Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Hong Kong jumped 2%; South Korea, Indonesia, Thailand and the Philippines also did well. Japan, India and New Zealand dropped. Europe, Africa and the Middle East are currently mostly up. The UK, France, Turkey, Greece, Denmark, Switzerland and Saudi Arabia are doing well; Russia is down more than 1%. Futures in the States again point towards a moderate gap up open for the cash market.

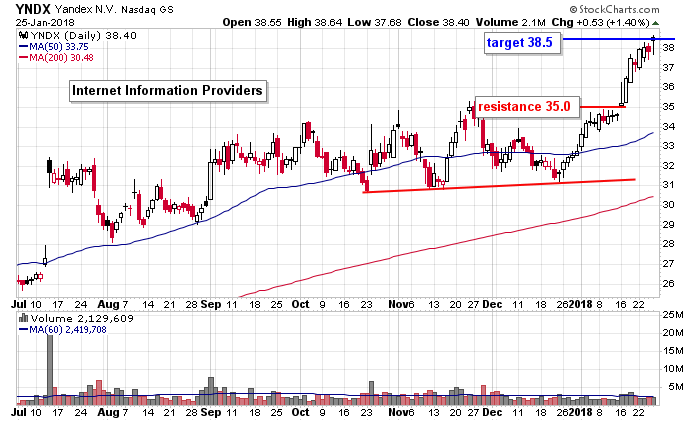

YNDX is a trade from two weeks ago that just hit its target.

The dollar is down. Bitcoin is down. Oil and copper are down. Gold and silver are down. Bonds are down.

Stock headlines from barchart.com…

Intel (INTC -0.46%) rallied more than 3% in after-hours trading after it reported Q4 revenue of $17.05 billion, much better than consensus of $16.35 billion. Rival chipmaker Advanced Micro Devices (AMD -2.36%) gained 2% in after-hours trading on the strong revenue growth from Intel.

Whirlpool (WHR +2.30%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Raymond James with a 12-month target price of $200.

Equinix (EQIX -0.48%) fell over 3% in after-hours trading after CEO Steve Smith resigned, citing “poor judgement’ with an employee matter.

Intuitive Surgical (ISRG +2.82%) dropped over 3% in after-hours trading after it reported a Q4 net loss of -35 cents per share versus a profit of $1.71 a share a year earlier, citing a $318 million expense related to the new U.S. tax laws.

Tesla (TSLA -2.39%) gained 1% in after-hours trading after it said it is on track with projections for increased Model 3 production rates provided earlier this month, refuting a CNBC report that said the company’s battery manufacturing problems are worse than it has acknowledged.

Maxim Integrated Products (MXIM -2.18%) climbed nearly 5% in after-hours trading after it reported Q2 net revenue of $622.6 million, higher than consensus of $620.5 million, and then said it sees Q3 revenue of $620 million to $660 million, above consensus of $602.3 million.

Celanese (CE +2.03%) gained 1% in after-hours trading after it reported Q4 adjusted EPS of $1.98, higher than consensus of $1.87.

Starbucks (SBUX -0.46%) fell 3% in after-hours trading after it reported Q1 comparable sales rose 2%, weaker than expectations of a 3% increase.

SVB Financial (SIVB +0.16%) dropped 6% in after-hours trading after it reported Q4 EPS of $2.19, well below consensus of $2.56.

Matthews International ({=MATW gained over 1% in after-hours trading after it reported Q1 adjusted EPS of 64 cents, above consensus of 61 cents.

E*TRADE Financial (ETFC -1.78%) lost 1% in after-hours trading after it acquired one million retail brokerage accounts with $18 billion in assets from Capital One for a purchase price of $170 million.

Flex Ltd (FLEX -0.74%) gained almost 2% in after-hours trading after it reported Q3 adjusted EPS of 31 cents, above consensus of 30 cents, and said it sees Q4 adjusted EPS of 28 cents to 32 cents, the midpoint better than consensus of 29 cents.

8×8 Inc (EGHT +2.88%) jumped nearly 8% in after-hours trading after it reported Q3 adjusted EPS of 2 cents, higher than consensus of 1 cent.

Mitek Systems (MITK -3.28%) rose over 3% in after-hours trading after it reported Q1 revenue of $12.1 million, better than consensus of $11.6 million.

Thursday’s Key Earnings

Biogen (NASDAQ:BIIB) +2.1% hunting for late-stage assets.

Caterpillar (NYSE:CAT) +0.6% after beating estimates.

Celgene (NASDAQ:CELG) +1.2% on strong Revlimid sales.

Freeport-McMoRan (NYSE:FCX) +1.1% with strong cash flows.

Intel (NASDAQ:INTC) +3.7% AH as data center sales surge.

Starbucks (NASDAQ:SBUX) -4.3% AH on a holiday drink flop.

Western Digital (NYSE:WDC) -1.1% AH despite beating earnings.

Today’s Economic Calendar

8:30 Durable Goods

8:30 GDP Q4

8:30 International trade in goods

8:30 Retail Inventories (Advance)

8:30 Wholesale Inventories (Advance)

1:00 PM Baker-Hughes Rig Count

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY