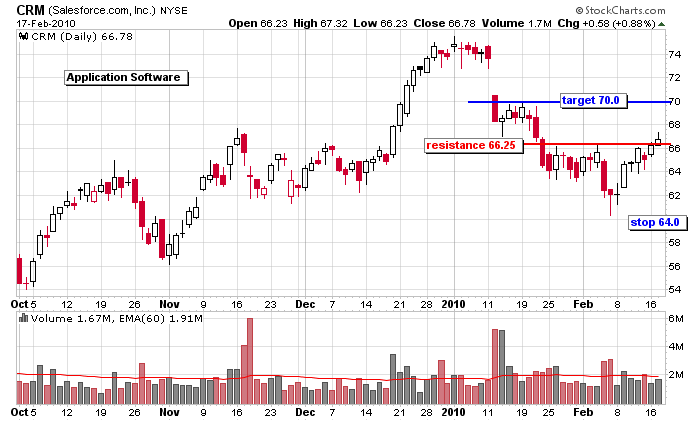

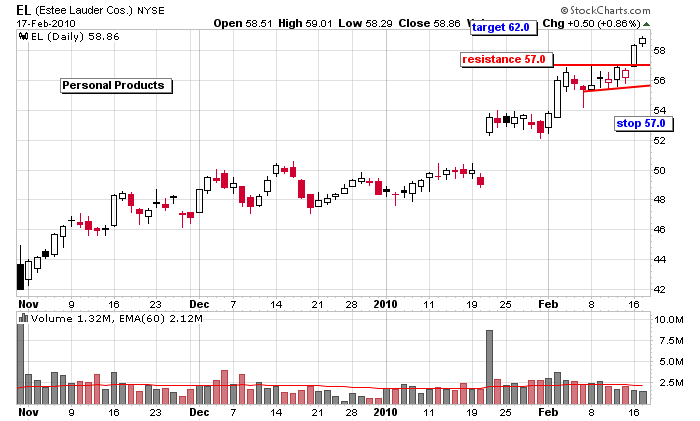

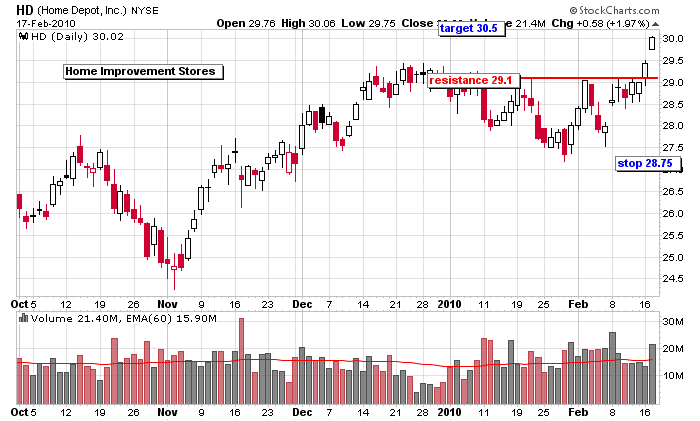

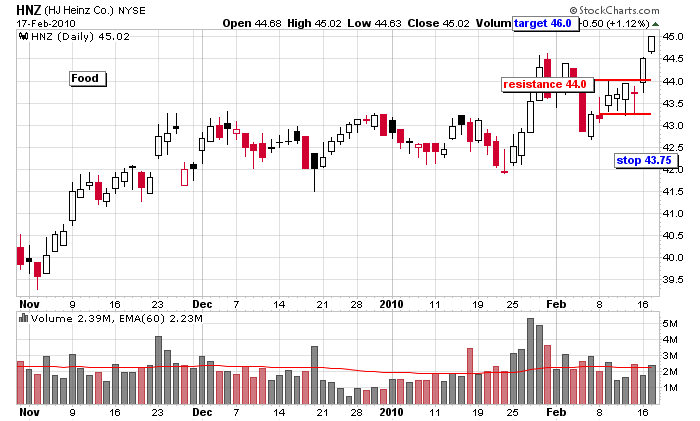

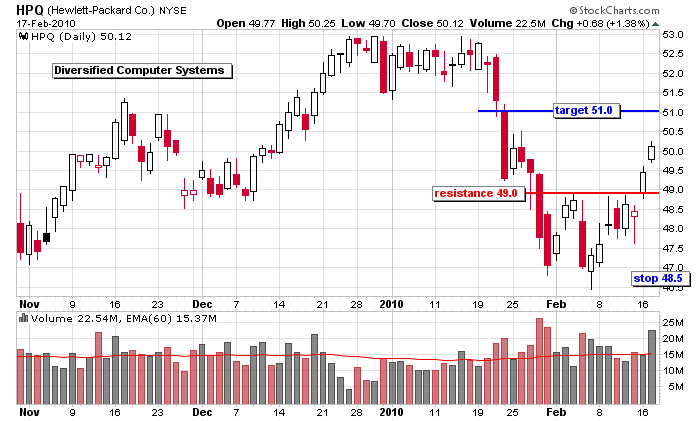

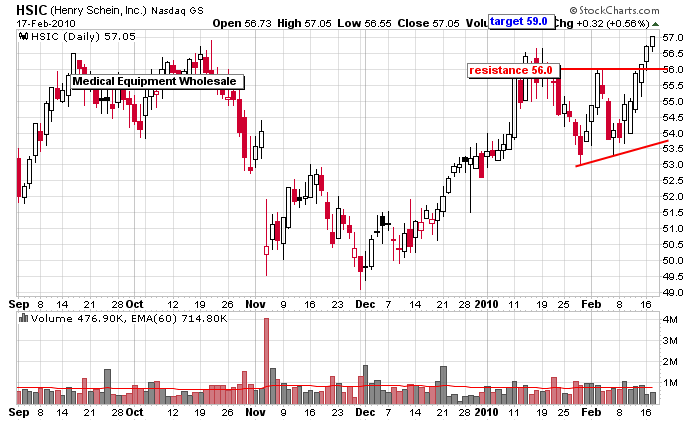

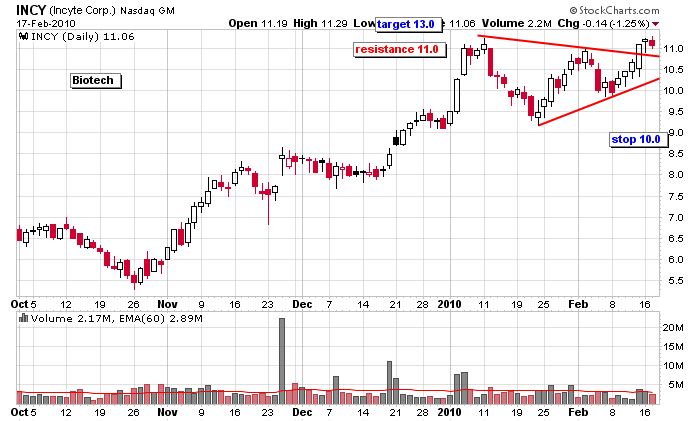

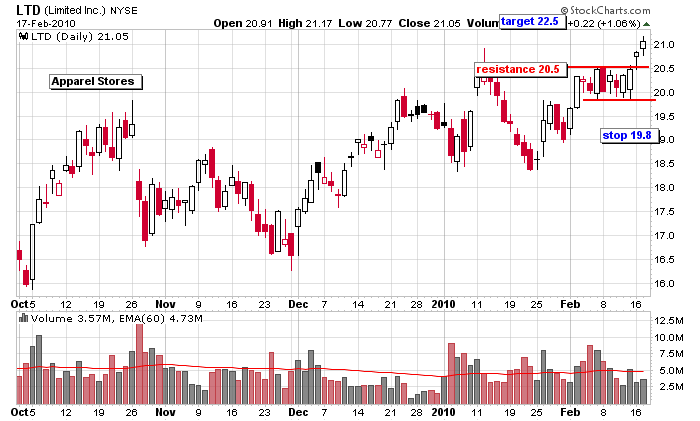

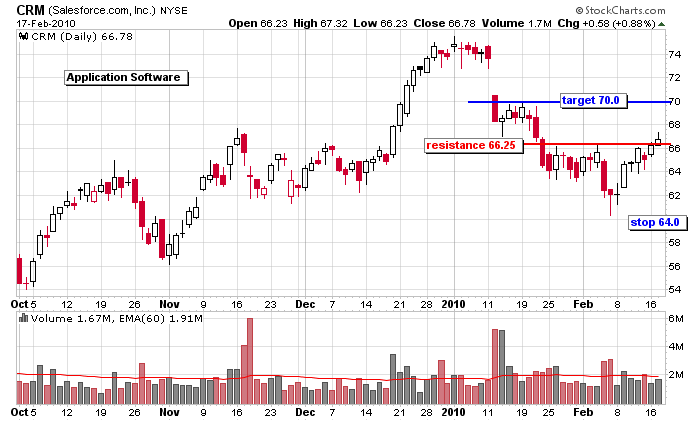

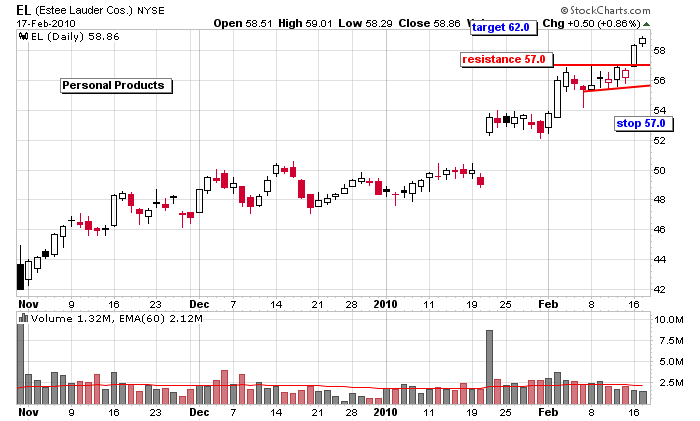

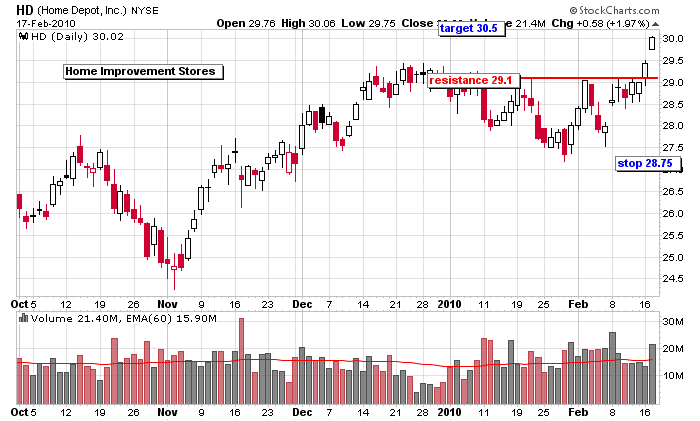

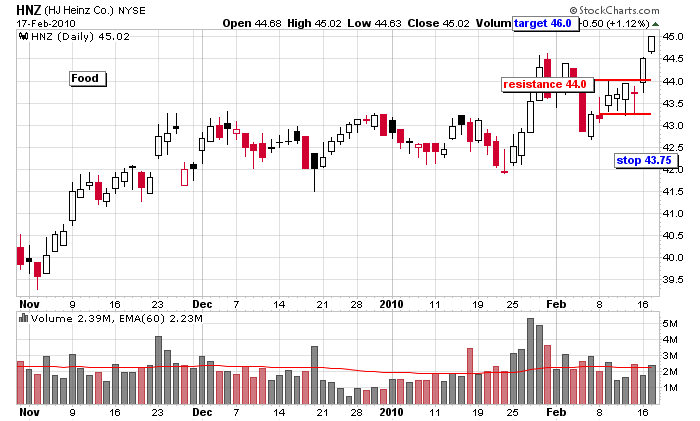

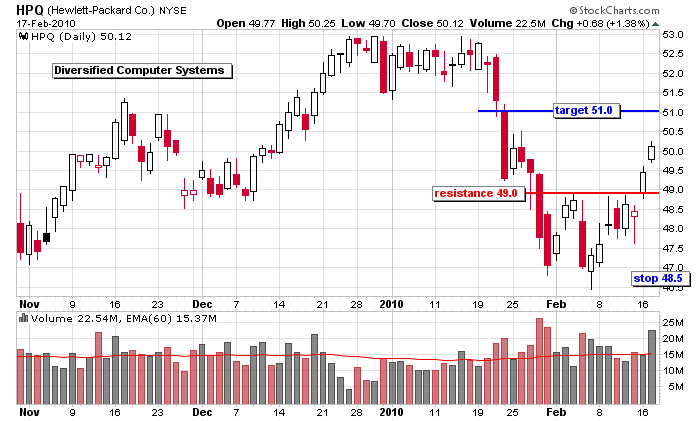

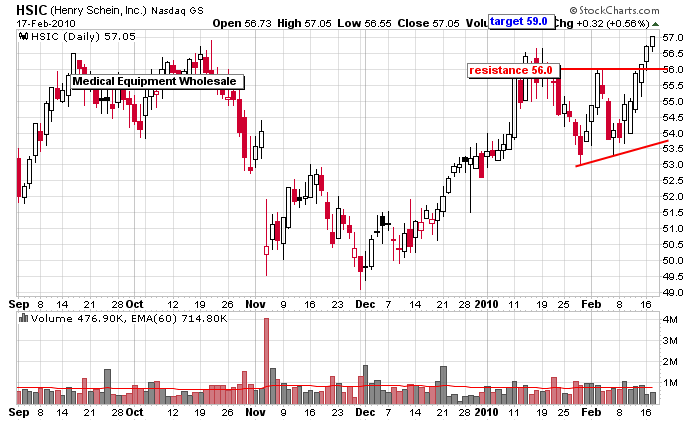

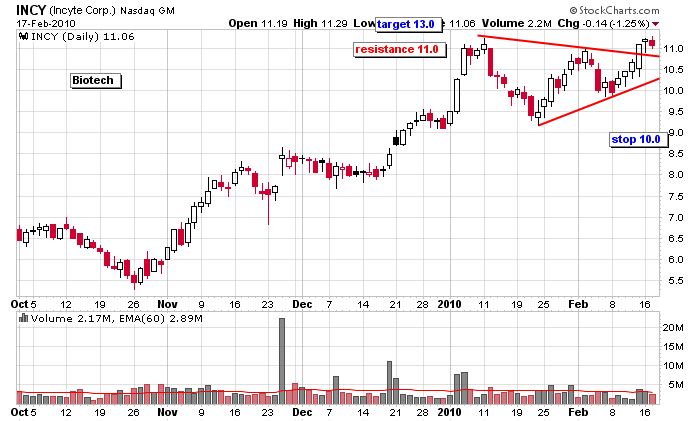

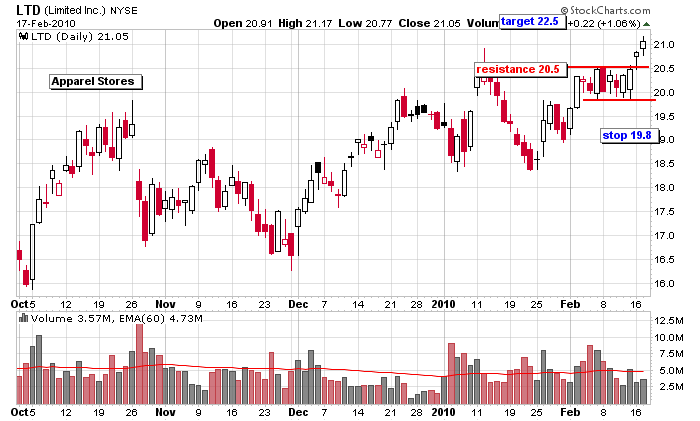

The following set ups were posted to our Long List this weekend. Are you getting these before they make their moves?

0 thoughts on “New Long Set Ups”

Leave a Reply

You must be logged in to post a comment.

The following set ups were posted to our Long List this weekend. Are you getting these before they make their moves?

You must be logged in to post a comment.

I have thought of subscribing to your advisory for stock trades, but note that many of them are rather short investment periods, and I don’t want to have to sit in front of my computer all day. I note this evening that you cite a traget price foir selections.

Would it be practical and reasonable to put in your trades with stop loss orders and sell orders when the stock reaches the limit price – or something like that?

I have checked with Optionsxpress and they have not arranged for autotrading for your service yet. I would sign up in a moment if autotrading were established.

Rudy

Hi Rudy,

I tell traders they need to be either short term (exit within a week) or longer term (holding time often > a month). If you’re somewhere in the middle, you’re likely to get stopped out at exactly the wrong time.

You could put a sell order in at the target and stop, but there are many times I advise exiting a position for no other reason than most of the movement has happened and there’s no reason to sit around another week bargaining for an extra half point. Exits are not hard. It’s the entries that are a challenge if you don’t wish to be in front of your computer.

As far as autotrading -> are you referring to the options autotrading service or a stocks autotrading service?

Jason

Some good ideas, but the cost of trying to follow the position is too great for the working man. I use stop loss orders, but one needs more visibility to set the limit sell order if the stock is active.

I am an indexer I guess. Not too bad, about 80% this year.