Good morning. Happy Thursday.

The Asian/Pacific markets got hit hard today – several lost more than 2%.

Europe is currently mixed with a lean to the upside.

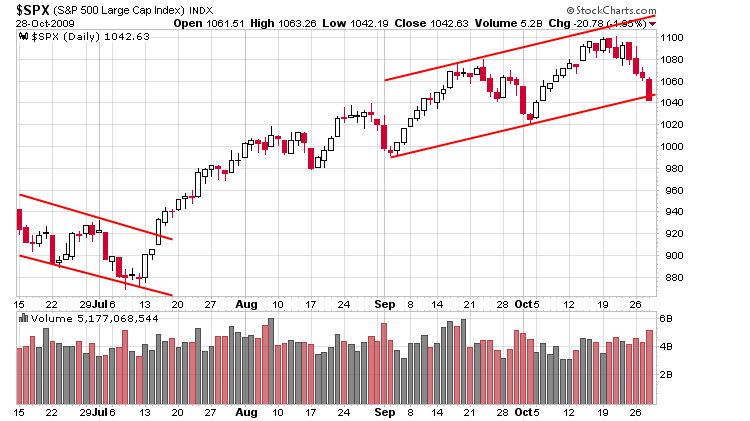

Futures here in the States suggests a small gap up open for the cash market. This comes off the market having fallen 6 of the last 7 days and SPX support on the daily chart being hit yesterday. Here’s the chart.

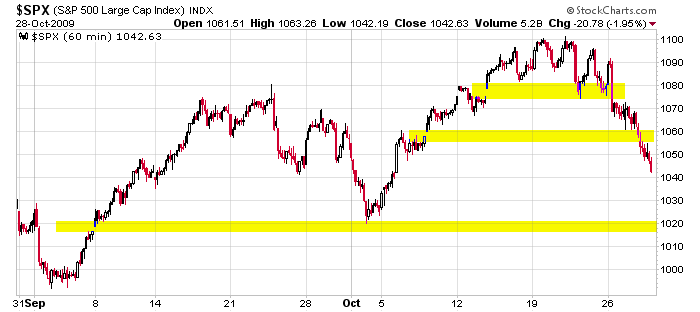

Here’s the 60. Two gaps have been filled. You can see the next one just below 1020.

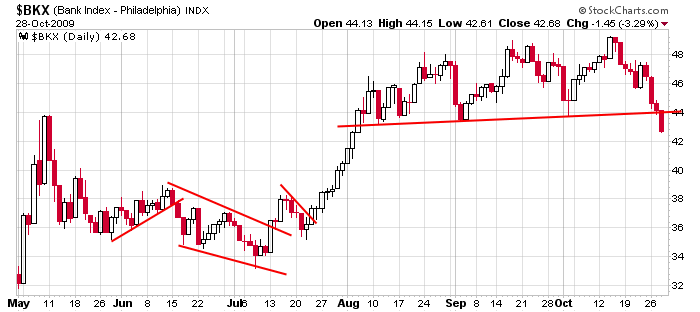

So far I’d say the pull back isn’t much different than other pull backs we’ve had over the last 7 months with one exception – Some key groups are breaking down. Here’s the banking group – some technical damage has been done.

It’s getting a little late to go short, and until the bulls can prove they aren’t completely leaving the market, I’m not going long.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 29)”

Leave a Reply

You must be logged in to post a comment.

Jasom, could you describe why you pay attention to open gaps? (yellos zone on your second chart)

From my point of view they have no meanings, they just a “technical issue” due to changinf time zone, US market can not work at a time wht asia/europe market is open, so those gaps just show what other markets did during americans “off hours”. Why they important and why you mention them?

thanks

Alex

Hi Alex…the reason I highlight the gaps is because much more often than not, they fill. Why they fill doesn’t matter; bottom line is they fill, so I keep them in the back of my mind.