Good morning. Happy Thursday.

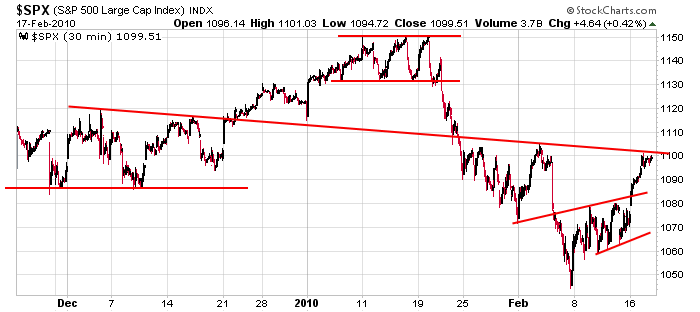

The Asian/Pacific markets closed mostly down, but losses were minimal. Europe is currently mixed with an upward bias. Futures here in the States point towards a flat or slightly down open. This comes off a light-volume advance that saw the S&P hit our resistance zone at 1100. Here’s the 30-min chart I’ve been working off. A pullback to 1090 would better set the stage for a breakout and subsequent rally to the highs at 1150, but the nature of the market the last several months has been steady winning streaks. It’s been common to see 8 of 9 up days or 10 of 12 up days. It’s a little weird for the market to move without correcting, but that’s been its character lately.

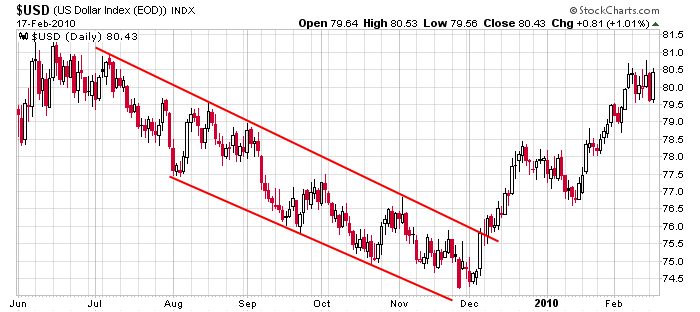

The dollar is a bit of concern. Yesterday, all of the previous day’s loss was recovered, and on a closing basis, the currency is at a high. The inverse correlation between the dollar and market remains, so unless they decouple, the market won’t be able to move up if the dollar busts out of its trading range.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers