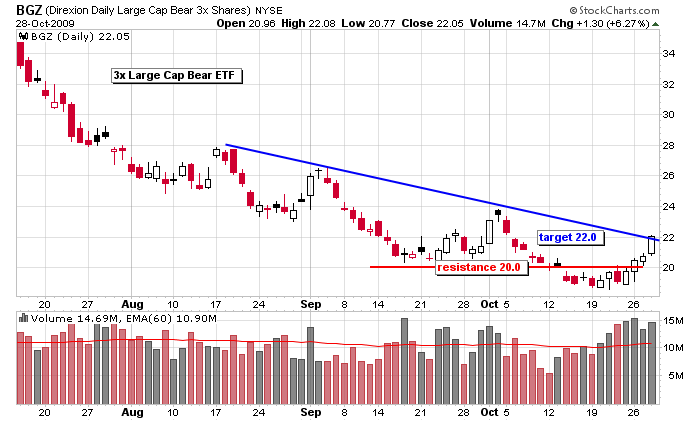

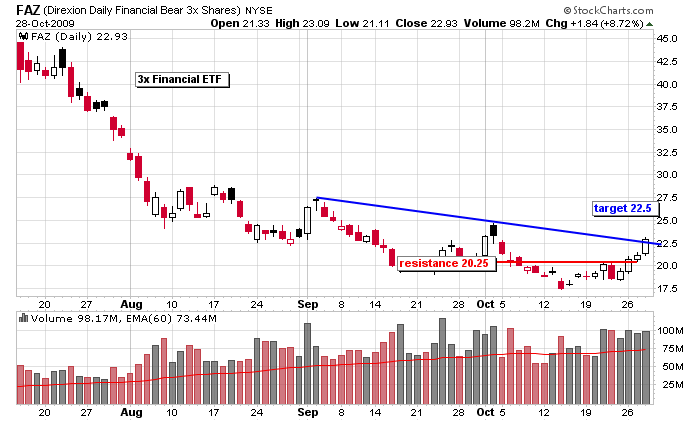

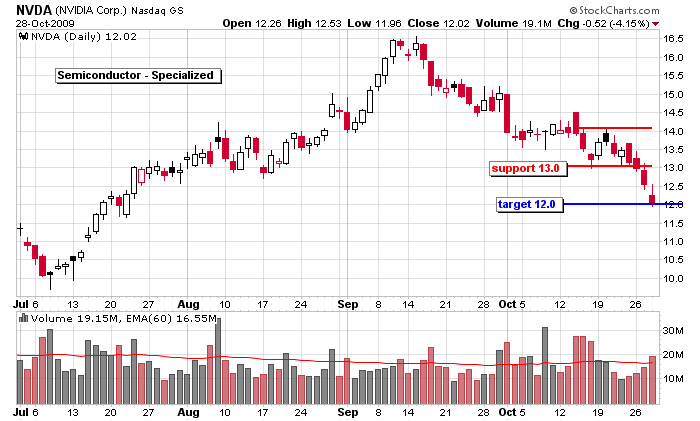

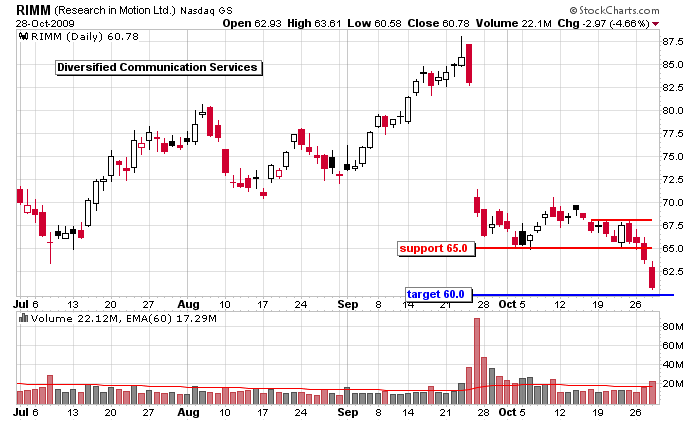

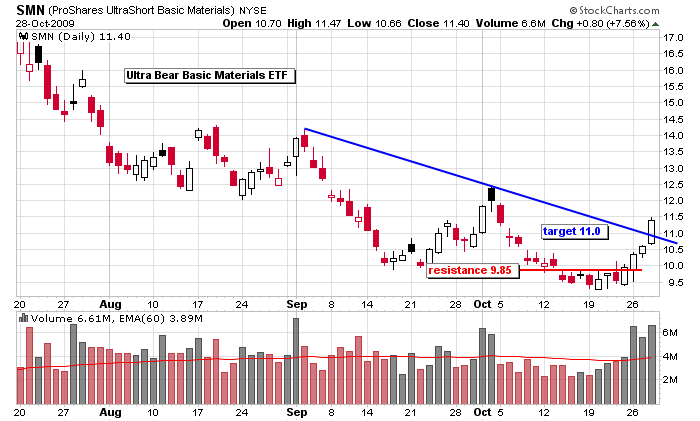

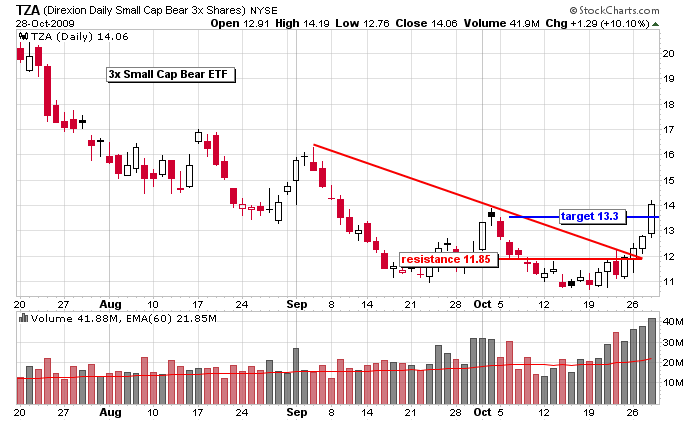

For the first time in a long time our bias switched to the downside this past weekend. We posted two new short set ups, but since it was earnings season and we didn’t want to attempt picking a needle out of a haystack, we mostly played the inverse ETFs. Here are the bearish plays we added to our trading lists this past weekend.

0 thoughts on “Stock Trades”

Leave a Reply

You must be logged in to post a comment.

so now what. looks like the market is going to continue down. what are you swing or position trades? these ETFS could be longer term holdings. I do not want to sit in front of a computer all day. It would have been nice to have had the qld or sso since may.

I have never made money trying to trade for 1 or 2 points which is why I don’t subscribe to your service although your stock picking might be great.

To give you guys credit their is no one out there really calling the longer term shots correctly anyway with any consistency. So for what your service is I mean no criticism.

I’ve never attempted to call the long term…not worth my time…I don’t have a crystal ball. I’m sticking with the short term…that’s what I’m good at.

You made some excellent calls on these securities, catching a very rapid decline. I would suggest, however, that one might have made more money by either shorting FAS, which has fallen from over 88 to 69 in 4 trading days, or buying puts on it, since the short would have required more capital than some traders could commit, in liieu of the FAZ trade. Similar trades could have been accomplished on the etfs that are ” double long ” the other etfs, such as the spx, etc. They are higher prices and, consequently, have farther to fall t han the longs on the downside will gain and the fall is always faster than any gain on the other side.

I guess if you nailed the exact top and bottom of FAS you could have made 20%, but no one can be that perfect.

And whether a stop drops from 88 to 69 or breaks out at 11 and moves to 13 doesn’t matter. It’s the same percentage gain. Instead of doing 1000 shares of FAS, you might do 8000 shares of a 10-dollar stock. Same exact trade.

I find the long side easier to play which is why I went with the inverse ETFs.

I tend to agree with Ray. 100 points up one day then 100 points down the next. It seems like a great market for day traders. But if you can’t stay glued to the computer you’ll get lacerated. So is the market in a correction? 4% down? 10% down? Will the market revisit the March lows or will the S&P bust through 1250?

Larry I don’t attempt to predict, guess or figure such stuff out. I play the odds and then I play good defense. Most of my big winners are “surprises” that went farther than I was expecting.

The targets were surprisingly short> Does that mean you expect the market to rebound quickly? Or does it mean you want to be able to notch several profitable trades on your belt?

Marty…My targets were conservative because the market was solidly trending up. Higher highs and higher lows have been registered for several months. It would not have been responsible to assume the market would do anything other than temporarily correct.

Now that the targets have been hit, it’s time to re-evaluate.