Good morning. Happy Monday. Hope you had a nice weekend.

Last week was a pretty good one for the market. Everything closed up, and the small caps gained over 4%. Most of the indexes made new highs Friday, and we had several good breakouts.

But warning signs persist, and we’re not getting much follow through. In many cases, profits need to be taken when available.

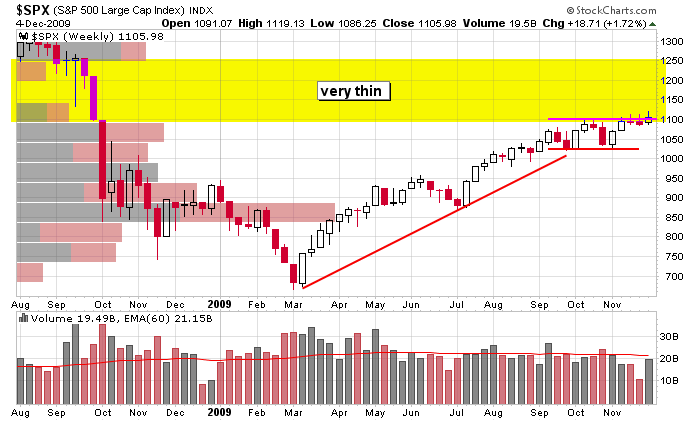

Here’s the SPX weekly. If the thin volume area is supposed to lack resistance due to a lack of investors looking to get out even, someone needs to tell the market. For 3 weeks the market has peaked its head above 1100, and thus far no quick move up has resulted.

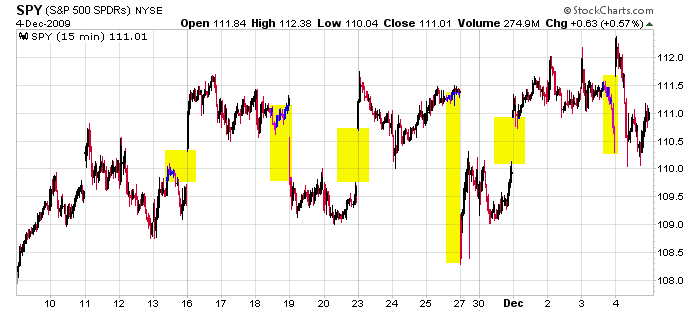

This is one reason profits need to be taken when available. Here’s the 15-min SPY chart. There have been 6 big gaps in just the last 3 weeks, and in the end the market is unchanged since mid November.

The Asian/Pacific markets closed mixed – there were a couple 1% movers in both directions. Europe is currently mixed. Futures here in the States suggest a small gap down open for the cash market. The dollar is continuing Friday’s move up; commodities are down.

Nothing else to add right now. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers