VAR +2.02%) jumped over 12% in after-hours trading after it reported Q1 adjusted EPS of $1.06, higher than consensus of 88 cents, and then raised guidance on full-year adjusted EPS to $4.24 to $4.36 from a prior view of $4.05 to $4.17.

Xilinx (XLNX -2.73%) rose almost 5% in after-hours trading after it said it sees Q4 sales of $635 million to $665 million, the midpoint above consensus of $642.2 million.

Legg Mason (LM +0.73%) gained over 2% in after-hours trading after it reported Q3 operating revenue of $793.1 million, better than consensus of $768.5 million.

Dolby Laboratories (DLB -0.40%) climbed over 8% in after-hours trading after it reported Q1 adjusted EPS of 79 cents, well above consensus of 60 cents, and then said it sees Q2 adjusted EPS of 74 cents to 80 cents, higher than consensus of 71 cents.

Spark Therapeutics (ONCE -2.10%) rallied almost 4% in after-hours trading after it entered into a pact with Novartis to commercialize Voretigene Neparvovec and will receive $105 million in an upfront fee.

Ethan Allen Interiors (ETH -0.37%) fell 3% in after-hours trading after it said it will begin a “major marketing campaign” and will boost advertising by 33% in Q3 and by 15% in Q4.

Ford Motor (F +0.75%) lost almost 1% in after-hours trading after it said it sees fiscal 2018 pre-tax profit lower than last year.

Celestia (CLS -0.54%) tumbled almost 9% in after-hours trading after it reported Q3 adjusted EPS of 27 cents, below consensus of 31 cents.

ShotSpottter (SSTI +1.19%) jumped over 10% in after-hours trading after it announced an agreement with Verizon to expand its gunshot detection services to more cities by leveraging Verizon’s Light Sensory Network.

Iovance Biotherapeutics (IOVA -4.96%) climbed over 3% in after-hours trading after it reported three of eight evaluable patients with Metastatic Squamous Cell Carcinoma of the head and neck treated with its LN-145 experienced a confirmed partial response.

Ocular Therapeutix (OCUL -0.80%) dropped 12% in after-hours trading after it announced that it had commenced an underwritten public offering of $25 million of its common stock.

Wednesday’s Key Earnings

Abbott Laboratories (NYSE:ABT) +4.2% topping expectations.

Baker Hughes (NYSE:BHGE) -5.7% posting a Q4 loss.

Comcast (NASDAQ:CMCSA) +1.3% boosted by a dividend hike.

Ford (NYSE:F) -0.8% AH as commodities hurt results.

General Electric (NYSE:GE) -2.7% announcing an SEC probe.

Las Vegas Sands (NYSE:LVS) +0.3% AH as net income doubled.

Novartis (NYSE:NVS) +4.9% after beating estimates.

United Technologies (NYSE:UTX) -0.3% dented by a tax charge.

Today’s Economic Calendar

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 New Home Sales

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $28B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY

4 thoughts on “Before the Open (Jan 25)”

Leave a Reply

You must be logged in to post a comment.

markets look like they did before the last big crash, warns bank CEO (American GSacks pres) at Davos. Numbers day today.

GCR coming…Trump trying to save the usa corporation..

trade and currency wars and the pyramid Sovereign and company debt implosion

the world has gone totally insane with greed

the great DEPRESSION and the soon to come selfish depression to end all DEPRESSIONS

USA FIRST ==CHINA GERMANY,RUSSIA JAPAN, All first—all bull

the soon to come total depression to wipe ALL greed and the entire share market and purge ”self ness ”

only then can the world learn that MUTUAL BENEFIT OF ALL LEADS TO PROSPERITY

it must have been forever since i commented here. dollar index was trying to break out above 100 when i was last posting. that ended up being a false breakout. then the dollar went back into its range between 92 and 100. now it broke down below 90. definitely supports the stock market rally due to currency effect. there may be other impacts if it keeps falling this fast though.